Abstract

Object. Considerable attention is paid to microfinance in modern conditions. It is one of the ways of financial support of entrepreneurial activity and represents the provision of financial services to small businesses that are at the stage of business formation or do not have access to bank lending. The study of the current state of microfinance infrastructure in the Republic of Kazakhstan, insufficient theoretical knowledge of individual problems in the field of microfinance entrepreneurship, the practical significance of solving these problems determined the relevance of the article. The purpose of the study is to develop and substantiate recommendations for the development of the microfinance system of entrepreneurship in the Republic of Kazakhstan.

Methods. In the course of the study, methods of theoretical, diagnostic, empirical, experimental, graphical representation of the results were used. When discussing the results of the functioning of the microfinance market, the following methods were used: analysis, synthesis, clarification, generalization.

Results. In order to implement entrepreneurial initiatives, the Kazakh practice of real expansion of microfinance volumes is considered, the analysis of the features of micro-crediting is carried out. The characteristic of the place of conditions of micro-crediting of entrepreneurship in the microfinance market of the Republic of Kazakhstan is given.

Conclusions. In modern conditions, with the development of Internet technologies, micro-loans are issued not only in cash, but also with the use of electronic technologies. Innovations such as real-time service via the Internet or mobile communication can open up new opportunities for MFOs.

Keywords: microfinance, microfinance organization, entrepreneurship, business environment, microcredit, financing.

In the context of global instability of the financial market, micro-credit is one of the most effective ways to support entrepreneurship, which, in turn, contributes to strengthening economic stability in the country. The development of microfinance in modern economic conditions justifies the growth of financial capabilities and purchasing power of a certain group of the population, serves as the basis for intensifying entrepreneurship, as well as maintaining the financial stability (with a competent approach) of citizens who do not have the opportunity to use the credit resources of banks.

Microfinance in countries with economies in transition is not only social, but also political in nature, as it contributes to the formation of a class of owners by supporting the development of small businesses. The peculiarity of microfinance programs in these countries is that they are not so large - scale and their main purpose is financial support for entrepreneurial initiatives expressed by economically active segments of the population. And the clients of microfinance programs are mainly current and potential subjects of small business and entrepreneurship, as well as residents of rural areas and single-industry towns living in areas where banking services are insufficient. (Charaeva M. V., 2019)

Microfinance institutions are focused on activities at the stage of formation and accumulation of experience in the development and implementation of their own optimal models of microcredit in order to support entrepreneurial initiative and ensure employment of the population.

Currently, the main reason for the need for a microfinance system for entrepreneurship is the ability of the population to access funds and support business. At the same time, in the Republic of Kazakhstan, as in the entire post - Soviet space, it is easy to get financing only for residents of large cities, while the rest, especially rural residents, are practically deprived of access to financial services-banks are not ready to lend to the needs of remote small businesses. Therefore, the inaccessibility of loans hinders entrepreneurial initiative in the regions.

In this regard, it is particularly relevant to analyze the situation on the microfinance market, provide statistical data, features of micro-credit and microfinance organizations, and identify trends and prospects for the development of Kazakhstan's microfinance organizations based on the analysis of the regulatory framework.

The purpose of the work is to determine the prospects for the development of the microfinance market in Kazakhstan based on a situational analysis of the market of microfinance and microcredit of entrepreneurship in the Republic of Kazakhstan.

The importance of this study lies in the fact that under the current conditions, bank loans remain inaccessible to small and medium-sized businesses, which in turn create prerequisites for the development of microfinance as an integral part of the country's financial system.

Despite the sufficient elaboration of the problems associated with the development of the system and mechanism of microfinance entrepreneurship is of some scientific interest and requires a comprehensive development. In this regard, for a comprehensive disclosure of the research topic, the works of foreign scientists were studied: Muhammad Yunus (2008), Widiarto I., Emrouznejad A., Anastasakis L. (2017), Li L.Y., Hermes N., Meesters A. (2019), Raineix F. (2017)

Microfinance is attracting more and more attention and is being used as a mechanism for financing entrepreneurs. Issues aimed at deepening the scientific understanding of how microfinance contributes to entrepreneurship were considered in the works of Alexander Newman, Susan Schwarz, David Ahlstrom (2017)

There are authors who pay special attention to the development of women's micro-entrepreneurship and the role of microfinance organizations in supporting their activities. Dubreuil GE, Mirada CT.(2010), Asma Salman (2018).

Proponents of microfinance argue that it is necessary to provide a way out of poverty, allowing individuals to take advantage of profitable business opportunities Miriam Bruhn, Carpena Fenella and Bilal Zia (2012)

The versatility, complexity and insufficient elaboration of the problem of microcredit in the country require an integrated approach to the study and improvement of its theoretical and methodological aspects.

In the course of the study, theoretical, diagnostic, empirical, experimental, and graphical methods of displaying results were used. As part of the study of the theoretical part, regulatory documentation and experience of microfinance and microcredit organizations were studied. When discussing the results of the functioning of the microfinance market: analysis, synthesis, refinement, generalization were used.

The experimental basis of the study was the initial data of the microfinance market and the organizations operating in it, when the object of management under study underwent transformational changes under the influence of external and internal factors affecting it.

The study of the problem included the following stages:

- A theoretical study of existing methodological approaches to the organization of microfinance activities in the territory of the Republic of Kazakhstan was carried out;

- The supervisory functions of the agency of the Republic of Kazakhstan for regulation and development of the financial market as a regulator of the microfinance market were considered and the situation with microfinance was analyzed;

- The theoretical and practical component of the conclusions is clarified, the research results are summarized and systematized, and prospects for the development of the microfinance market are outlined.

Recently, the microfinance market in Kazakhstan has undergone significant changes. In order to ensure the stability of microfinance organizations (MFOs), the availability of financial, technical means and personnel to comply with minimum standards, requirements for the size of the authorized and equity capital of MFOs were established in November 2019. The period of 2020-2021 was unique for the microfinance market of Kazakhstan and included several events and trends that had a significant impact on the activities of MFOs associated with the introduction of mandatory regulation in this market with subsequent licensing.

The introduction of licensing will ensure control over compliance of the subjects of the microfinance market with the thresholds of the annual effective remuneration rate, prevent them from conducting illegal activities and fraudulent operations, schemes of financial pyramids, thereby helping to exclude unscrupulous organizations from the market and protect the interests of consumers (Elyubaeva A.V, 2021).

One of the main events of 2020 in the microcredit sector was the merger of creditors (pawnshops, credit partnerships, online lenders), which were not previously controlled by the state, with microfinance organizations. Since 2016, MFOs have been under the supervision of the National Bank, and since 2020 - the Agency for Regulation and Development of the Financial Market. Now all non-bank credit organizations are called organizations that carry out microfinance activities and are regulated by the Agency for Regulation and Development of the Financial Market. At the same time, it should be noted that organizations engaged in microfinance activities that were registered before the law came into force, in accordance with the requirements of the Law of the Republic of Kazakhstan "On Microfinance Activities", have the right to apply to the authorized body for obtaining a license to carry out microfinance activities until March 1, 2021.In case of noncompliance with this requirement, a requirement for compulsory restructuring or liquidation of organizations engaged in microfinance activities is filed. The consolidation of creditors affected the dynamics of market indicators and the profitability of the sector due to the events related to the pandemic. (Omarhanov E., 2020)

In addition, since March 2020, MFOs, along with banks, have offered the population and small and medium-sized businesses to "freeze" their loan portfolio for six months and postpone the deadline.

For the development of entrepreneurship, measures have been implemented to improve the mechanisms of the state program "Enbek" in terms of increasing the participation of microfinance organizations in lending to the population. This year, within the framework of the employment roadmap, new approaches to the selection of infrastructure projects, employment of the unemployed and micro-crediting have been completely revised and developed.

Since the beginning of the pandemic, entrepreneurs have suffered losses in all areas of business: financial, personnel, image. One of the most vulnerable categories in terms of business sustainability was individual entrepreneurs. At the same time, existing measures to support small businesses are sometimes not enough to provide financial support to all categories of entrepreneurs.

For example, according to the agency for regulation and development of the financial market of the Republic of Kazakhstan, more than 12.4 thousand small and medium-sized businesses, including individual entrepreneurs, legal entities and peasant farms, received loan extensions during the pandemic period.

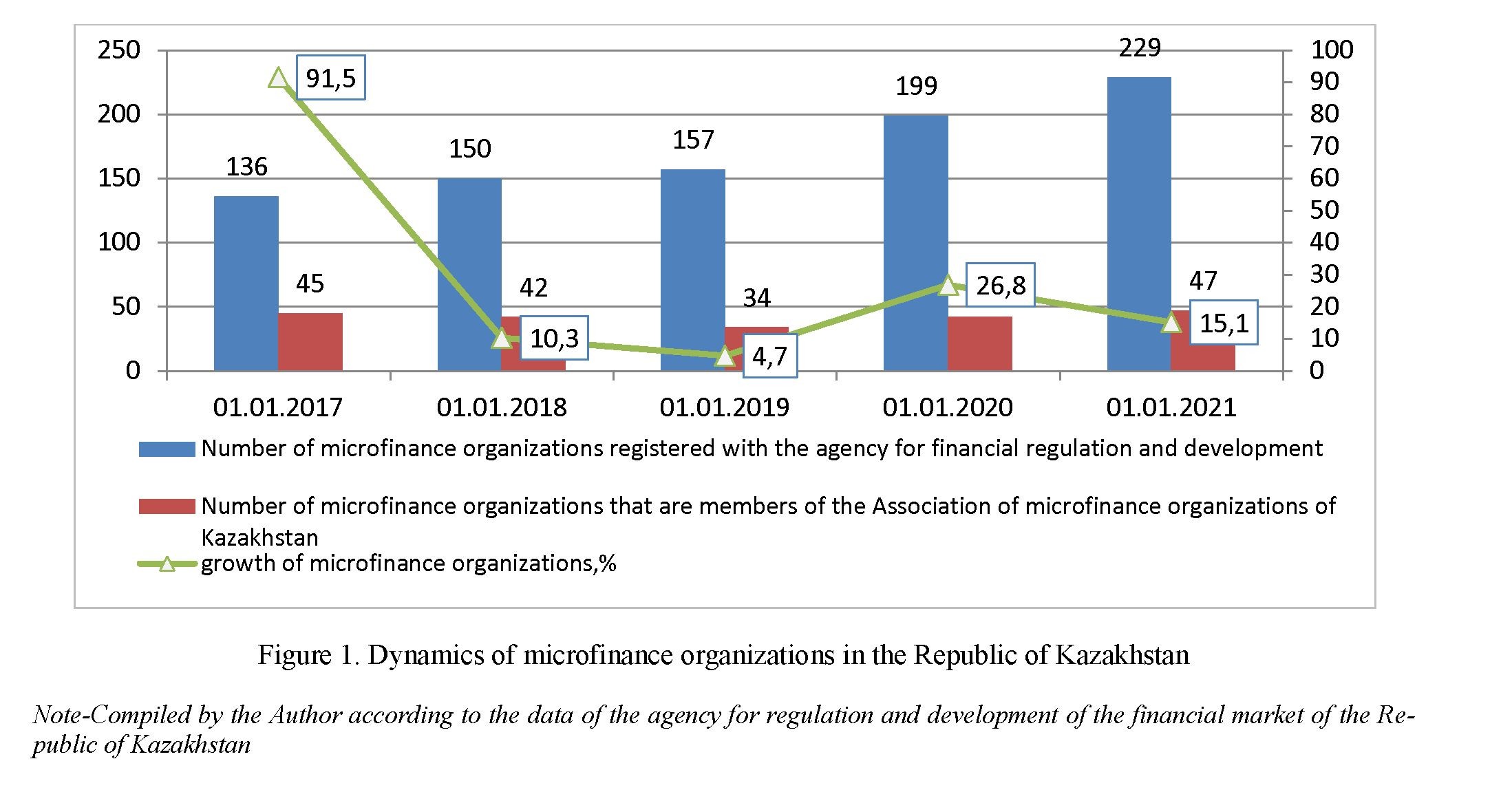

The dynamics of changes in microfinance organizations in general are shown below (Figure 1)

The dynamics of changes in microfinance organizations in general are shown below (Figure 1)

As of April 1 of this year, 883 subjects of the micro-credit market, including 178 microfinance organizations (MFOs), 542 pawnshops and 163 credit partner agencies, received licenses to carry out microfinance activities (Ajtzhanov S., 2019). A positive trend is the almost 2-fold increase in the number of microfinance organizations registered with the agency for financial regulation and development over the past 5 years, as it confirms the need for the relevant institution and the presence of demand for its products.

As of January 1, 2021, 229 existing microfinance organizations were registered in the Register of the agency for regulation and development of the financial market of the Republic of Kazakhstan. Since the beginning of 2020, 47 microfinance organizations have been included in the agency's register, an increase of 15% since the beginning of the year. Until March 1, 2021, organizations engaged in microfinance activities were required to apply for a license. As of March 1, 2021, 56 microfinance organizations have received licenses to carry out microfinance activities. The loan portfolio of the microfinance organization as of January 1, 2021 amounted to 4 418 billion, issued by the National Bank of the Republic of Kazakhstan(NBRK) tenge, the portfolio increased by 42.6%.

"Currently, 56 MFIs and 4 Associate Members of the Association of microfinance organizations of Kazakhstan, which occupy a share of 83% in the microcredit market, are members of the Association of microfinance organizations of Kazakhstan: LLP "First credit bureau", JSC "Entrepreneurship Development Fund""Damu"", LLP ""Smart Pay"", Association of legal entities "Kazakhstan Fintech Association".

In 2020, within the framework of the business roadmap 2025 (business roadmap 2025), a business micro - credit program was launched. Within the framework of this direction, up to 5 million loans will be issued for working capital and up to 20 million loans for investment purposes. At the same time, most loans up to 5 million tengeare issued on an unsecured basis at a rate of 6% for the final borrower. Within the framework of the "Enbek" program, budget micro - loans in cities and villages began to be issued through JSC" fund for financial support of Agriculture "at 6% per annum(Omarhanov E.,2020).

The micro-loan was launched as part of the Employment Roadmap program. These microcredits were issued to graduates of Bastau-business through microfinance organizations created by the National Chamber of Entrepreneurs "Atameken". By the end of the year, within the framework of these programs, it is planned to cover more than 24 thousand business entities with micro-loans.

The Business Roadmap 2025 program provides support measures in the form of subsidizing interest rates and guaranteeing loans to small and medium-sized businesses. The final cost of borrowed funds for entrepreneurs under these programs has decreased and is 6%.

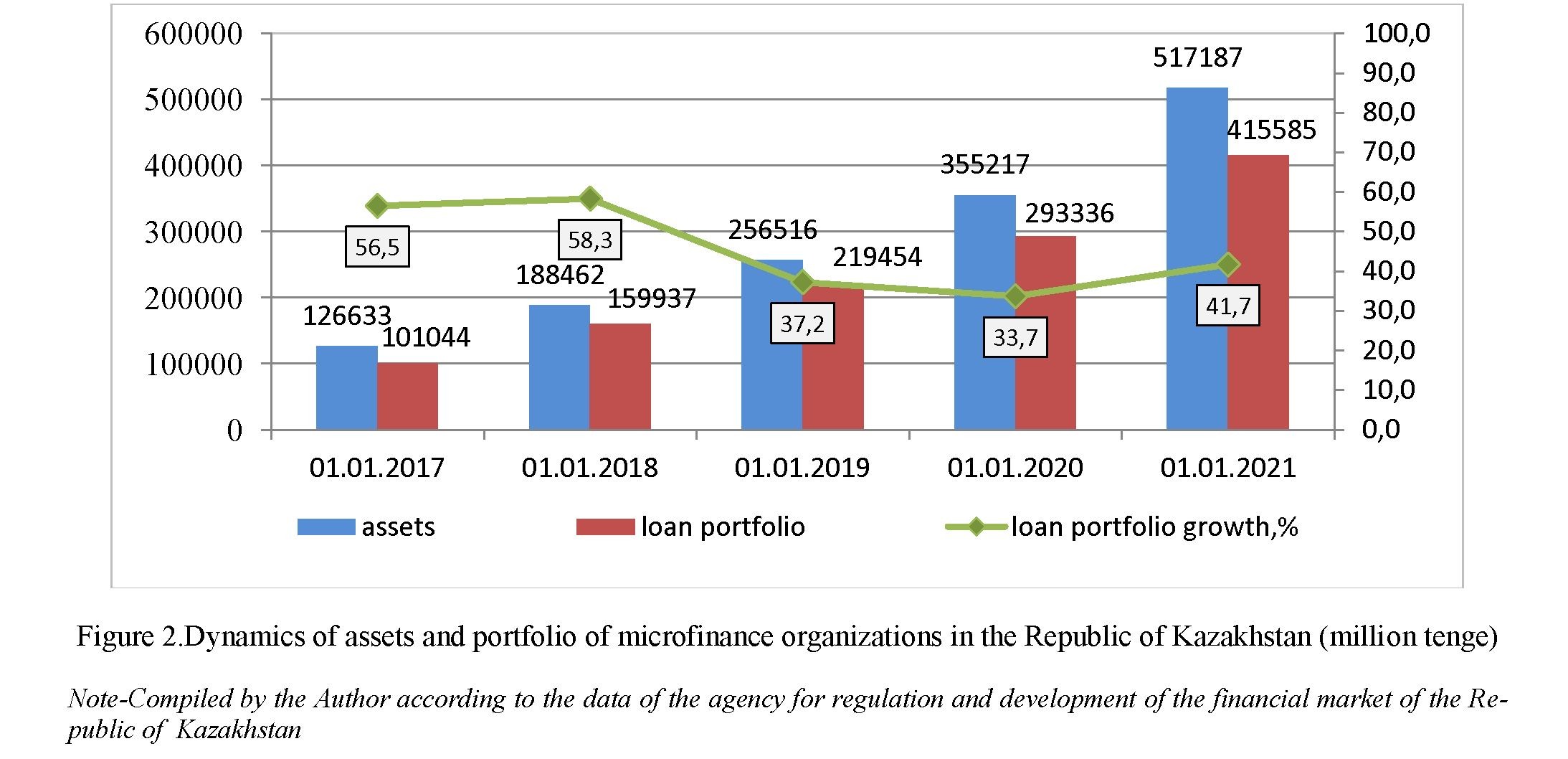

As for the state of the loan portfolio of microfinance organizations, the loan portfolio of microfinance organizations shows positive dynamics every year (Figure 2). As of January 1, 2021, the loan portfolio amounted to 415 billion tenge, an increase of 42% compared to the previous year. The share of the financial portfolio of microfinance organizations is 80-82% of the total assets.

As for the state of the loan portfolio of microfinance organizations, the loan portfolio of microfinance organizations shows positive dynamics every year (Figure 2). As of January 1, 2021, the loan portfolio amounted to 415 billion tenge, an increase of 42% compared to the previous year. The share of the financial portfolio of microfinance organizations is 80-82% of the total assets.

141

The volume of assets in 2020 increased by 38.5% compared to the previous year, and the amount of capital increased by 34%. Also, over the past five years, we can see a 4-fold increase in the portfolio of microfinance organizations, which is associated with a 1.7-fold increase in the number of microfinance organizations. New legislative norms have expanded the opportunities of the MFIs lending sector, and the maximum amount of micro-loans has been increased to 50 million tenge. MFIs also had the opportunity to issue bonds and participate in repo operations on the stock exchange, which, in turn, made it possible to increase the assets of microfinance organizations from year to year. Kase became the first company in the Republic of Kazakhstan to issue bonds in US dollars on the Kazakhstan Stock Exchange "MFO" Credit Time " LLP. The volume of issues amounted to 12 million US dollars, the turnover period is 2 years, and the yield is 6% per annum.

The volume of assets in 2020 increased by 38.5% compared to the previous year, and the volume of capital increased by 34%. Also, over the past five years, we have seen an increase in the portfolio of microfinance organizations by 4 times, which is due to an increase in the number of microfinance organizations by 1.7 times. New legislative norms have expanded the possibilities of the microfinance organizations lending sector, and the maximum amount of microcredits has been increased to 50 million tenge. MFOs also had the opportunity to issue bonds and participate in repo operations on the stock exchange, which, in turn, made it possible to increase the assets of microfinance organizations from year to year. KASE became the first company in the Republic of Kazakhstan to issue bonds in US dollars on the Kazakhstan Stock Exchange of MFO Credit Time LLP. The volume of issues amounted to 12 million US dollars, the turnover period is 2 years, and the yield is 6% per annum.

Similar to the work of the bank, the activities of microfinance institutions have a pronounced public significance. Initially, the creation of microfinance organizations was caused by the desire to use financial methods to solve social problems and often to the problems of poverty and financial accessibility. However, many microfinance organizations are currently commercial organizations, so the assessment of their effectiveness should include economic measurements.

In foreign literature, it is customary to distinguish two groups of influence of MFO ' activities: financial (commercial, economic) and social. The combined use of two groups of them allows us to assess the overall effectiveness of MFO (Ckhadadze N. V.,2017)

The positive trend in the number and portfolio of microfinance organizations was the basis for considering their profitability (Figure 3).

Net Profit of microfinance organizations increased by 4.7 times over the last 5 years. It is possible to see the dynamics of growth of net profit (loss) of microfinance organizations. Factors affecting net profit include income related to remuneration, income not related to remuneration, and indicators of reserve growth.The attraction of borrowed capital from private investors who expected to receive the necessary income also encouraged the microfinance organization to pay more attention to its investment attractiveness and stability of net cash flow. The desire to increase profitability and ensure financial stability has led to a change in the structure of their customer base in favor of rich customers. (Berlage L., Vasudeo N., 2015). Studies have shown a positive impact of microfinance organizations on facilitating customers ' access to financial services. At the same time, their contribution to the development of entrepreneurial activity and improving the well-being of households is significant.

In 2020, the number of individuals who are clients of microfinance organizations increased dramatically, that is, the number of borrowers in the state increased by 41% compared to the previous year. As for legal entities in 2020, it increased by 70 legal entities. Such measures indicate an increase in demand for microfinance organizations in the country. According to the figure, individuals are the main consumers of microfinance organizations. And if we look at the direction of application of micro-loans received by them (Figure 4), we see that the main direction is the entrepreneurial goal.

If we evaluate microfinance organizations from the point of view of solving socio-economic problems, we can highlight some functions in this area:

- increasing the availability of micro-credit funds, promoting the development of small and mediumsized businesses, increasing tax revenues to the budget, and thus solving a number of socio-economic tasks;

- increase in the purchasing power of citizens who are not potential borrowers of banks due to certain circumstances based on the lack of guarantees for banks and confidence in their solvency due to the expansion of the MFО network in the country;

- improving the quality of regulation in this area by the agency for financial regulation, which will allow introducing the activities of MFО into the legal channel and reducing the volume of the "shadow" economy.

In a market economy, a significant place is occupied by the micro-credit system, the main goal of which is to support small and medium-sized businesses, improve the standard of living of the low-income population and strengthen competition in the financial services market. World experience confirms the special role of small and medium-sized businesses in solving political, economic and social issues of society's development. Being the main branch of the economy, small businesses ensure the level of employment of the population, contribute to the introduction of new technologies, and increase the efficiency of national production. Currently, one of the most pressing issues on the agenda is the development and activation of entrepreneurship, which is the basis for the country's economic transformation. Despite the increase in financial support for small and medium-sized businesses by the state, the volume of financing of entrepreneurship by financial organizations is decreasing. Thus, despite the recent significant and large-scale changes, the creation of a comprehensive and comprehensive system of credit and financial support for small and medium-sized businesses remains an urgent problem. Currently, some steps have been taken to develop entrepreneurship, but the insufficient scale of its development prevents small businesses from fulfilling their tasks. Therefore, the object of micro-credit implements one of the state programs aimed at stimulating small and medium-sized businesses, providing large-scale coverage of the population in financial transactions and ensuring their employment. Also, the lack of interest of the banking sector in lending to small and medium-sized businesses

due to the lack of trade Security, return projects and credit history indicates the need for the development of the micro-credit system in Kazakhstan. Accordingly, the development of small and medium-sized businesses in the country requires further improvement of the micro-credit system, which, in turn, consists of such problems as limited financial resources of micro-credit organizations, insufficient development of the legal and material base and poor quality of personnel. In this regard, the problem of studying the well-being and prospects for the development of the Microfinance System in Kazakhstan, organizational mechanisms of financing and lending to small and medium-sized businesses, the accumulated number of contradictions within the framework of supply and demand require the development of mechanisms for improving the development of credit and financial support (Uksusova M.S.,2018)

The main prospects for improving the level of efficiency of microfinance institutions are: improving the management of their operating costs, improving the legal regulation of their activities, increasing the motivation of employees of microfinance organizations and providing non-financial support to borrowers of microfinance organizations.

Innovations such as real-time services via the internet or mobile communications can open up new opportunities for microfinance organizations. Innovations in microfinance include software that supports subsystems for tracking transactions and customer information, the use of credit scoring systems to assess borrowers ' creditworthiness, and improved network connections between branches to exchange information and track transactions. In addition, new technologies may include services provided through ATMs, chip cards, POS devices, and mobile apps. Microfinance organizations are interested in implementing these technologies to improve their efficiency for the following reasons:

- well-thought-out information systems, network connections and credit scoring systems allow you to collect accurate information about customers, monitor the use of micro-loans and reduce credit risk, as well as get reliable information about their activities;

- adapting new technologies can reduce operating costs by simplifying and standardizing transactions;

- the use of new ways of obtaining and processing and servicing customer information expands the coverage of customers, which contributes to the implementation of social tasks and the use of scale efficiency, which leads to a reduction in operating costs (Chichulenkov D. A., 2020).

The implementation of the trend program for the development of incentive programs for credit inspectors in order to increase the number and volume of micro-loans per 1 employee will contribute to improving the efficiency of microfinance organizations. They include training programs (advanced training) on working with problem clients, working time management, operational risk management, accounting principles, and other useful skills.

Various microcredit programs successfully implemented in many countries of the world community have their own specifics and direction, which is determined by the level of economic development and national characteristics of the state. If countries with a large concentration of the poor and the underdeveloped sector of the economy consider microfinance as an effective tool for combating pauperism and poverty by supporting self-employment of the population, in developing and developed countries microfinance is positioned as one of the directions for the development of small and medium-sized businesses, being an effective economic tool for solving social problems. At the same time, implementing its functions and being an economically viable type of activity, microfinance is a socially-oriented business.

The demand for micro-loans remains high in the credit market. Micro-credit is not a new service for the people of Kazakhstan. . The financial scope of this loan is not large, and people get it for a short period of time. The most attractive aspects of this service are the short term of consideration of the order. To get a loan, you need to have a small list of necessary documents. To order a loan, it is enough for the consumer to show his civil documents.

Currently, despite the growing popularity of microfinance organizations, they have the following restraining problems:

- search, attract and retain customers in micro-credit organizations. Due to the growing competition in the microfinance services market, there are also difficulties in attracting solvent customers. This is especially noticeable in large cities, where the number of MFOs per capita increases, and the level of solvency and responsibility of customers is much lower. In such a situation, microfinance organizations are forced to allocate effective advertising channels in order to have a constant flow of "paying" customers.

- the low level of financial literacy is also a big problem for this sector. In the country, mainly the microfinance sector is designed to provide loans to farmers and entrepreneurs. However, the low level of financial literacy of some entrepreneurs does not allow them to manage funds optimally.

Microfinance, which is characterized by a high flexibility of the implementation mechanism, is an adaptive tool to meet the needs of aspiring entrepreneurs from disadvantaged segments of the labor market. Given that the segment of microenterprises is particularly exposed to difficulties in obtaining loans in the external financial market, microfinance is considered as an important political tool in reducing the negative impact of the crisis.

In general, according to analytical studies, enterprises of the country, most of which are subjects of business, show that the main factors hindering their activities are related to financing problems and lack of funds.

In March 2020, Kazakhstan closely faced the pandemic and limited business activity. These circumstances significantly hindered the growth of the customer base and loan portfolio. There was a question of quickly creating an online sales channel. Microfinance organizations have launched a mobile application in a short period of time, thanks to which customers have the opportunity to apply for a micro-loan, transfer it to a bank card, and make monthly payments.

References

- Charaeva, M.V. (2019). Realii i perspektivy ispol'zovaniya mikrofinansirovaniya v usloviyah razvitiya predpriyati malogo i srednego biznesa [Realities and prospects of using microfinance in the context of the development of small and medium-sized businesses]. Finansovye issledovaniya - Financial research, 2 (63), 42-50[in Russian].

- Muhammad Yunus (2008). Creating a World Without Poverty: How Social Business Can Transform Our Lives (Coauthor: Dr Karl Weber); Public Affairs

- Widiarto, I., Emrouznejad, A.,& Anastasakis, L. (2017).Observing choice of loan methods in not-for-profit microfinance using data envelopment analysis. Expert Systems With Applications, 82, 278–290

- Li, L.Y., Hermes, N., &Meesters, A. (2019). Convergence of the performance of microfinance institutions: A decomposition analysis, Economic Modelling, 81, 308–324.

- Raineix, F. (2017). Microfinance in France: a success story? In: Microfinance Barometer 8th Edition. CGAP. Retrieved fromhttp://www.convergences.org/wp-content/uploads/2017/09/BMF_2017_EN_FINAL-2.pdf.

- Newman, A., Schwarz S., & Ahlstrom D. (2017). Microfinance and entrepreneurship: An introduction. International Small Business Journal: Researching Entrepreneurship, 35(7), 787–792

- Dubreuil, G., &Mirada, C. (2010). Microfinance and gender considerations in developed countries: The case of Catalonia. Management Research Review, 12(33, 12), 1140-1157

- Salman, A. (2018). Micro-Finance: A Driver for Entrepreneurship, Entrepreneurship - Trends and Challenges, Sílvio Manuel Brito, IntechOpen, DOI: 10.5772/intechopen.75031. Retrieved from

- https://www.intechopen.com/chapters/59850

- Miriam Bruhn, Carpena Fenella& Bilal Zia (2012).Microfinance for Entrepreneurs. The Oxford Handbook of Entrepreneurial Finance Edited by Douglas Cumming.

- Elyubaeva, A.V (2021).V 2021 godu MSB predostavyatl'gotnyekredityna 2,5trlntenge [In 2021, SMEs will provide preferential loans for 2.5 trillion tenge].Retrieved fromhttps://kapital.kz/business/95372/v-2021-godu-msb- predostavyat-l-gotnyye-kredity-na-2-5-trln-tenge.html [in Russian].

- Omarhanov, E. (2020). Kaksobytiya 2020 goda povliyalinarynok mikrokreditovaniya [How did the events of 2020 affect the microcredit market]. Retrieved from https://kapital.kz/finance/92334/kak-sobytiya-2020-goda-povliyali-na- rynok-mikrokreditovaniya.html[in Russian].

- Ajtzhanov, S. (2019). Listing dlya MFO: chegostoit i voskol'koobhoditsya [Listing for MFIs: what it costs and how much it costs]. Retrieved from https://kapital.kz/finance/93839/lis,ting-dlya-mfo-chego-stoit-i-vo-skol-ko-obkhodit- sya.html[in Russian].

- Qarzhy narygyn retteu zhane damytu agenttіgіnіn resmi sajty [Site of the agency for regulation and development of the financial market of the Republic of Kazakhstan]. gov.kz/memleket/entities/ardfm?lang=kk. Retrieved from https://www.gov.kz/memleket/entities/ardfm?lang=kk [in Kazakh].

- Ckhadadze N.V. (2017). Mikrofinansirovanie zarubezhom: opyt resheniya social'nyh zadach [Microfinance abroad: experience in solving social problems]. Ekonomika. Nalogi. Pravo -Economy. Taxes. Right, 1, 101–109. [in Russian].

- Berlage, L., & Vasudeo, N. (2015).Microcredit: from hope to scepticism to modest hope.Enterprise Development and Microfinance, 26, 63–74.

- Qazaqstan Respublikasy Strategiialyq zhosparlau zhane reformalar agenttіgі Ulttyq statistika byurosynyn resmi sajty [Site of the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic of Ka- zakhstan].stat.gov.kz. Retrieved from https://stat.gov.kz.[in Kazakh].

- Uksusova M.S. (2018). Mikrofinansirovanie: soderzhanie, osobennosti, problem i perspektivyrazvitiya [Microfinance: content, features, problems and prospects of development]. Ekonomicheskij zhurnal - Economic Journal, 3, 50-66 [in Russian].

- Chichulenkov D. A. (2020). Tipy i napravleniya povysheniya effektivnosti mikrofinansovyh organizacij [Types and directions of improving the efficiency of microfinance organizations]. Finansovye rynki i banki - Financial markets and banks, 2, 77- 85.[in Russian].