Object: In management activity, many companies have to find effective solutions for forecasting and planning various financial scenarios. Effective management of the financial activity of large companies should be based on continuous improvement of business processes, where it is necessary to consider the conditions of the enterprise activity and improve its competitiveness through the consistent implementation of optimization processes and their objective assessment using methods of financial activities forecasting and planning. The research aims to analyze the financial and economic aspects of the companies’ functioning and their impact on the tourism cluster in socialization.

Methods: The study was carried out by applying general methods used in economic science, based on a logical description of the components and functions of digital technologies, reflecting their essential properties using a systematic approach, providing the necessary study in depth of the scientific problem. The following methods were used in the research process: abstract-logical, economic-statistical, monographic, methods of system analysis, economic comparison, expert assessments. When processing and organizing the data, methods of mathematical modeling and forecasting were used. The methods used for the study of economic phenomena and the processing of primary information in their entirety make it possible to ensure the reliability of the analysis and the validity of the findings.

Findings: The authors reached conclusions and recommendations for improving the sustainable development of companies, results of which were presented using a graphical method.

Conclusions: Based on the initial data regression analysis was applied to assess the impact on the amount of income from the main activity of Kazakhstan Temir Zholy JSC of factors such as the volume of passenger traffic and the volume of railway traffic. The coefficients of elasticity are analyzed to supplement the commensurate indicators of the closeness between the factor and the result, allowing ranking of the factors according to the strength of their influence on the result.

In the context of the transformation of the economy, as well as the rapidly changing market situation, including situations of international importance, companies need to apply innovative methods both in the technological process and in management methods, where certainly the emphasis is on the financial component, which should not only improve the form and methods of management but should be constantly changed and flexibly restructured depending on changes in the strategy of enterprise development.

All this motivates and encourages companies to improve business processes, and senior management is encouraged to find and implement new effective methods of business process management based on forecasting methods.

In modern conditions, almost all companies are trying to develop a strategy for their development based on the interests and needs of consumers, market conditions, and changes in the socio-economic poli-

*Responsible author:

E-mail address: ainuraphd@mail.ru cy of the state, designed for both long- and short-term periods. The more precise the determination of future business development results setting goals, mechanisms development, and ways to achieve them, the safer for the user and therefore, the more effectively the company’s management will solve problems. Thus, in strategic planning and in making current and future business decisions, the question of assessing the prospects for a company's development arises, and it is necessary to develop practical methods for determining those prospects.

The development and support of entrepreneurial activity, the development of competition, and investment attractiveness depend on a wide range of factors reflecting the general situation of the state’s economic policy and the position of state institutions. The issues of developing the business environment, increasing investment attractiveness, and overall competitiveness of the economy are among the key areas of economic policy of any state.

For many of the world’s largest businesses, sustainability is the key to minimizing risks, increasing sustainability, increasing competitiveness and opening new opportunities.

As the process of managing the financial stability of the enterprise is one of the important issues that concern the financial well-being of the company, it is necessary to observe the necessary parameters of FS, as low financial stability can lead to the inability of the enterprise to meet its financial obligations, and its excessive stability can hinder development by exacerbating the costs of the enterprise with excessive (excessive) stocks and reserves.

The problems of ensuring economic-financial stability and competitiveness of large enterprises are the most urgent for the modern Kazakhstan economy. Large companies are of great strategic importance and play a major role in ensuring the country’s economic security. In this regard, it is necessary to pay attention to such tasks as employing able-bodied people, raising living standards in the new geopolitical conditions, developing the transport industry, and providing it with substantial investment support.

Mechanisms of strategic management in various sectors of the economy must consider the main trends and features of industrial development, as well as their adaptation to modern economic conditions.

In all social, economic, and technological transformations it is necessary to identify the factors that will contribute to the transformation of entrepreneurial activity in the next 5–10 years and form the basic criteria for further analysis (Меtsik et al., 2019, 2465).

Capital budgeting is one of the most important decisions faced by the financial management of any organization (Batra et al., 2014). This is a planning mechanism used by an organization to make evaluation decisions on how to divide resources between investment projects (Al-Mutairietal et a., 2018) and evaluation of investment projects that will create benefits for over one year and that will help the company generate revenue or reduce future costs (Khamees et al., 2010).

The evaluation of capital investment budgeting proposals is part of the investment decision. In this context, financial management and capital investment decision-making are fundamental to the survival and success of the company in the long-term perspective (Michelon et al., 2020).

The term “sustainable development” officially appeared in the scientific lexicon in the late 1980s, and the beginning of the concept of sustainable development is most often associated with this period. At the same time, conceptual approaches to sustainable development originated a decade earlier. They are associated with special public attention to the increase in the level of environmental pollution, the reason for which was seen in the rapid socio-economic development. Attention to the problem of sustainable development is tirelessly supported in the works of foreign researchers, such as (Strezov et al., 2017; Karman, 2019), etc., which consider the problems and propose solutions on substantiating the concept of sustainable development as an alternative to the concept of economic growth.

Sustainable economic development can be achieved through the formation of a favorable innovation environment, which promotes the activation of investment activities and allows for the effective use of innovative potential to increase competitiveness and accelerate socio-economic development.

According to (Levina, 2017), the Fourth Industrial Revolution requires high-tech companies to not only grow but also to achieve high performance and respond quickly in an ever-changing market. Finally, a country needs to be competitive in the high-tech market, not only for the development of individual companies but also for the country’s economy as a whole, as it facilitates the development of best practices and the country’s involvement in global integration processes (Levina, 2017, 88).

Thus, the key idea of sustainable development of companies is to achieve strategic goals in the longterm period, considering the interests of various stakeholders, which takes into account all aspects of the company’s activities, including economic, social and environmental, and also corresponds to its corporate values.

Today, sustainable development should be defined as the process of economic, social, and managerial changes aimed at coordinating economic activity, the use of natural resources, solving social problems, developing scientific and technological progress to improve the quality of life (Bobylev, 2017).

A growing number of companies, integrating to improve sustainability, are implementing their strategic initiatives with a tendency to expand the managerial aspects of planning (Izmailova, 2021).

According to (Wang, 2021), many companies are currently focused on profitability and short-term return on investment. Other researches indicate a significant and positive relation between innovations in the field of sustainable development and the competitiveness of the firm (El-Kassar et al., 2018; Qiu et al., 2019; Suat et al., 2019).

The sustainable development trend is gaining strength on a global scale and creates new niches and new opportunities for large companies and for the country as a whole, which will significantly affect the activities of companies both within the country and on foreign economic activity. The growing importance of sustainable development factors forms a request for their analysis and evaluation in the activities of companies, including in the framework of sustainable development indices and ratings (ESG-indices). Such an assessment supports both investors and responsible companies and promotes best practices.

The research questions. Recognizing that many processes in the economy are inextricably linked to the development of social institutions, it is necessary to apply methods and methodologies for analyzing financial sustainability, which is being actively developed both in Kazakhstan and abroad.

Considering the impact of many processes taking place in the economy and their impact on the development and functioning of companies, there is a transformation and a certain presentation in the application of methods and methodology. Therefore, the issues of assessment and analysis of financial stability of enterprises are of sufficient importance and the need to identify new scientific research.

The scientific novelty consists in the fact that at the present stage of the development of socioeconomic relations, the mechanism and tasks in sustainable development of business strategies of large companies aimed at implementing targeted programs and development plans for business segments have been firmly established as one of the most important mechanisms of business operations in the financial market.

Currently, economic, political, and social changes taking place at the global level are becoming increasingly interconnected and interdependent, creating a complex interaction between development factors. These changes transform existing development paradigms and create the need to find new ways to articulate national and global interests. Therefore, the analysis of globalization inevitably turns into an analysis of various aspects and different levels of this process. Such an analysis should at least include the following areas:

- political and economic analysis of global power structures;

- a related comparative socio-institutional analysis of ways to include specific regions in global structures;

- a critical cultural assessment of the understanding of a position in global structures requiring appropriate activities organized by the actors (groups of agents) of globalization.

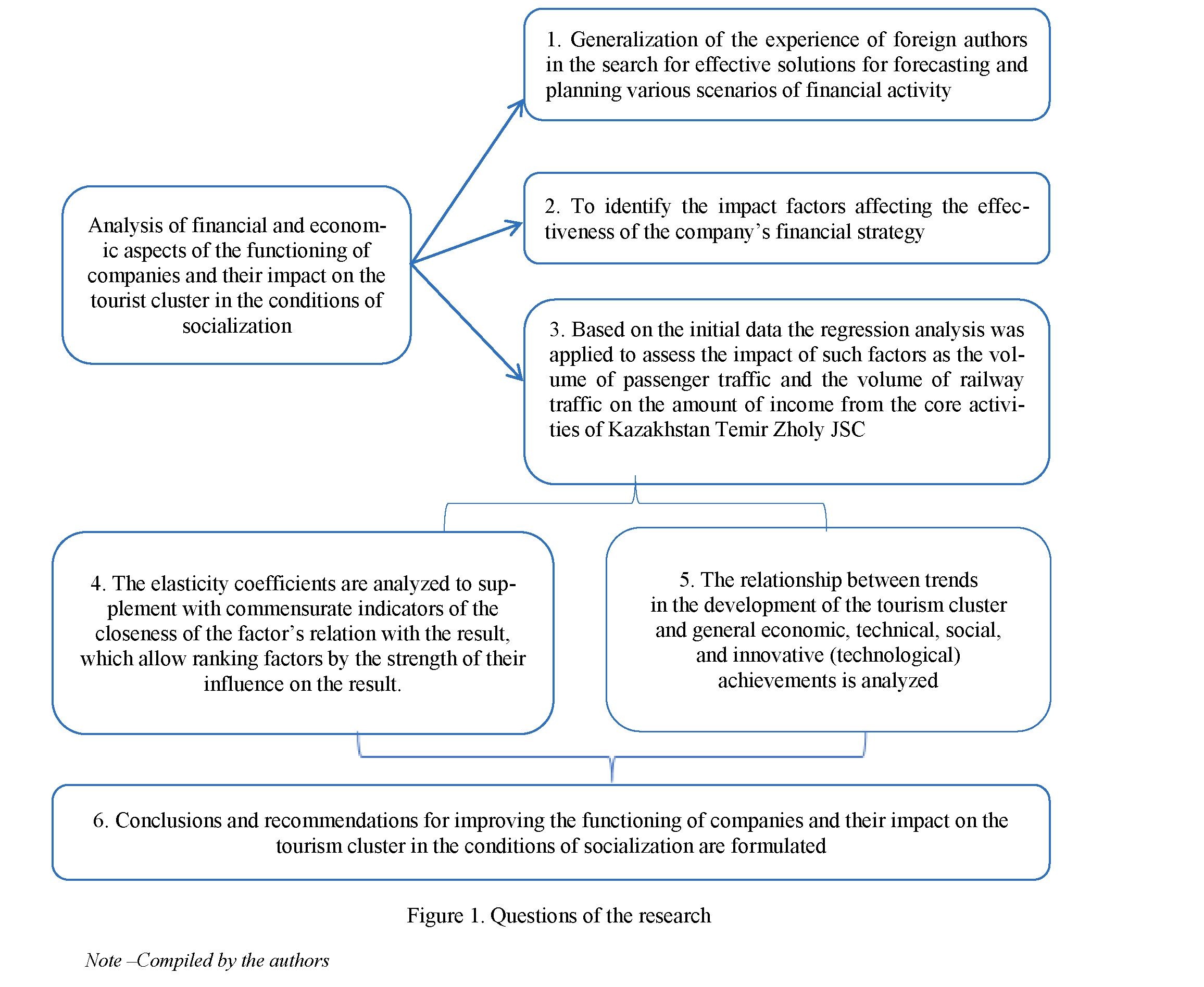

For safer and more reliable development of companies it is necessary to use certain methods and mechanisms of management, which will be adapted to the conditions under which the company develops and functions, namely adapted to innovation, anti-crisis policy, the strategic orientation of industry development. Thus, a set of tools and methods in management should be aimed at:

- ensuring the leading position of the organization in the market;

- ensuring the financial state of the company;

- achievement of key indicators of strategic development and planning of the company (Fig. 1).

91

Among the common and even mandatory management and planning tools for sustainable and safe development for organizations, the following ones may be particularly in demand:

- financial management (to ensure liquidity, profitability, financial stability);

- management of information resources;

- innovation and competitiveness management;

- quality management and effective marketing;

- risk management;

- active cooperation of companies with local authorities and government.

Based on the above determinants of organizational development, with an effective contractual policy, timely and full implementation of commitments, and, therefore, further planning of organizational activities and financial well-being, improving long-term relationships with other organizations are necessary conditions for their strengthening.

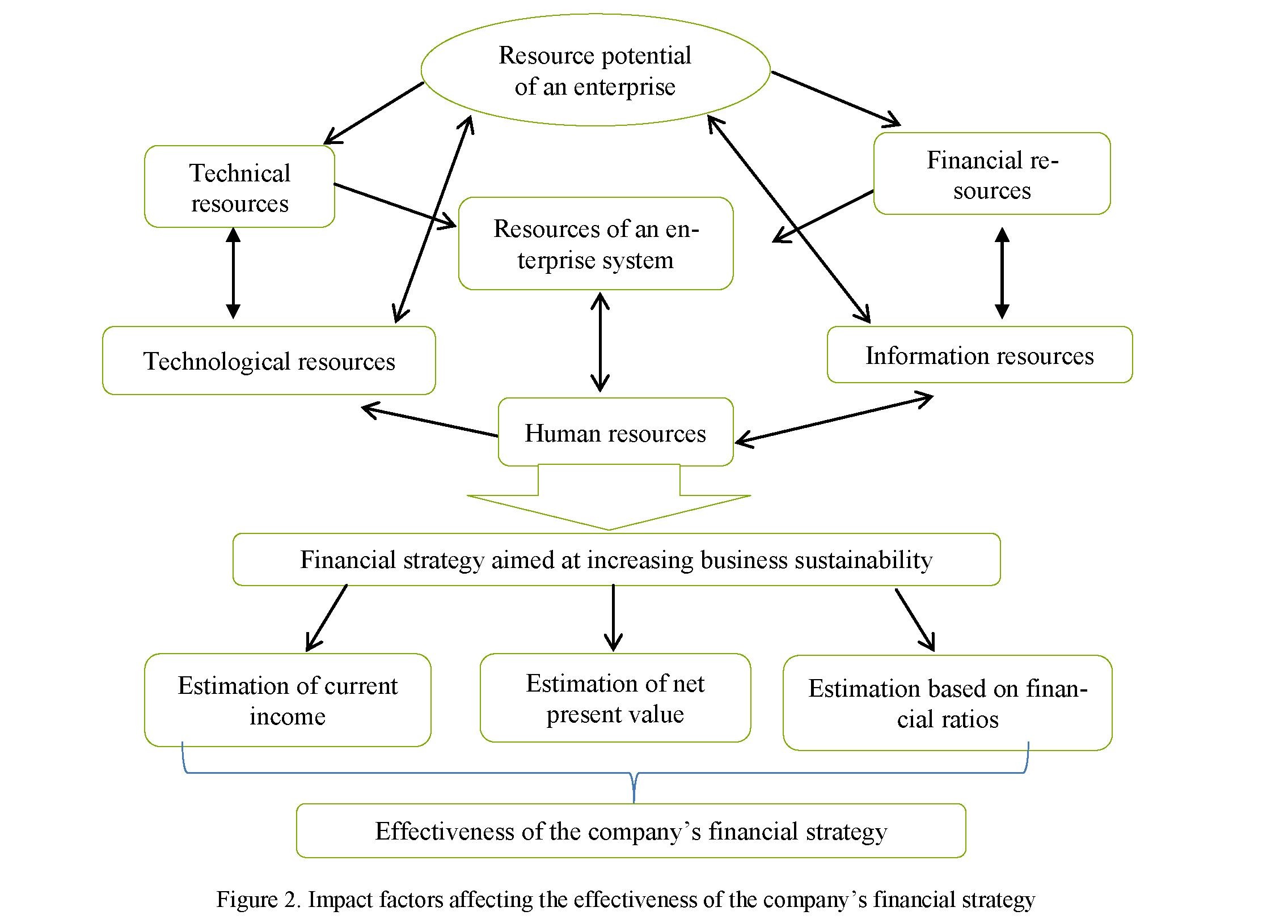

Thus, the intensive development of the market of goods and services, the competitive environment development in commodity movement and international relations, the strengthening of integration trends in the global economy make it necessary to search for adequate market mechanisms to ensure the effective functioning of enterprises (Fig. 2).

ECONOMY Series. № 1(105)/2022

Note – Compiled by the author.

The impact factors involve:

- assessment of the ongoing processes (social, economic, etc.);

- vision of the future to identify the difficulties and problems encountered;

- justification and analysis of various scenarios of resources changes in the company’s activities (personnel, production, scientific and technical) (Gerashchenko, 2019).

With a reasonable vision of the financial component and effective application of financial methods of company management, it is possible to predict the efficiency of invested funds, which will be higher than the market rate of return of the investor. The positive value of EVA demonstrates an increase in market value in comparison with the depreciated value of net assets and the successful implementation of the innovative growth strategy in terms of payback and profitability. With a minus or zero value of EVA, the implemented strategy is ineffective (Pavlov, 2015, 72).

It is necessary to distinguish the stages that allow the analysis of economic and financial efficiency, aimed at increasing the value of the company and the sustainability of its growth.

Stage 1. Analysis of the value of fixed and current assets before implementing the financial policy aimed at increasing the economic value added.

Stage 2. Analysis of the forecasting of the volume of financial resources to plan financial resources in innovative projects.

Stage 3. Attraction of resources and their transformation into the company’s assets.

Stage 4. Estimation of firm’s value after implementation of financial policy of innovative growth based on an indicator of economic added value (Dannye predpriiatia AO “Kazakhstan Temir Zholy”, 2021).

It should also be emphasized that the strategic management of the company’s financial activities focuses primarily on the entrepreneurial style, which is based on setting strategic goals of the achieved level of financial activity by minimizing the alternatives for strategic financial decisions.

The current stage of economic development of the Republic of Kazakhstan is characterized by increasing interaction with other countries, which fully applies to financial markets. Over the past decades, national financial markets have undergone significant changes. As their infrastructure has been transformed, capital flows between them have increased within different countries, and their mutual influence and interdependence have increased. All this is largely dictated by the processes of globalization and integration, which result from the development of the economy internationalization, taking place in institutional transformations, the lifting of administrative and economic restrictions, the adoption and recognition of international standards.

The expansion of rail transport flows from China and Southeast Asia to the EU countries is important for Kazakhstan, whose national economy is being integrated into the global economy. An important factor influencing the development strategy of Kazakhstan’s transport system is the benefits and advantages it can achieve.

In a rapidly changing market situation, companies, to be leaders in their field of activity, must keep up with the times look for new products (services), technologies, working methods, business processes, which should improve the management process, and consequently, change or flexibly restructure depending on changes in the company’s development strategy.

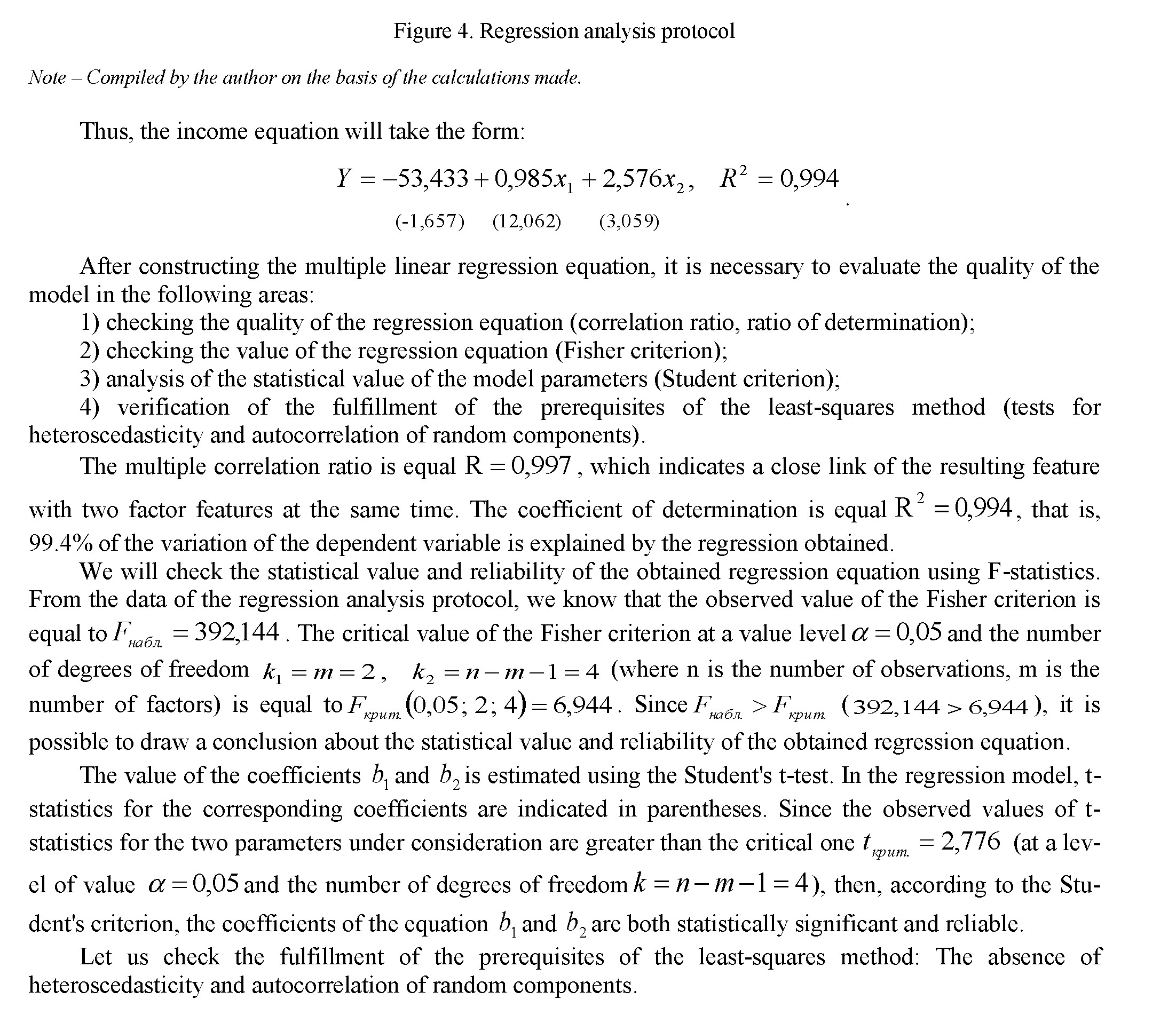

One of the methods that allows us to investigate the dependence of one variable on several explanatory factor variables influencing it is multiple regression analysis (Mate, 2013). To do this, a multiple linear regression equation is constructed:

Regression analysis is applied to assess the impact on the amount of income from the main activity of JSC Kazakhstan Temir Zholy (y, million tenge) of such factors as:

1) the passenger traffic (x1, million tenge);

2) the railway traffic (x2, million tenge).

After approximating the intial data, the protocol for regression analysis is obtained (Fig. 4).

Regression statistics

Variance analysis

|

Multiple R |

0,99746 |

|

R-square |

0,99493 |

|

Rated R-square |

0,99239 |

|

Standard error |

12,80247 |

|

Monitoring |

7 |

|

df |

SS |

MS |

F |

F Value |

|

|

Regression |

2 |

128547,24417 |

64273,62208 |

392,14369 |

0,00003 |

|

Balance |

4 |

655,61297 |

163,90324 |

||

|

Total |

6 |

129202,85714 |

|||

|

Ratios |

Standard error |

t-statistics |

P-value |

||

|

a |

-53,43300 |

32,25166 |

-1,65675 |

0,17291 |

|

|

b1 |

0,98453 |

0,08162 |

12,06227 |

0,00027 |

|

|

b2 |

2,57564 |

0,84193 |

3,05921 |

0,03769 |

The analysis of the quality of the multiple linear regression equation allows us to conduct further research of the constructed model (Sedelev, 2009).

Let us analyze the obtained regression coefficients:

- with an increase in the passenger traffic by 1 million tenge, the income from the main activity will increase by 0.985 million tenge with the volume of railway traffic unchanged;

- an increase in the volume of railway transportation by 1 million tenge causes an increase in income from the main activity by 2,576 million tenge with the volume of passenger traffic unchanged.

Using the equation of multiple linear regression, supplemented by an equation with commensurate indices of closeness of the relationship between the factor and the resultant trait allow us to rank these factors by the strength of their influence on the result. These indicators include the aggregate average elasticity coefficients:

Having analyzed these elasticity coefficients, we get the following conclusions:

1) with an increase in the volume of passenger traffic by 1% of the average level, income increases by 0.836% of its average level with the volume of railway traffic unchanged;

2) with an increase in the volume of railway traffic by 1% of the average level, income increases by 0.231% of its average level with the volume of passenger traffic unchanged.

Thus, at the moment, passenger transportation is of the greatest importance for generating income from the main activity of Kazakhstan Temir Zholy JSC.

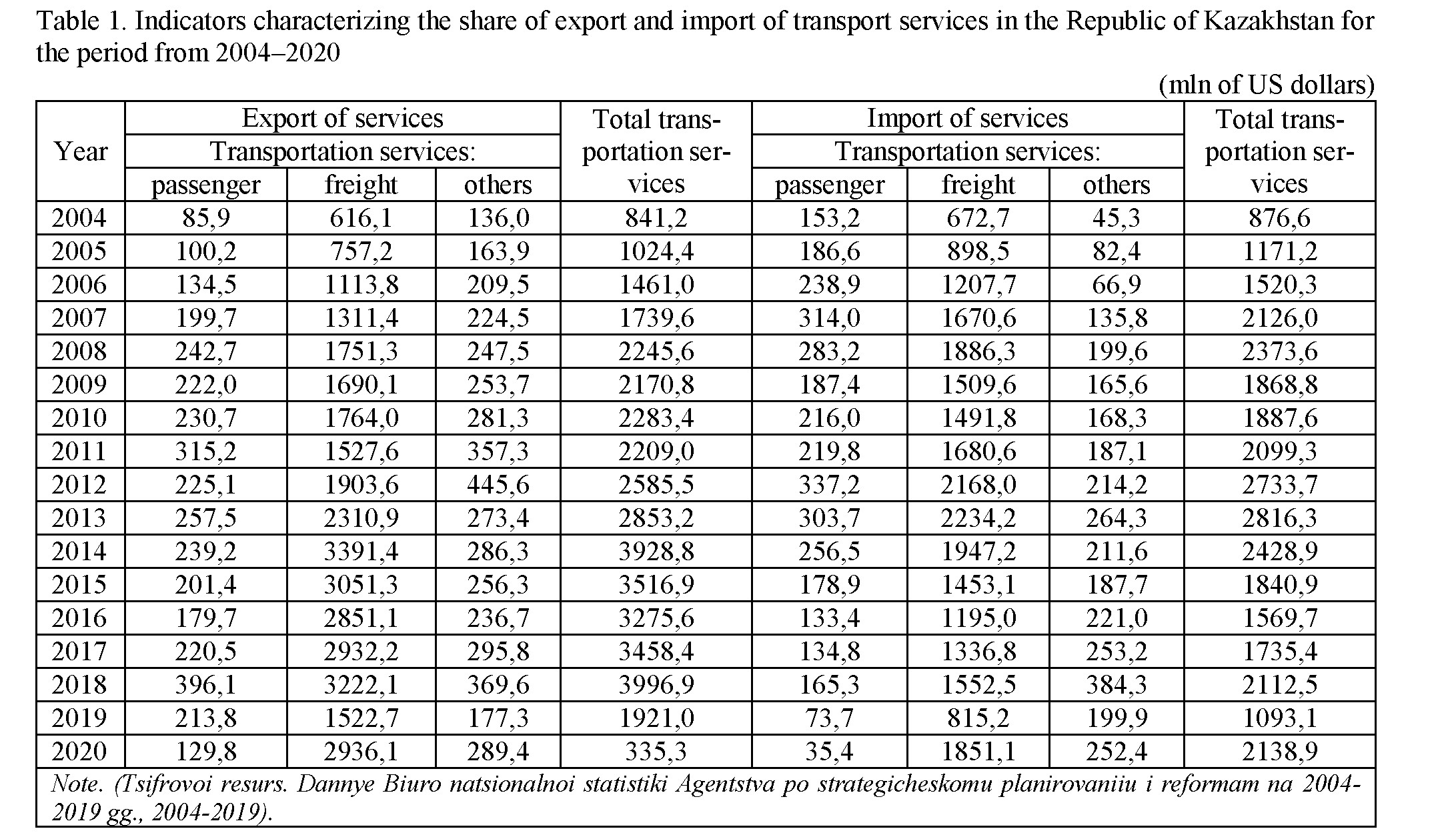

Considering the tourism cluster in the system of transport logistics, we note the importance of passenger transportation, which is not only a means of getting people from one point to another but also an important driver of socio-economic development of the territory (Table 1) (Tsifrovoi resurs. Dannye Biuro natsionalnoi statistiki Agentstva po strategicheskomu planirovaniiu i reformam na 2004-2019 gg., 20042019).

The growth of enterprises engaged in the tourism sector indicates that financial resources are invested in this industry every year in the form of investments (Fig. 5).

There is a direct link between development trends in the tourism industry and overall economic, technical, social, and innovation (technological) progress. Therefore, service companies should promote interaction with other actors and stakeholders in the development of tourism clusters and improve the quality of the services they offer through innovative management practices that minimize investment and maximize impact.

The development of an effective mechanism for coordination between a wide range of stakeholders, including government agencies, the private sector, banks, academia and civil society (population) will be given special attention, considering the multidimensional nature of the tourism sector.

Regional cooperation in the field of tourism can contribute to strengthening economic, social, and cultural relations between countries, thereby improving the image of the region and making it more attractive to foreign visitors and investments (Fig. 6).

Efforts will need to be directed towards mobilizing a broader spectrum of financing, including development partners, the State budget, the private sector, and PPP mechanisms. It is also possible to propose the creation of a regional investment fund to support investments in tourism on a regional dimension and impact.

Thus, a set of sustainable development measures will provide conditions for further increasing the potential of resources, as well as help solve several economic, social, technological, environmental, territorial and demographic problems.

In modern studies of spatial economics and economic geography, the socio-cultural environment is considered as a factor that has a noticeable impact on the functioning of the tourism cluster.

The external environment certainly affects the competitiveness of enterprises, so it is necessary to constantly adjust and change the economic activities of companies, planning operational and strategic tasks to maintain financial stability. However, each change can carry both threats and new additional opportunities for economic growth.

The problems of ensuring economic-financial stability and competitiveness of large enterprises are the most urgent for the modern Kazakh economy. Under the new geopolitical conditions, given the important role of big business in ensuring economic and strategic security, employment for the working-age population and improving living standards, special attention should be paid to the development of industry and significant investment support.

Having analyzed these elasticity ratios at the researched enterprise, the following conclusions were obtained:

1) with an increase in the passenger traffic by 1% of the average level, an income increases by 0.836% of its average level with the constant railway traffic;

2) with an increase in the railway traffic by 1% of the average level, an income increases by 0.231% of its average level with the constant passenger traffic.

Thus, at the moment, passenger transportation is of the greatest importance for generating income from the main activities of Kazakhstan Temir Zholy JSC, which indicates that passenger transportation is not only a means of delivering people from one point to another, but an important driver of socio-economic development of the territory, which certainly affects the development of the tourism cluster, and a set of sustainable development measures will provide conditions for further capacity building of resources, as well as help solve a number of economic, social, technological, environmental, territorial and demographic problems.

98

Вестник Карагандинского университета

- Al-Mutairi, A., Naser, K., & Saeid, M. (2018). Capital budgeting practices by non-financial companies listed on Kuwait Stock Exchange (KSE). Journal of Cogent Economics & Finance, 6(1), 2–18. Retrieved from

- http://dx.doi.org/10.1080/23322039.2018.1468232.

- Batra, R., & Verma, S. (2014). An empirical insight into different stages of capital budgeting. Journal of Global Business Review, 15(2), 339–362. Retrieved from http://dx.doi.org/10.1177/0972150914523588.

- Bobylev, S.N. (2017). Ustoichivoe razvitie v interesakh budushchikh pokolenii: yekonomicheskie prioritety [Sustainable development in the interests of future generations: economic priorities]. Mir novoi yekonomiki — The world of new economy, 3, 90–96. Retrieved from https://www.elibrary.ru/item.asp?id=30394968 [in Russian].

- Dannye predpriiatia AO "Kazakhstan Temir Zholy" po sostoianiiu na 01.01.2021 g. [Data of the enterprise of Kazakhstan Temir Zholy JSC as of 01.01.2021] [in Russian].

- El-Kassar, A.N., & Singh, S. (2018). Green innovation and organizational performance: the influence of big data and the moderating role of management commitment and HR practices. Journal of Technological Forecasting and Social Change, 144, 483-498. DOI:10.1016/j.techfore.2017.12.016.

- Gerashchenko, I.P. (2019). Finansivovaia strategiia: modelirovanie i optimizatsiia [Financial strategy: modeling and optimization: monograph]. Saint Petersburg: Book House, 350 [in Russian].

- Izmailova, M.A. (2021). Ustoichivoe razvitie kak novaia sostavliaiushchaia korporativnoi sotsialnoi otvetstvennosti [Sustainable Development as a New Component of Corporate Social Responsibility]. MIR (Modernizatsiia. Innovatsii. Razvitie) [MIR (Modernization. Innovations. Development].12(2), 100–113.

- https://doi.org/10.18184/2079-4665.2021.12.2.100-113 [in Russian].

- Karman, A. (2019). The role of human resource flexibility and agility in achieving sustainable competitiveness. International Journal of Sustainable Economy, 11(4), 324–346. DOI: 10.1504/IJSE.2019.103472.

- Khamees, B., Al-Fayoumi, N., & Al-Thuneibat, A. (2010). Capital budgeting practices in the Jordanian industrial corporations. International Journal of Commerce and Management, 20(1), 49–63.

- http://dx.doi.org/10.1108/10569211011025952.

- Levina, A.M. (2017). Formirovanie konkurentnykh preimushchestv kompaniami vysokotekhnologichnykh otraslei: model i ее osnovnye komponenty [Formation of competitive advantages by companies in high-tech industries: the model and its main components]. Strategicheskie resheniia i risk-menedzhment — Strategic decisions and risk management]. 4, 5, 88–97. https://doi.org/10.17747/2078-8886-2017-4-5-88-97 [in Russian].

- Mate, E. (2013). Materialno-tekhnicheskoe obespechenie deatelnosti predpriiatiia [Material and technical support of enterprises]. Moscow: Progress [in Russian].

- Меtsik, О.I., Petrenko, Ye.S., & Venchkizova, Ye.A. (2019). Smart-predprimateistvo kak sovremennyi yetap razvitiia predprimatelskoi deatelnosti [Smart entrepreneurship as a modern stage of business development]. Kreativnaia yekonomika — Creative Economy, 13, 12, 2465–2478. Retrieved from doi: 10.18334/ce.13.12.41426 [in Russian].

- Michelon, P., Lunkes, R., & Bornia, A. (2020). Capital budgeting: a systematic review of the literature. Production Journal. https://doi.org/10.1590/0103-6513.20190020.

- Pavlov, A.I. (2015). Teoreticheskie aspekty finansovoi strategii predpriiatia [Theoretical aspects of the financial strategy of an enterprise]. Evraziiskii nauchnyi zhurnal — Eurasian Scientific Journal, 8, 72–77 [in Russian].

- Qiu, L., Jie, X., Wang, Y., & Zhao, M. (2019). Green product innovation, green dynamic capability, and competitive advantage: evidence from Chinese manufacturing enterprises. Journal of Corporate Social Responsibility and Environmental Management, 27, 146–165. Retrieved from https://onlinelibrary.wiley.com/doi/10.1002/csr.1780.

- Sedelev, B.V. (2009). Regressionnye modeli i metody otsenki parametrov i struktury ekonomicheskikh protsessov [Regression models and methods for estimating parameters and structure of economic processe]. V.V. Kharitonov (Ed.). Moscow: MEPhI [in Russian].

- Strezov, V., Evans, A., & Evans, T.J. (2017). Assessment of the Economic, Social and Environmental Dimensions of the Indicators for Sustainable Development. Journal of Sustainable development. 3(25), 242–253. DOI:

- 10.1002/sd.1649. Retrieved from https://www.researchgate. net/publication/310792086_Assessment_of_the_ Eco- nomic_Social_and_Environmental_Dimensions_ of_the_Indicators_for_Sustainable_Development.

- Suat, L., & San, O. (2019). Corporate environmental management: eco-efficiency and economics benefits among manufacturers certified with EMS14001 in Malaysia. Journal of Int. J. Recent Technol. Eng, 7(6), 873–886.

- Tsifrovoi resurs. Dannye Biuro natsionalnoi statistiki Agentstva po strategicheskomu planirovaniiu i reformam na 2004–2019 gg. [Digital resource: Data of the Committee on Statistics of the Republic of Kazakhstan for 2004– 2019]. stat.gov.kz. Retrieved from http://www.stat.gov.kz [in Russian].

- Vilkomir, A.K. (2019). Printsipy i metody finansovoi strategii predpriiatiia v usloviiakh yekomomicheskogo krizisa [Principles and methods of financial strategy of enterprises in the conditions of economic crisis]. Audit and financial analysis — Audit and financial analysis, 3, 15–20 [in Russian].

- Wang, Z. (2021). Business Analysis on Sustainable Competitive Advantages. E3S Web of Conferences, 235 (9). https://doi.org/10.1051/e3sconf/202123503009.