Abstract

Object: To consider how financial development affects income inequality in Kazakhstan taking into account foreign savings, economic development, education, and the functions of democracy as factors.

Methods: For analyzing data and obtain accurate results, empirical models, variables, and measures, trends and descriptive statistics were applied.

Results: The findings of experiment indicate that a 1 % rise in financial development (the distribution of domestic credit to the private sector) results in a 0.09 percent increase in income inequality. Table 1 illustrates the corresponding short-term estimate of 0.047.

Conclusions: To sum up, research contributes to our knowledge of the relationship between amid income inequality, monetary development, and other governing elements in Kazakhstan during the change of period. The authors evaluate the impact of economic growth, financial development, foreign direct investment, education, and democracy on income alterations using the longest available time range. Besides, they demonstrate that Kazakhstan's financial growth exacerbates wealth inequality. In instantaneous, the three main points are sent for policy reasons. The financial sector must be strengthened in order to bridge the gap among the “haves” and “have-nots.”

Introduction

Income inequality and economic convergence have become a common topic for Kazakhstan since the country's independence in 1991. Mikhalev (2003) paints an excellent picture of Kazakhstan's transformation from Soviet-style financial classlessness to a society marked by glaring inequality fuelled by ‘resource nationalism.' In the early 1990s, declining output, rising income inequality, destruction of social safety nets and hyperinflation were all common. In this context, a dramatic increase in income inequality during the country's change to individuality has presented the administration with a wide range of policy issues in supporting comprehensive growth in this newly transitioned republic. Kazakhstan began developing substantial oil reserves in 1989, with oil which was assumed to be the primary export product. Oil exports, traditional government macroeconomic policies, severe budget fetters on businesses and the financial sector, the elimination of trade alterations, and slackened pricing policies helped to reverse the previous economic scenario in the second part of the 1990s. Between 1996 and 2013, several economic changes resulted in extraordinary average annual growth rates of 6 %. The number of people living in poverty has decreased dramatically (Jonbekova, 2020). In rural areas, however, large levels of income inequality persist. To tackle regional inequities, various measures such as cash transfers to immigrants, real estate taxes, and price grants to the rural poor are being implemented. The financial industry is still struggling, with one-third of bank loans classified as non-performing possessions. The main purpose of this paper is to discuss the relationship between salary levels and economic convergence in Kazakhstan.

Literature Review

The following subsections provide a brief review of the literature on non-economic and economic issues related to income inequality. We examine the five most important findings and explain why they are important in Kazakhstan. This segment of the appraisal is directly related to suggested unified empirical model, suggested in Section 3.

E-mail address: railash91@gmail.com

Finance-growth-income inequality

The general assumption that financial expansion stimulates economic progress has spawned a significant body of study. The Kuznets theory sparked a flood of empirical and theoretical work on the relationship amongst economic development and income inequality. (De Dominicis et al., 2008) conducted a meta examination of over 400 approximations on the association between economic development and income inequality and found that data quality and taster size all have an impact on the connection between the two variables. According to the research, the relationship between income inequality and economic development is complicated, and no agreement has been achieved. The academics disagree on whether fiscal progress benefits the entire population equally or excessively advantages the rich or poor, especially in developing countries (Jonbekova, 2020). The theory of inequality widening in finance and income, the theory of inequality harrowing in finance and income, and the theory of inverted U-shaped inequality between finance and income are three seperate hypotheses. The first two theories are based on Newman and Banerjee, Zeira, and Galor’s conceptual frameworks, while the third suggestion is based on Greenwood and Jovanovich's theoretical foundation. The finance-income inequality widening theory states that when institutional quality is poor, financial progress may benefit only the rich.

Foreign direct investment (FDI)

Foreign direct investment improves technology and knowledge and can be a significant source of economic development, especially in developing republics. The evidence on the impact of FDI on income inequality is mixed with variations in money inflows, cumulative skilled labor requirement demand, phases of growth, workforce, and total substructure. Multinational investors, for example, may compel a drop-in labor wages by exerting pressure on the country's labor union. This will disproportionately harm the low and middle classes. Workers' bargaining leverage may be eroded if multinational corporations threaten to remove their investment. Multinationals' capital exhaustive nature also generates a fake split economic structure inside the economy with a tiny advanced sector and a big backward sector. FDI may strengthen business governance and management practices by providing funds and technology. This could boost the skilled labor sector's productivity, raising economic growth and widening income inequalities.

Education- income inequality

The large amount of prose on the impact of schooling on income inequality can be divided into two major groups. According to Knight and Sabot, the composition effect shows how unsatisfactory education circulation leads to increasing income inequality, but the density effect raises the regular education level, resultant in a beneficial influence on income sharing (Seitz, 2018). Long-term investments in higher education and education will have a greater compression effect than arrangement effect, resulting in a more evenly distributed income distribution. According to Juhn, a growth in pay inequality is mostly due to a rise in education, as well as other factors. Current studies on the education-inequality nexus produce contradictory empirical conclusions, based on our findings. According to Yang, the gap is due to chance sample mistakes, mis requirement biases, and the likelihood of partiality in the recording of outcome for different republics.

Democracy-income inequality

Democracy, by definition, requires widespread political engagement, as well as a national political system based on free elections. Laws, institutions, and policies, the power to mobilize collective preferences, define the impact of any political system on a country's income distribution. As democracy holds the principles of “one person, one vote” and a representative government, it is frequently associated with economic redistribution programs (e.g. well-being spending, liberal taxation, price subsidies) (Ye, D. 2020). Lenski found that democracy redistributes political power in favour of the popular and reduces inequality. Democracy endorses equal money distribution while the poor are allowed to demand more equitable asset allocation. However, the literature on the influence of democracy on income delivery is divided. Muller, Moon, and Rodrik claim that democracy reduces wealth inequality. On the other hand, democracy, has no significant impact on wealth inequality, as stated by Deininger, Squire, Power, and Jesionowski.

This study provides an alternate policy method to the examination of income inequality by combining the four parts of the literature. Financial development, we argue, will resistance abrasion increase and economic growth while avoiding the possible incentive difficulties associated with redistributive measures. Foreign investment, education, and fairness will play important roles in Kazakhstan's development.

Methods

Inequality in Kazakhstan.

In this section an experiential model is presented. Also, we examine the preliminary trends and the descriptive statistics of the variables.

Empirical model, variables and measures

In the case of Kazakhstan, we analyze the relationship between income inequality and financial development, using financial growth, foreign direct speculation, education, and egalitarianism to control variable quantity. Generic functional form of experiential model is:

IE=F (Y, F1, F, E, D) (1)

where IE stands for income inequality, Y for economic growth, F for monetary development, F 1 for foreign direct speculation, E for schooling, and D for democracy. To lessen the acuity of the time series data, all series are converted to natural logarithms (Shahbaz, 2010), resulting in reliable and dependable approximations. The unsettled variable definition is as follows: Democracy is restrained by political liberties and civil rights, whereas education is measured by a composite score of secondary and primary enrolments (Tur- ganbayev, 2017). The education index is signified by a multiple index of primary and secondary enrolments, and democracy is measured by political liberties and civil liberties. Distant direct speculation includes net inflows of FDI as a percentage of gross olomestic product (GDP); the education index is represented by a composite index of primary and secondary enrolments; and egalitarianism is slow by political freedoms and public liberties. Is the residual term a normal delivery with zero-mean, finite-variance? This measure captures the amount of credit moved from savers to the isolated sector. Without credits granted to the state sector and credits issued by central and expansion banks, as opposed to alternative measurements Ft. Credit to the private sector is seen as a complete pointer to financial development in the fiction.

Trends and descriptive statistics

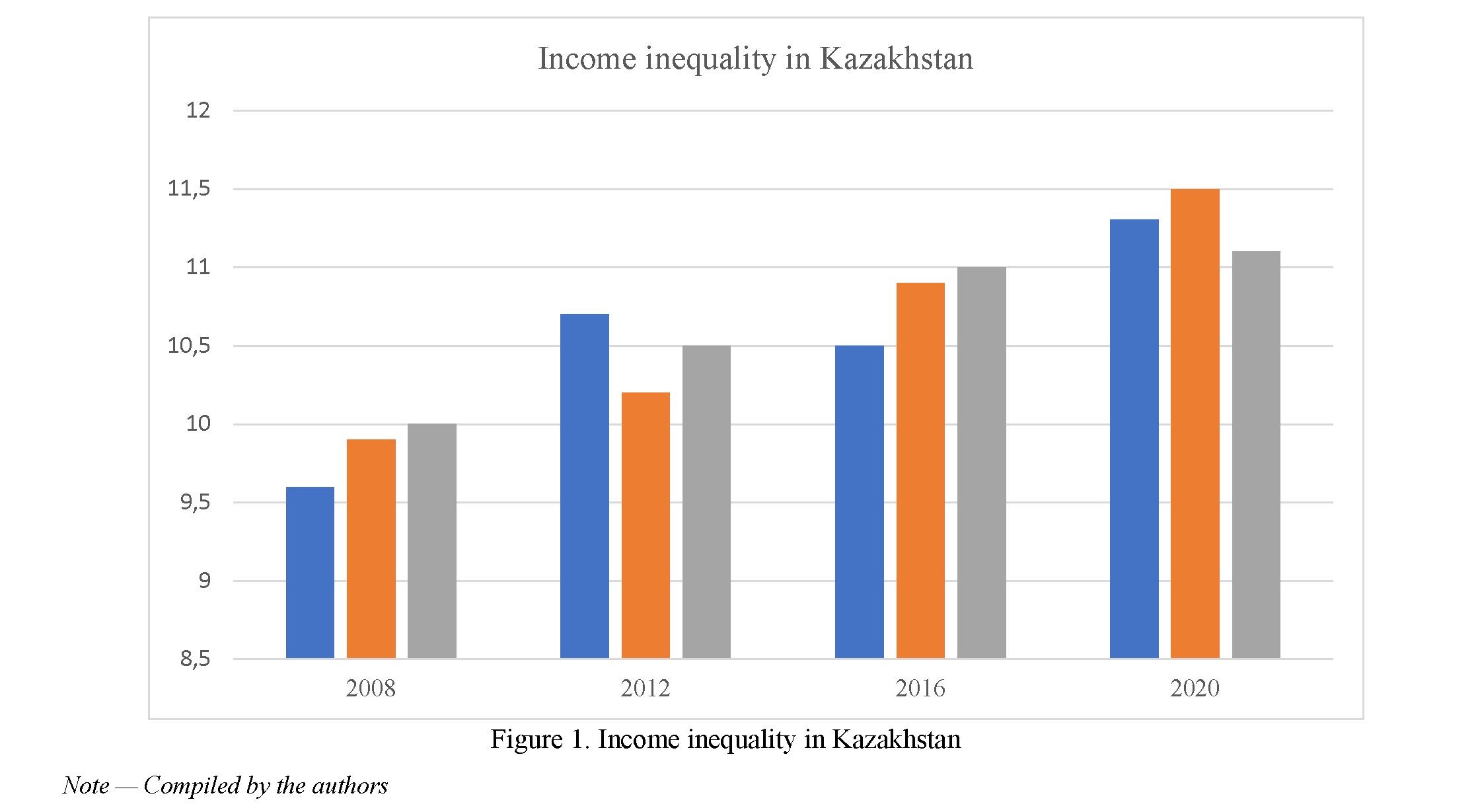

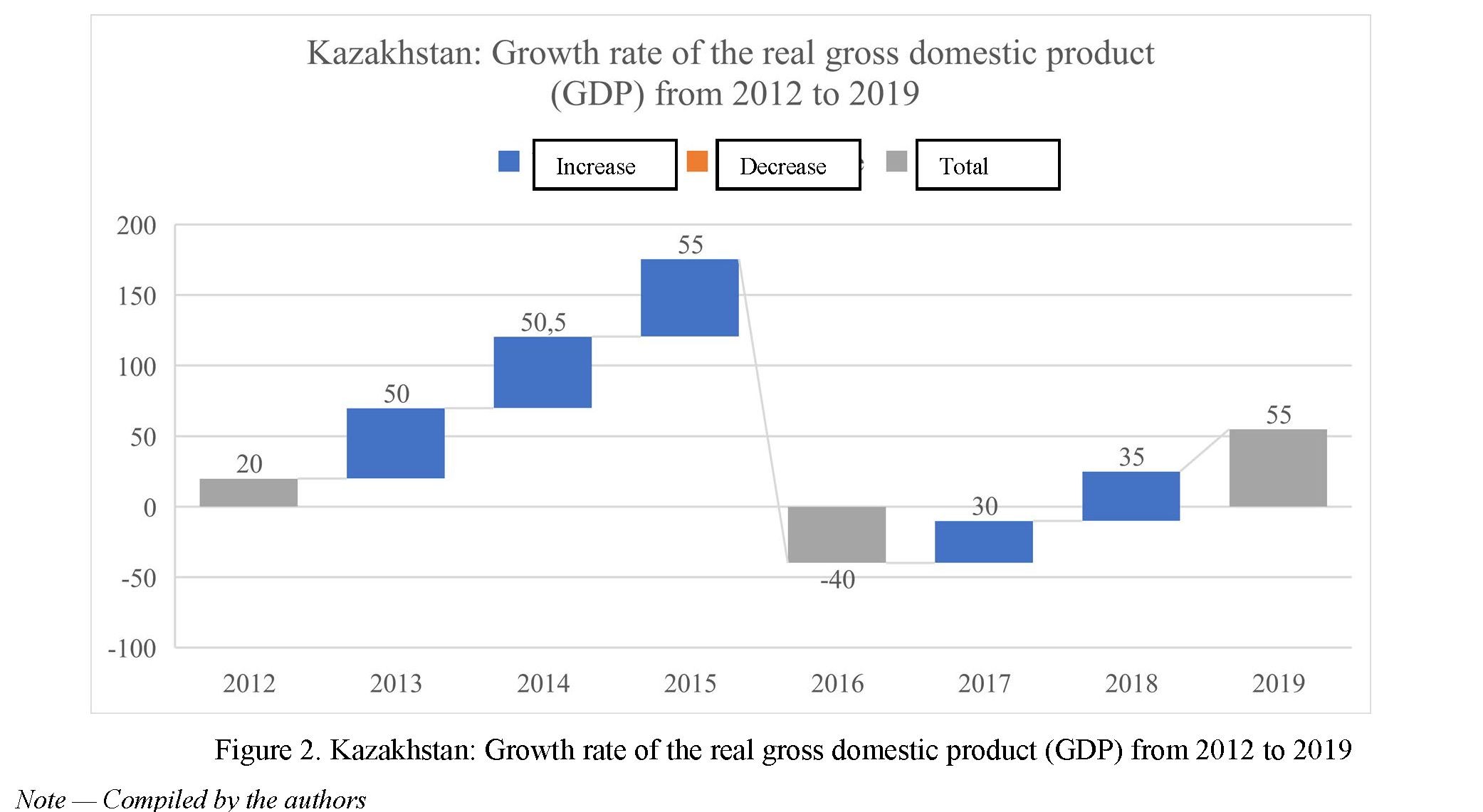

Figure 1 demonstrates a shifting pattern in Kazakhstan's income inequality. Inequality in income grew fast from 2002 to 2007, then more slowly from 2008 to 2020. Income inequality has decreased since 2002, compared to earlier years. Figure 2 illustrates the trend in GDP per capita, which is variable but positive (Begim, 2018). The tendency in domestic recognition to the private part per capita, which is used as a proxy for measure financial development, is depicted in Figure 3. From 1996 onwards, the trend climbed, then endured modest and consistent between 2000 and 2005. The rising trend in the financial growth index since 2005 can be linked to earnings from the oil segment, which has resulted in an influx of foreign cash (Figure 1,2).

According to early statistics (Table 1), income inequality, economic progress, financial development, distant direct speculation, schooling, and democracy all exhibit a normal distribution, which is verified by Jonquière test statistics (Begim, 2018). In comparison to democracy and economic inequality, financial development and foreign direct investment illustrate a plenty of variations. Comparing to financial progress and foreign direct investment, economic growth is less erratic, yet, it is more volatile in comparison with democracy and income inequality.

Table 1. Findings from the ARDL Bounds Test

Note — Authors’ Computation from E-views 9.5 Output

|

Test Statistic |

Value |

K |

|

F Statistic |

7.585137 |

7 |

|

Critical Value Bounds |

||

|

Significance |

IO Bound |

I1 Bound |

|

10 % |

1.92 |

2.89 |

|

5 % |

2.17 |

3.21 |

|

2.5 % |

2.43 |

3.51 |

|

1 % |

2.73 |

3.9 |

Results in Table 1 indicate long-run relationship.

Discussion

There are three primary steps in our estimating strategy. To analyse the stationarity properties of the variables, we first use the Augmented Dickey–Fuller (ADF), the Phillips–Perron and Zivot–Andrews tests. A structural break in the series is not taken into account in the first two-unit root tests. The Z–A test is implemented in two different ways. The first version allows for a single break in the trend variables' intercept, whereas the second version allows for a single break in the trend function's intercept and slope. The Z–A tests reveal that at their first difference, all variables are stationary. Break periods run from 1993 to 2005, and each one is noteworthy because the economy is in transition during this time, and the discovery of oilfields in 2006 increased oil exports, affecting income inequality. Following the cointegration test, we evaluate the long-run dynamics in the second step of our estimation. We use the autoregressive distributed lag (ARDL) bounds testing approach developed by Pesaran and Shin to overcome the small sample bias typical of classic cointegration tests (Aldashev & Danzer, 2020). The structural break is taken into account in this test. The

ARDL limits test is flexible in terms of the integrating order of the variables, whether they are determined to be stationary at I (1), I (0), or I (1) / I (0), as stated in the literature (0).

Furthermore, the short-run estimate of financial growth and income difference in Kazakhstan demonstrates a positive connection between finance and income inequality. Poor parts of the people may find it hard to obtain credit from financial organizations in the early phases of fiscal growth due to a lack of collateral and monetary illiteracy, rendering them undeserving of credit, as demonstrated by Perotti. As a result, with increased financial development, fairer income delivery for the economy is becoming a more detached ideal. More financial development is predicted to lessen income inequality during the transition by providing better education (Barrett et al., 2017). In this regard, we urge that Kazakhstani policymakers and managements develop human capital (education) — enhancing policies so that the lowest strata of the population can benefit from education, allowing them to enhance their income. Poor people's credit worthiness is expected to improve when their income level rises, allowing them greater access to financial services (Akhmetova, 2017). The association between financial development and income inequality is favourable and statistically significant in the long run. Financial development exacerbates income inequality by providing domestic private credit to Kazakhstan's top classes. In the long run, a 1 % rise in financial development (the distribution of domestic credit to the private sector) results in a 0.09 percent increase in income inequality. Table 1 shows the matching short-term estimate of 0.047.

Conclusions

To sum up, research contributes to our knowledge of the relationship amid income inequality, monetary development, and other governing elements in Kazakhstan during the change period. We evaluate the impact of economic growth, financial development, foreign direct investment, education, and democracy on income inequality since individuality using the longest available time range. From 1990 to 2014, our empirical data illustrate a surprising amount of integration across the variables, with many major break dates. The presence of long-run dynamics between the variables has been established. Also, income distribution improves as a result of economic expansion, increasing foreign direct investment, and the spread of education. Financial progress and democracy, on the other hand, have a negative impact on income inequality. In the case of Kazakhstan, the empirical lack of the GJ hypothesis is proven. It is discovered that there is a U-shaped relationship between financial development and income inequality.

References

- Akhmetova, N.S. (2017). Modern law in Kazakhstan in terms of convergence of legal systems. Education & Science without Borders, 8 (15), 31–34.

- Aldashev, A., & Danzer, A.M. (2020). Linguistic Fragmentation at the Micro-Level: Economic Returns to Speaking the Right Languge (s) in a Multilinguistic Society. The Journal of Development Studies, 56 (12), 2308–2326.

- Barrett, T., Feola, G., Khusnitdinova, M., & Krylova, V. (2017). Adapting agricultural water use to climate change in a post-Soviet context: Challenges and opportunities in Southeast Kazakhstan. Hum Ecol, 45, 747–762 https://doi.org/10.1007/s10745–017–9947–9.

- Begim, A. (2018). How to retire like a Soviet person: informality, household finances, and kinship in financialized Kazakhstan. Journal of the Royal Anthropological Institute, 24 (4), 767–785. Stan. Human ecology, 45(6), 747–762.

- Bolysbekova, M., Khassenov, M., & Kenzhalina, G. (2019). Convergence in the perception of eurasian integration in the political and expert community of Kazakhstan. Central Asia & the Caucasus, 20 (3), 51–66.

- Cities, D., & Housing, U. (2018). Urbanization in Kazakhstan.

- Hauck, M., Artykbaeva, G. T., Zozulya, T. N., & Dulamsuren, C. (2016). Pastoral livestock husbandry and rural livelihoods in the forest-steppe of east Kazakhstan. Journal of Arid Environments, 133, 102–111.

- Jonbekova, D. (2020). The diploma disease in Central Asia: students' views about purpose of university education in Kazakhstan and Tajikistan. Studies in Higher Education, 45 (6), 1183–1196.

- Khadys, B., Sikhimbayeva, D., & Bozhkarauly, A. (2018). State regulation of the development of the agro-industrial complex of the Republic of Kazakhstan. J. Advanced Res. L. & Econ., 9, 127.

- Kireyeva, A. A., Mussabalina, D. S., & Tolysbaev, B. S. (2018). Assessment and identification of the possibility for creating IT Clusters in Kazakhstan regions. Economy of the region, 14 (2) 463–473.

- Mukhametzhan, S. O., Junusbekova, G. A., & Daueshov, M. Y. (2020). An Econometric Model for Assessing the Asymmetry of Urban Development as a Factor of Regional Economic Growth: The Case of Kazakhstan. Industrial Engineering & Management Systems, 19 (2), 460–475.

- Seitz, W. (2018). Urbanization in Kazakhstan.

- Seitz, W. (2021). Urbanization in Kazakhstan: desirable cities, unaffordable housing, and the missing rental market. International Journal of Urban Sciences, 25(1), 135–166.

- Shahbaz, M., Bhattacharya, M., & Mahalik, M. K. (2017). Finance and income inequality in Kazakhstan: evidence since transition with policy suggestions. Applied Economics, 49 (52), 5337–5351.

- Turganbayev, Y. (2017). Total factor productivity convergence across the Kazakh regions. Post-Communist Economies, 29(2), 182–197.

- Yaskal, I., Maha, L. G., & Petrashchak, O. (2018). Spatial distribution of economic activities and internal economic integration in Romania. Journal of Urban & Regional Analysis, 10 (2), 217 — 240.

- Ye, D. M. (2020). The management of urban development for the regional economic growth: the example of Kazakhstan. Economy of the region, 16 (4),1285–1300.