Abstract

Object: The article considers the issues of development of small and medium businesses as one of the significant elements for the effective functioning of economics aimed to create favourable conditions for developing domestic business.

Methods: Small and medium businesses play an important role to ensure economic public involvement, tax payment into the budget, and social and economic development on the whole. The article describes the basic sources for financing investment projects of small and medium business entities, considers the condition of small and medium businesses in the Republic, analyzed the problems controlling the development, represented the author’s view for the solution. The authors research the sources for financial support of entrepreneurial development, the insufficiency problem, the lack of drivers for implementation. Based on the analyses of entrepreneurial activity in Kazakhstan for the last years conclusions and recommendations have been represented to improve economic levers of regulating entrepreneurship activities, the prognosis for the further development of small and medium businesses has been done. With the help of Desk Research, the basic indexes of small and medium business development and ways of financing small and medium businesses have been analyzed.

Findings: Based on the regressive multiple data analyses and application of technical analysis, the amount of manpower employed in the small and medium business, the amount of GVA in the GDP (gross domestic product), the credit tranche, given to the small entrepreneurship, investments in the capital stock have been calculated.

Conclusions: The necessity to deregulate business financially and legislatively has been justified. There have been worked out the practical recommendations to ensure refusal from the routine and specific random inspection visits. There also has been made an access to state and quasi-procurement together with the electronic trading platform, category system, and pre-qualified selection.

The development of SMB (small and medium businesses) is one of the strategic tasks of the country that promotes stimulation of competitive environment in order to implement new methods and effective technologies at the enterprises, to raise workforce productivity, to apply high technology. SMB also plays a social role by stabilizing medium population stratum, creating new workplaces, reducing unemployment and poverty.

The state policy in the Republic of Kazakhstan related to private entrepreneurship is aimed to form the middle class, by developing small businesses focused on the creation of new high-tech industries with the highest added value.

To achieve this goal as one of the stages of realization of the strategy of industrial and innovative development of the Republic of Kazakhstan, it is envisaged to solve the problem of developing the infrastructure of entrepreneurship.

In the Republic of Kazakhstan, such organizations include state-owned and state-created organizations; non-governmental organizations; commercial organizations. A comparison of organizational and functional structures allows us to compile a matrix of participation of infrastructure institutions in the process of entrepreneurship development in Kazakhstan (The financing of small and medium-sized enterprises in the euro area (august, 2007, pp.75). Currently, it seems relevant for small and medium-sized businesses to search for alternative sources of financing, since small and medium-sized businesses are quicker to adapt to changes and can push the economy out of a protracted recession (Gazman, 2013).

One of the specific features of project financing is the use of a large number of financial and non- financial instruments, a mature normative framework, tendering, which leads to significant costs for legal processing of the project and legal support. As a result, investment projects for the implementation of which it is necessary to apply project financing are limited to such additional costs (Doing Business, 2014).

Project financing has a history of less than a quarter-century. It appeared in the 70s in connection with the «oil boom» when oil and other energy prices rose many times over a short period. The profitability of investment projects in oil and gas production began to amount to hundreds or even thousands of percent per year. This influenced the behavior of banks that began to search for highly profitable lending projects (primarily in the oil and gas sector of the economy).

To finance very large projects, they joined the consortium. Later, in the 80s, project financing began to be used in the telecommunications sector, mining, and infrastructure. As noted by E.R. Yeskomb, the project financing is a way of attracting long-term borrowed financing for large projects through financial engineering, based on a loan against cash flows created only by the project itself, and is a complex organizational and financial measure for financing and monitoring the implementation of the project its participants (Aimurzina, 2018).

The investment activity of small and medium enterprises is regulated by the state and regional regulatory acts coordinating the investment activities of all business entities in the country’s market.

In the Republic of Kazakhstan, the average annual increase of active entities in SMB amounts to 2,4 % for the last 5 years, the amount of employed in SME is 2 %, output of product is 13,2 %, the share in GRP is 5 % (Committee on Statistics, 2019).

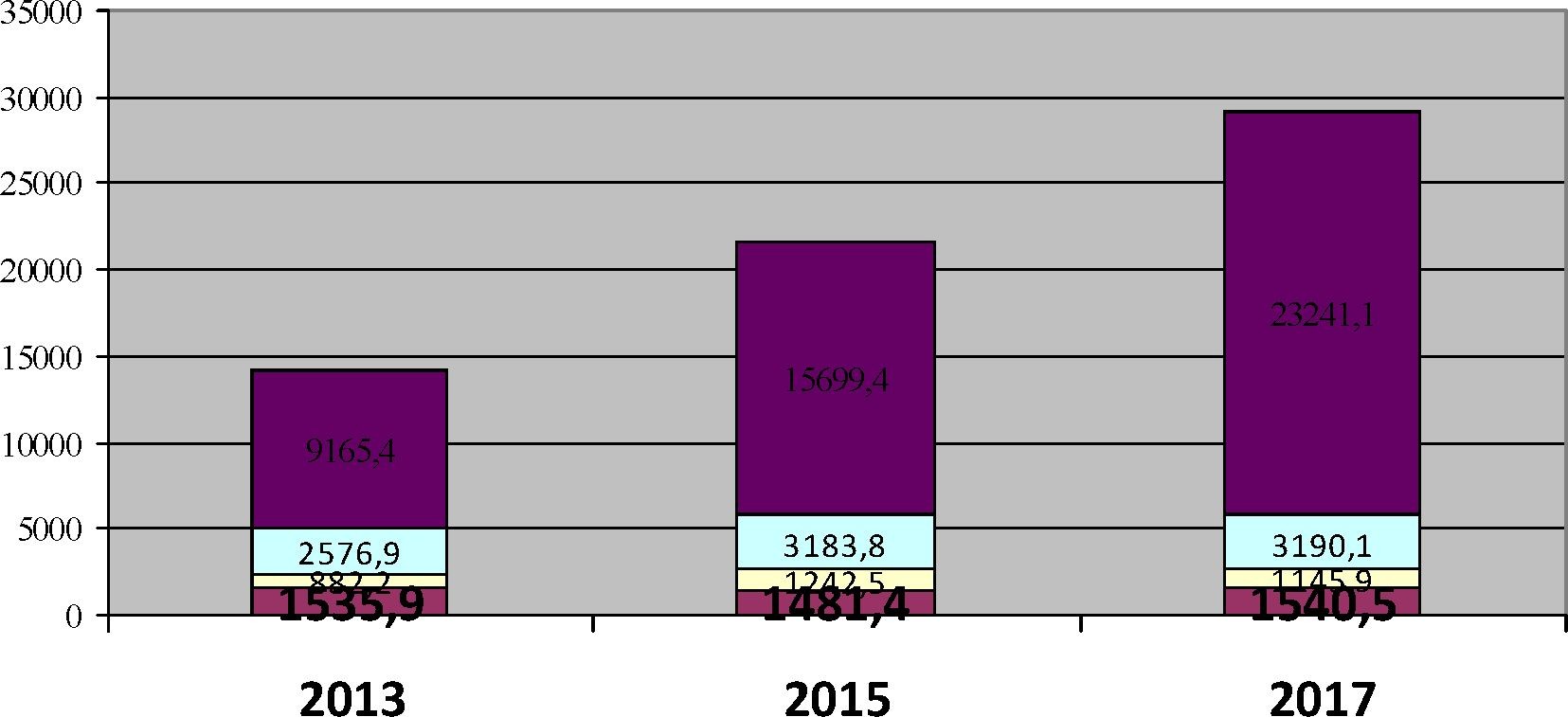

For 2013–2017, there is a slight annual increase of the registered entities by 0,03 %. The graph shows basic indexes of SMB development in the Republic of Kazakhstan for the period of 2013–2017 years.

The amount of the registered entities The amount of active entities in SME

The number of the employed in SME, thous. Rate of Production, bln.tenge

Figure 1. Basic indexes of SME development in the Republic of Kazakhstan for the period of 2013–2017 years

Note: Compiled by the author on the basis of the source (Committee on Statistics of the Ministry of National Economy of the Republic of Kazakhstan)

127

Based on the Committee on Statistics The Ministry of National Economics of the Republic of Kazakhstan (MNE) the trend line has been built for the period from 2005–2017 years (Graph 2), showing the tendency between the number of employed in the SME and the proportion of GVA (Gross Value added) of SME (Small and Medium Entrepreneurship) in the GDP (Gross Domestic Product). R-squared product R2 is determined as the coefficient of determination between the level of the statistical series and the time and chracterizes the proportion of fluctuation of the statistical series influenced by the time. The closer the R2 to 1, the more significant the trend equation is (Sartov, 2016).

The scattering graph showed the vivid escapes, at the same time the R-squared product is above the optimal value of R2=0,9525>0,7. Due to this, the given factor is considered to be significant. The bigger amount of the employed in the SME, the higher parameters of the GDP of the country is. The prognosis is possible in such a model and we see that the point prognosis, at first sight, is accurate as the R-squared product equals to 0,9525. Polynomial equation of the dependency of GVA proportion in the GDP from the number of the employed in the SME can be described by the function: y = 4E-16x6 — 6E-12x5 + 4E-08x4 — 0,0001x3 + 0,2692x2 — 271,05x + 112701.

The estimated data of the employed in the SME and the proportion of SME’s GVA are displayed in Graph 3 and were made based on the linear trend.

Based on the proximate analysis the impact forecast of the number of employed in the SME has been made up in proportion to GVA in the GDP.

According to the forecast the proportion of SME contribution in the GDP in 2022 in Kazakhstan will make up 34 %. In comparison with such developed countries like USA (52 %), Germany (55 %), France (50 %), Denmark (61 %), Italy (68 %) the stated parameter is quite low.

However, one of the main tasks of the strategic plans for the development of Kazakhstan is to achieve 50 % of enterprises’ contribution in the country’s GDP. To accomplish the following task the government takes necessary measures to expand and improve state programs to support the SME. Thus, at present more than 13 thousand of business projects have been financed, the Development Production Employment and Mass Entrepreneurship Program has been adopted which allots credits for up to 18 million tenge with 6 % of rock-bottom rate.

One of the main SME’s external financing is a credit financing. Credit financing is determined as money supply given by the financial organizations subject to specific conditions (creditworthiness, promptness, paying capacity) for a certain period. Creditworthiness of borrower of the investment fund is the ability to accumulate the cash flow in order to pay back the investment credit allotted based on the basic parameters from the point of risk and income evaluation necessary for the bank to make the effective decision for the project.

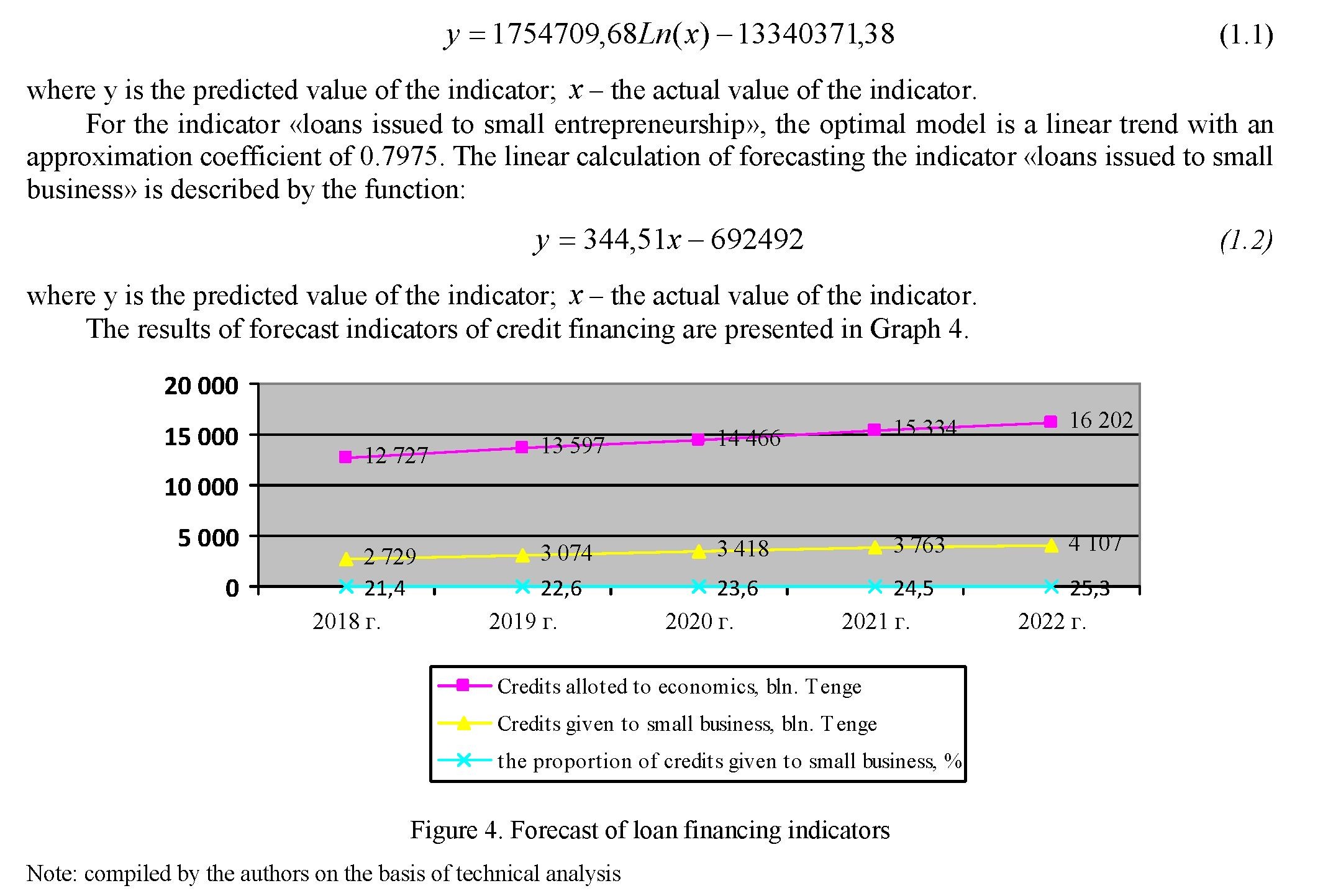

The dynamic credit financing of second tier banks given to the small entrepreneurship has an annual growth for the 2012–2018 years, which is 13,8 %, also, the proportion of credit financing has increased by 4,2 % with the total amount of funds allotted in the country’s economy (Productivity Drag from Small and Medium-Sized Enterprises in Japan (june 2019, pp. 21).

Based on the dynamics of the actual indicators of loans issued to small businesses in the total volume of loans issued to the economy, as well as applying technical analysis based on the exponential and linear trend lines, we will predict the dynamics of credit financing until 2023.

For the indicator «loans issued to the economy» a model of the logarithmic trend line was selected.

The analysis of this graph shows that the model of the time series selected in the form of a logarithmic trend, in principle, adequately describes the real process, the coefficient of reliability of the approximation is 0.75. Prediction in such a model is possible and we see that the point forecast, at first glance, is reliable.

The logarithmic calculation of forecasting the indicator «loans issued to the economy» is represented by the following equation:

Thus, by 2022, the share of loans issued to small businesses will amount to 25.3 % of the total loans issued to the economy.

Results

One of the main financial funds to support entrepreneurship is Damu Entrepreneurship Development Fund JSC, which provides financial and non-financial support to SMEs through state programs for both startups and existing ones. Credit financing is provided through certain second-tier banks and leasing companies that are partners of the Fund.

To determine the effectiveness of government programs to support entrepreneurship we consider the dynamics of the main indicators for the period 2012–2017 (Graph 5).

The above graph clearly demonstrates the stable growth of investment projects by 29.8 % since 2012. At the same time, credit financing indicators are growing, the average annual growth is 3.3 %.

Unlike loan financing, venture capital has a number of features.

According to the terminology of E.S. Krapivina venture capital fund is an investment fund that focuses on working with innovative enterprises and projects, often start-ups (Krapivina, 2014). Venture financing is a risky activity aimed at using scientific achievements and technical innovations that have not yet been used in practice. In the entrepreneurial code of the Republic of Kazakhstan venture financing refers to activities related to the financing of individuals engaged only in innovative activities by investing in their authorized capital, acquiring financial instruments issued by them, or providing them with a cash loan (Business Code of the Republic of Kazakhstan, 2015).

Thus, venture financing is in many respects different from credit financing. The main differences are the mandatory presence of an innovative component in the investment project, the ability to attract financing without providing collateral. Venture financing participants can be enterprises that are in the early stages of development, as well as operating enterprises planning to expand or modernize production facilities.

The terms of the financing are provided on the terms of payment of the investment loan during the longterm investment period with an annual interest rate of 15 % or higher or by participation of the authorized capital of SMEs, while the calculation of the valuation of the company is determined at the preliminary stage of negotiations.

With the entry into force of new legislation in the Republic of Kazakhstan on issues of venture financing (Law of the Republic of Kazakhstan, 2018) the demand for venture financing will increase due to the availability and simplification of procedures, as well as the creation of a legal framework. The emergence of an agreement on the exercise of the rights of participants in a business partnership will allow for the implementation of activities related to the management of the partnership by participating in voting at a general meeting of participants. In addition, participants in the partnership may provide compensation for property losses due to the impossibility of fulfilling their obligations.

The concept of a «venture manager» is introduced, engaged in the conduct of asset management activities of a venture fund on the basis of an agreement concluded with it. The opening of the Astana Hub international technology park for IT start-ups, being a platform to attract venture capitalists and business angels, will allow SMEs to develop in high-tech innovative areas.

The investment portfolio of fixed venture capital funds in the Republic of Kazakhstan is presented in Table. When compiling the investment portfolio, annual reports for 2017 were used by NATR JSC, Kazyna Capital Management JSC (Annual reports of Kazyna Capital Management JSC, 2018).

Table. Investment portfolio of fixed assets in the Republic of Kazakhstan

|

№ |

Name of private equity fund |

Venture fund |

Venture fund investments, mln. tenge |

|

1 |

JSC «Areket» |

JSC «NATR» |

264,6 |

|

2 |

JSC «Delta Tehnology» |

1320 |

|

|

3 |

Wellington Partners Ventures III Technology Fund L.P. |

1329 |

|

|

4 |

Flagship Venture Fund |

1281 |

|

|

5 |

Vertex III Venture Fund |

674 |

|

|

6 |

Aureos Central Asia Fund |

JSC «Kazyna Capital Management» |

1 961 |

|

7 |

Wolfensohn Capital Partners (WCP) |

9 213 |

|

|

8 |

ADM Kazakhstan Capital Restructuring Fund (KCRF) |

18 315 |

|

|

9 |

Russian-Kazakhstan Nanotechnology Fund (RKFN) |

9 250 |

|

|

10 |

Falah Growth Fund (FGF) |

18 500 |

|

|

11 |

Kazakhstan Growth Fund (KGF) |

14 800 |

|

|

12 |

Macquarie Russia and CIS Infrastructure Fund (MRIF) |

11 100 |

|

|

13 |

CITIC-Kazyna Investment Fund I (CKIF) |

37 000 |

|

|

14 |

Almex-Baiterek Fund (ABF) |

10 323 |

|

|

15 |

Islamic Infrastructure Fund (IIF) |

1 110 |

|

|

16 |

Baiterek Venture Fund (BVF) |

14 134 |

|

|

17 |

Kazakhstan Infrastructure Fund (KIF) |

37 000 |

|

|

18 |

DBK Equity Fund C.V. |

1 106,3 |

|

|

Note: Compiled by the author on the basis of (Annual reports of JSC NATR) |

|||

The formation of a legal framework that helps to regulate the relationships of venture capital market participants, the creation of a mechanism for state participation in the financing of venture capital funds through development institutions and national companies will stimulate an increase in venture capital investments in innovative projects, which will increase GDP indicators in certain way countries.

JSC National Agency for Technological Development is the main operator of the program for grant financing of innovative projects. One of the main programs is «Innovative Grants».

Innovation grants are budgetary funds provided to the subjects of industrial and innovative activity on a non-repayable basis for the implementation of their industrial and innovative projects within the framework of priority areas for the provision of innovative grants. Since 2017 the program has been amended, namely, the grant limit has been increased to 500 million tenge, the requirements for grant recipients regarding the presence of 3-three years of business experience, as well as the presence of their own participation in the project have changed. In addition, the procedure for reviewing and filing an application has been simplified, also examination time was reduced.

According to the results of 2017, out of 208 grant applications 9 innovative grants were approved, with a total value of 1.687 billion tenge, 24 % of which were aimed at the commercialization of technologies, 34 % for the technological development of existing enterprises, 42 % for the development of industries. In terms of industries, the leading place is taken by the development of information and communication technologies, then advanced technologies in the agricultural sector, the third and fourth places are mechanical engineering and advanced technologies in construction.

Thus, the state stimulates the development of innovative entrepreneurship, creating favorable conditions for the introduction of new advanced technologies and innovative solutions.

In addition to traditional methods of attracting financing, there are also modern methods. A vivid example is the crowdfunding system for attracting investments, that is, financing from a large number of people.

In Kazakhstan this type of financing appeared in 2013, however active work has begun recently. The presented crowdfunding platforms provide a service to attract financing for the implementation of business ideas from around the world.

The state provides legislative support, measures are taken to deregulate the business (Tolmachev, 2015). To date, the number of permits has been reduced by more than three times and an audit of state control and oversight functions has been carried out. Practical recommendations have been worked out, suggesting the abandonment of the existing order of conducting random checks and most of the checks in a special order. The audit of legislation has been completed with a view to providing business with reports and information to state bodies. At the first stage of the work, about 1600 information requirements are planned to be reduced by 30 %. To solve problems with unreasonable tax audits, the number of scheduled inspections is reduced, counter checks of suppliers are excluded, and so on, which ultimately will reduce the number of inspections by 40 %.

In conclusion, it should be noted that the considered sources of external financing are not the only ones; there are many other ways of financing, including various combinations and options for implementing investment projects.

A lot of work has been done to ensure business access to public procurement and the procurement of the quasi-public sector, with the introduction of an electronic procurement platform, a categorization system and prequalification. An analysis is carried out to formulate a nomenclature of products and demand for large enterprises (Adigwe, 2012).

Thus, the country's economic growth is directly dependent on the development of SMEs and on a favorable investment climate. The development of small and medium-sized businesses is the main instrument of industrial and social modernization of Kazakhstan in the 21st century.

- Adigwe, P.K. (January, 2012). Project Finance for Small and Medium Scale Enterprises (SMEs) in Nigeria. (Vol. 6 (1), Serial No. 24, pp. 3–12), An International Multidisciplinary Journal, Ethiopia

- Aimurzina B., & Kamenova M. (2018). State Tax Management: Current Status and Mechanism of Improvement (pp. 196). Book’s Craiova: ASERS Publishing.

- Doing Business 2014 (october 29, 2013, p. 3–12). Understanding Regulations for Small and Medium-Size Enterprises. A World Bank Group Corporate Flagship.

- Productivity Drag from Small and Medium-Sized Enterprises in Japan (june 2019, p. 21). Prepared by Mariana Colacelli and Gee Hee Hong Authorized for distribution by Paul Cashin WP/19/137.

- The financing of small and medium-sized enterprises in the euro area (august, 2007, p.75). Monthly Bulletin: European Central Bank.

- Tolmachev, D.E., Ulyanova, E.A., & Pliner, L.M. (2015). Yeltsin Development Of Small And Medium-Sized Regional Enterprises: Creation Of Priority Areas. (Vol. 1, Iss.1, p. 79–93). New Research into Regional Economy Problems.

- Gazman, V.D. (2013). Leveridzh-lizing: finansirovanie krupnykh investitsionnykh proektov [Leverage leasing: financing of large investment projects] / V.D. Gazman // Ekonomicheskii zhurnal VShE. — No. 1. URL: https://cyberleninka.ru/article/n/leveridzh-lizing-finansirovanie-krupnyh-investitsionnyh-proektov [in Russian].

- Godovye otchety AO «NATR» [Annual reports of JSC «NATR»] [Elektronnyi resurs]. — Rezhim dostupa: www.natd.gov.kz [in Russian].

- Godovye otchety AO «Kazyna Kapital Menedzhment» [Annual reports of Kazyna Capital Management JSC»] [Elektronnyi resurs]. — Rezhim dostupa: www.kcm-kazyna.kz [in Russian].

- Zakon RK ot 4 iiulia 2018 g. № 174-VI «O vnesenii izmenenii i dopolnenii v nekotorye zakonodatelnye akty RK po voprosam venchurnogo finansirovaniia» [Law of the Republic of Kazakhstan No. 174-VI dated July 4, 2018 «On amendments and additions to some legislative acts of the Republic of Kazakhstan on venture financing»] [in Russian].

- Krapivina, E.S. (2014). Finansirovanie razvitiia informatsionnogo obshchestva venchurnymi fondami v Respublike Kazakhstan / E.S. Krapivina // Molodoi uchenyi, 5, 272–274 [in Russian].

- Komitet po statistike Ministerstva natsionalnoi ekonomiki Respubliki Kazakhstan [Elektronnyi resurs]. — Rezhim dostupa: // www.stat.gov.kz [in Russian].

- Otchet o sostoianii razvitiia MSP v Kazakhstane i ego regionakh AO «Fond razvitiia predprinimatelstva «Damu» [Elektronnyi resurs]. — Rezhim dostupa: www.damu.kz [in Russian].

- Predprinimatelskii kodeks RK ot 29 oktiabria 2015 goda № 375-V ZRK [Business code of the Republic of Kazakhstan dated October 29, 2015 No. 375-V SAM] [in Russian].

- Sartov, U.K. (2016). Osnovy finansovogo menedzhmenta. — Almaty: LEM, 114 [in Russian].