Annotation

This article in concerned with analysis of the status and development of the Kazakhstani grain market over the period of 1954-2014. In addition, the paper contains general overview and analysis of the basic directions of Kazakhstani grain export and assessment and marcoeconomic analysis of market development.

The basic problems of increased exports of grain in the specified direction were discovered and the specific ways to resolve them and its further development were proposed as well. The study used techniques such as economics and statistics, monographic, abstract logic ones.

Grain production is the leading branch of the world’s agriculture, and grain market is the basis of the global business as the main segment of the world agro - food market. In connection with the decrease of grain production in Kazakhstan and changes in the global market, the theme of grain exports development became particularly relevant. Grain crops take almost half of all arable land in a world, and the volume of world grain trade in the years 2014-2015 was amounted to 312 million tons and today it tends to decrease. The leading place in the grain market is given to the United States, which accounted for 28% of trade, followed by Canada - 17%, Australia and the European Union - 15%, and Argentina -11%. Manufacture and grain sale are important issues for Kazakhstan, both in economically and politically terms. [1] Today, the industry has a large resource capacity to further increase in the volume and improvement of Competiveness of products, making it possible not only to meet the needs of internal needs of country, but also to act as a competitive exporter of grain in the world market.

The state and development of the grain market OfKazakhstan. Kazakhstan is one of the largest grain-producing countries in the world. In recent years, total cereal crops occupy more than 80% of the sown area of crops. The country annually produces about 13, 5-20, 1 mln. tons of grain. The average grain yield is 10-14 q/ha. In the year 2014, the gross grain harvest in Kazakhstan amounted to 17.2 million tons, while it was at the level of 18.2 million tons in the year 2012. One crop takes 76% of the total volume: wheat (9.8 million tonnes). The other cultures are 11.6% of barley, 4% of com, 2.7% of rice, 1.1% of oats, 0.2% of rye and 0.4% of buckwheat.

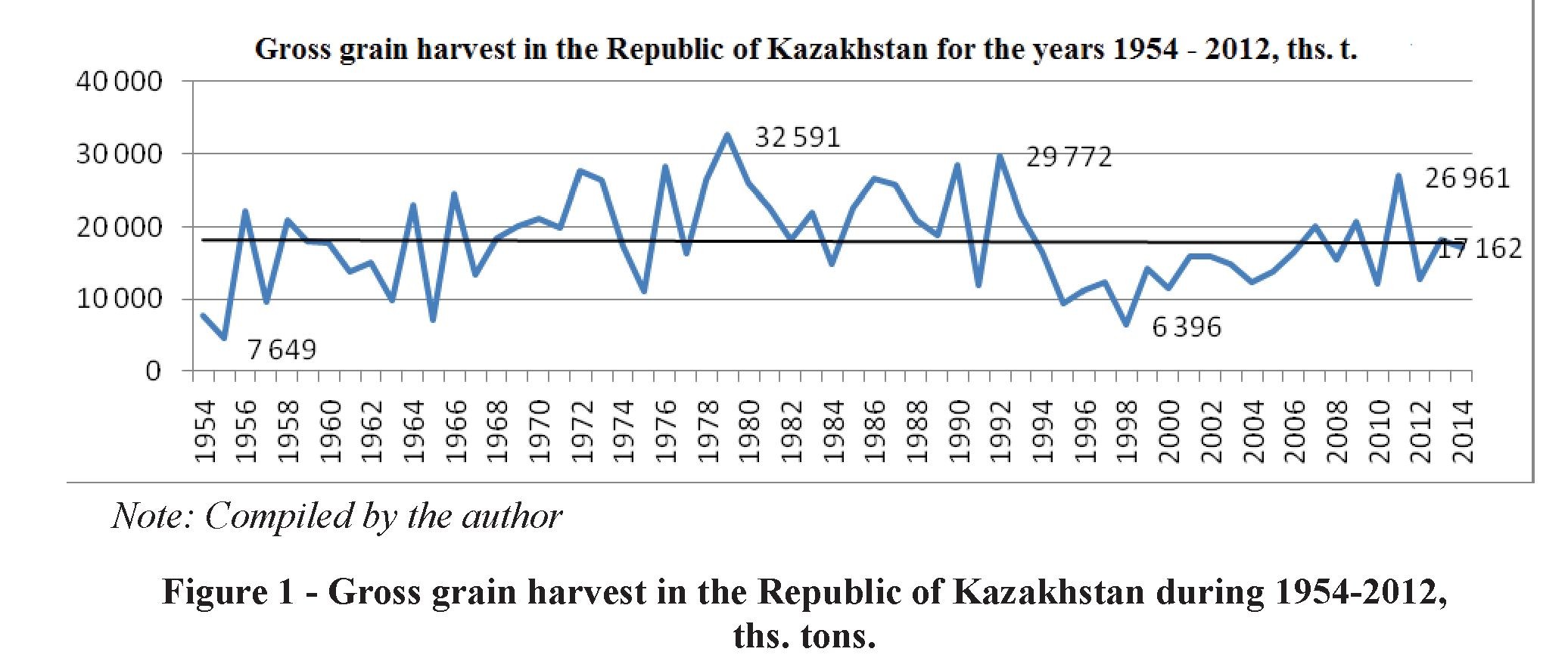

According to the Committee on Statistics of the Ministry of National Economics of the Republic of Kazakhstan, average value of grain yield in the republic was 11.7 quintals per hectare in the year 2014. There was no significant growth in the yield compared with the year 2013. The highest rate is observed in South Kazakhstan region, where the yield is up to 19.4, in Almaty region -18.2, in Zhambyl region -16.5 quintals per hectare. As for the gross harvest of grain crops, there has been a slight increase in the country’s grain production in recent years, which is graphically shown in Figure 1.

Based on Figure 1, we carry out the analysis of the gross grain crops harvest in the country for the period from 1954 to 2014. For example, in the year 1954 the gross grain harvest amounted to 7649 thousand tones, in the following years until 1978 the figure was from 4518 to 28 297 thousand tons. In the year 1979, grain harvest reached its peak during the analyzed period, which amounted to 32 591 thous. tons. Since independence, the lowest grain harvest was recorded in the year 1998 in the amount of 6396 ths. tons, while record harvest of 29 772 thousand tones and 26 961 thousand tones was in the year 1992 and 2011 respectively. Gross grain harvest in the republic amounted to 17,100 tons in the year 2014, which by 1,000 tons less than last year. This significant increase in gross production occurred in relation to the arid 2012 year in the year 2014 and is significantly less high-yielded in the years 2009, 2011.

Kazakh wheat has high baking properties due to the high content of gluten. About 80%

of wheat production refers to the upper classes with higher gluten content of 23% [2]. It exports in almost all CIS countries. However, this export trend is unstable. Thus, the supply of grain to the markets of the countries - participants of the Common Economic Space was reduced: the capacity of this market for Kazakh wheat has fallen by almost 35 times in the last 12 years. For example, Belarus buys grain unevenly from Kazakhstan, i.e. 19.7 tonnes of wheat were purchased in the year 2013, and our wheat was not in demand in the Belarusian market in the year 2014, because it replaced by the wheat from Russia and Ukraine.

Over the last five marketing years (2009/10 - 2014/15), the average annual grain exports from Kazakhstan amounted to about 5-7 mln. tons, but the overall decline in trading activity in the world, as well as the highest yields in traditional importing countries of Kazakhstan grain led to lowering in export volumes from Kazakhstan, which can be shown in Table 1.

|

Direction of exports |

2009/10 |

2010/11 |

2011/12 |

2012/13 |

2013/14 |

2014/15 |

2015/16 as of 31.10.15 |

|

ZzXzerbaijan |

535.0 |

1 100.4 |

1 071.5 |

742.6 |

787.8 |

187.8 |

9.7 |

|

Georgia |

154.0 |

226.2 |

459.4 |

183.7 |

175.9 |

5.2 |

0.0 |

|

Central ZzXsia * |

3 085.7 |

2 557.2 |

4 504.8 |

3 656.1 |

3 928.2 |

3 907.5 |

1 531.1 |

|

ZzXfghanistan |

1 761.4 |

371.9 |

1 150.6 |

394.3 |

907.8 |

953.4 |

244.0 |

Table 1 - Exports of wheat and flour in grain equivalent of Kazakhstan, thousand tons in marketing years (from July 1 to June 30)

|

Iran |

824.1 |

7.3 |

544.4 |

345.6 |

1 013.0 |

261.4 |

219.4 |

|

China |

17.0 |

30.2 |

162.4 |

61.5 |

272.7 |

110.4 |

57.7 |

|

RF ** |

103.7 |

64.3 |

328.1 |

1 046.2 |

1 317.5 |

366.0 |

141.8 |

|

Total |

6480.9 |

4 357.5 |

8 221.2 |

6 430.0 |

8 402.9 |

5 791.6 |

2 203.6 |

|

World market |

1 528.7 |

953.4 |

3 025.4 |

496.3 |

402.1 |

162.7 |

39.5 |

|

Total: |

8009.6 |

5 310.9 |

11 246.6 |

6 926.3 |

8 805.0 |

5 954.3 |

2 243.1 |

|

Exports of cereals (barley, oats, corn, rice, buckwheat, millet, etc.), thous. tons |

387.7 |

285.6 |

784.0 |

218.9 |

475.5 |

561.2 |

|

|

including the export of barley |

357.5 |

232.1 |

702.4 |

167.3 |

416.8 |

482.6 |

|

|

TOTAL grain and flour in grain equivalent, thous. tons |

8 397.3 |

5 596.5 |

12 030.6 |

7 145.2 |

9 280.5 |

6 515.5 |

2 243.1 |

|

including the export of flour |

2510.0 |

1 804.3 |

2 609.3 |

1 700.2 |

1 988.7 |

1 713.9 |

594.8 |

|

flour in grain equivalent |

3 585.7 |

2 577.6 |

3 727.6 |

2 428.8 |

2 841.0 |

2 448.4 |

849.8 |

Note: Compiled by the author according to the KGD AlF RK and JSC “NC “Kazakhstan Temir Zholy''

Table 1 shows, the export of grain from Kazakhstan was significantly decreased in the year 2014. This suggests that the need to expand the export trend, in not only the countries of Central Asia and the People’s Republic of China (PRC) and South-East Asia (SEA), as well as Iran and the Gulf countries. Positions of Kazakh grain exporters are unstable and subject to large fluctuations, since, depending on market conditions, as well as underdeveloped transport and logistics infrastructure of Kazakhstan’s export directions are constantly changing. We suggest considering the main directions OfKazakhstan grain export:

North - through the border crossings of Aksu, Petropavlovsk, Semiglavy Mar in the direction of the seaports of the Black and Baltic seas.

South - through the border crossings of Saryagash, Lugovoe, Bolashak (Iran, Uzbekistan, Turkmenistan, Kyrgyzstan, Tajikistan and Afghanistan).

West - through the port of Aktau (in Iran), as well as through railway station “Dina Nur- peissova” (ports of the Azov and Black Seas of Russia, Azerbaijan, Georgia).

East - through the border crossing of Kurka- mys, Lokot’ (Russia, Mongolia); through the border crossing railway station “Dostyk - Alashankou” (China).

The Black Sea direction is the main export route for Kazakh grain’s exit the capacious markets of North Africa, the Middle East and the EU. Due to geographical distance, the transport costs OfKazakhstan exporters reach at least 70 US dollars per ton to deliver grain to the ports of the Black Sea. At current market prices for grain, Kazakhstan wheat in these areas is uncompetitive in the Black Sea region. In this regard, the Government of Kazakhstan has taken steps to partial reimbursement of grain exporters during transport through the territory of Russia and China. It gave a powerful impetus to increase the export of Kazakh grain. In this regard, Kazakhstan export is now concentrated in the southern direction in the countries of Central Asia, Iran and Afghanistan.

Macroeconomic analysis in the direction of Kazakhstan - China. One of the most promising markets in increasing export of Kazakh grain is China, as we have noted above. China now appears as the largest producer of wheat, but almost all grown crop consumes itself, and therefore, the export of wheat is almost not carried out. Given China’s growing population and changing consumption patterns in the direction of increasing the foods consumption made from wheat, the Chinese market is very promising for Kazakhstan. China is also of interest as a transit country for the export of Kazakh grain to the countries of Southeast Asia and other countries in this area.

Import of wheat over the recent period has decreased slightly compared to the previous years, due to increasing wheat production in China (Table 2). Today, high protein wheat imported from the US, Canada, Australia and small volumes from Kazakhstan.

Table 2 notes that the average level of China’s wheat production in the last 5 years is about 121 million, tons, while imports average is 3.0 mln. tons. In the year 2014, Kazakhstan’s grain exports to China amounted to 201.2 ths. tons. An import of wheat in China is carried out based on quotas, issued by the National Development and Reform Committee of China (9.6 million tons in the year 2014). To date, COFCO Company takes 90% of quotas on imports of grain in China. The remaining 10% is distributed among private companies of China. COFCO, as well as other private companies are free to decide on the country of grain origin and suppliers. However, it should be noted that quotas to private companies of China to import exactly Kazakhstan wheat were not allocated in the years 2014 and 2015, while private companies and mills of China has been allocated a total of quotas on the volume of up to 50 ths. tons ofKazakh wheat in the year 2013.

|

MG Wheat |

2010/11 |

2011/12 |

2012/13 |

2013/14 |

2014/15 |

2015/16* |

|---|---|---|---|---|---|---|

|

Production |

115 180 |

117 400 |

121 023 |

121 930 |

126 170 |

130 000 |

|

Consumption |

110 500 |

122 500 |

125 000 |

116 500 |

118 000 |

116 500 |

|

Import |

927 |

2 933 |

2 960 |

6 773 |

1 926 |

2 500 |

|

Export |

941 |

978 |

969 |

889 |

803 |

1 000 |

Table 2 - Balance of China’s wheat according to MA USD

thous. tons

* forecast

Today, exports to China is performed by only state operator of grain JSC “NC “Food Corporation” and private Kazakh grain companies, representing the interests of major international grain traders, such as: Cargill (JV “DAN’ LLP), Bunge (Bunge East LLP), “Glencore International AG” (Kazakhstan Grain Company LLP), Archer Daniels Midland (ADM). The above- mentioned companies supply the Kazakh wheat as per contracts concluded between COFCO Company and international grain traders (Table 3).

Table 2 - Balance of China’s wheat according to MA USD

thous. tons

|

2009/10 |

2010/11 |

2011/12 |

2012/13 |

2013/14 |

2014/15 |

2015/16* |

|

|

Exports from Kazakhstan to China |

17.0 |

30.2 |

162.4 |

61.5 |

272.7 |

110.4 |

31,5 |

|

Consumption |

110 500 |

122 500 |

125 000 |

116 500 |

118 000 |

116 500 |

|

|

Import |

927 |

2 933 |

2 960 |

6 773 |

1 926 |

2 500 |

|

|

Export |

941 |

978 |

969 |

889 |

803 |

1 000 |

*As ofl September, 2015

** Compiled from data of KGD NfF RK and JSC “NC “Kazakhstan Temir Zholy''

AccordingtotheJSC “NC “Food Corporation”, the export ofKazakh wheat to China in 2015/16 MG is expected to reach 200-300 thous. tons, depending on the quality of wheat produced and competitiveness in the Chinese market. In order to develop markets for Kazakh wheat in the 2013/14 marketing year, JSC “NC “Food Corporation” had signed a number of contracts for the supply of Kazakh wheat with COFCO for a volume of 35 000 tonnes. During the visit of the President of the Republic of Kazakhstan N. A. Nazarbayev to China, JSC “NMH” KazAgro” and COFCO signed “Framework Agreement for Cooperation and wheat trade between the People's Republic of China and the Republic of Kazakhstan” on supply of 100 thousand tons OfKazakhstan wheat from JSC “NMH “KazAgro” for the years 2014/15.

Problem statement. Currently, in order to implement the decrees of the Head of State on development of promising markets, the country conducts a comprehensive study of optimum schemes and methods of grain delivery to China, as well as transit through its territory to the countries of Southeast Asia.

As of today, the export of Kazakh wheat to China is carried in bags of 50 kg loaded in covered wagons, mainly through the border crossing “Dostyk” (Kazakhstan) - “ Alashank- ou” (China). Wheat is transhipped from Kazakhstan cars into China wagons at the station “Alashankou”, which followed on the territory of China to the destination station. Accordingly, the costs of wheat transhipment on the Chinese border increase and amount to 15-17 US dollars per ton.

Today, one of the main problems in the export of Kazakh grain to China is a “transport format”. Historically Kazakh grain traders transport the grain in the specialized grain cars, while the representatives of the Chinese side, referring to the quarantine safety, require transporting the grain in sealed containers, taking into account the bagging. This obviously laborious process takes a long time, and significantly affects the production costs. This method of the grain transportation in addition to the use of manual labour requires also bearing the further costs for the purchase of sack tare, threads, sack-broaching machines, which leads to additional costs and, consequently, increase the cost of wheat.

Also today, the Kazakh wheat cannot withstand the price competition with the wheat from the United States and Australia. In other words, the cost of shipping of wheat from the United States and Australia by sea is approximately $ 20 per tonne, while transportation of Kazakh grain to the east of China, home to the bulk of its population, is worth about $ 100 - $ 120 per ton.

In accordance with the established practice of the transportation of grain in China and China’s quarantine service requirements (GUNKIK), delivery of our wheat is carried out exclusively as packaged wheat in bags. In addition, according to the requirements of GUNKIK, Kazakh wheat supply must be carried out from certain grain elevators located in the main grain regions and having a personal identification number (42 out of 211 licensed elevators). Currently, the most of Kazakhstan elevators have specialized packaging equipment for any wheat calibration in bags and loading devices in the wagon. Accordingly, we can conclude that today export of Kazakh wheat to China is very difficult and requires a thorough analysis with respect to roads and technical limitations of grain supplies.

Proposed solutions to these problems and prospects. Kazakhstan, as one of the largest producers of cereals at the world market, should make the ongoing search for new directions and markets for Kazakhstan wheat to realize its export potential.

However, one of the major problems which stand in the way of Kazakhstan grain exports to the world market is underdeveloped logistics infrastructure, high transport costs due to the territorial and geographical location of Kazakhstan, that is, the lack of direct access to the world’s leading commercial sea ports and as a consequence, the lack of alternative to rail transportation when shipping large volumes of grain.

China is an eastern neighbour OfKazakhstan and is not just a key player in the global market, which determines the main trends of global economic development, but also the emerging superpower, positions of which will largely determine the overall climate of international relations. Therefore, the relevance of strengthening friendship and equal strategic partnership grows from day to day. Relations between Kazakhstan and China are developing in a dynamic and efficient manner. Astana and Beijing share similar visions and approaches to solving urgent problems of global and regional policy. Kazakhstan continues to give priority to providing good-neighbourly, mutually beneficial and equal relations with China.

As a result of the state visit of the President of Kazakhstan Nursultan Nazarbayev to the People’s Republic of China on August 30 - September 3, 2015 the Joint Declaration on a new stage of comprehensive strategic partnership between Kazakhstan and China was signed on the basis of friendship, good neighbourliness and trust, the increased supplies of Kazakhstan wheat to China were agreed as well. Also, it was announced that China is ready to import the additional volume of Kazakhstan wheat during the talks between the President of the Republic OfKazakhstan Nursultan Nazarbayev and President of China Xi Jinping.

In addition, COFCO company and Chinese private companies are currently very interested in importing Kazakh oil crops, especially soybeans, rapeseed, sunflower seeds.

Thus, Kazakhstan has the potential to direct virtually all its export potential of agriculture to PRC. To achieve this goal, we propose the following:

- Construction of the Grain Terminal on the border of Kazakhstan - China capable of performing efficient packing of wheat in bags with further transhipping in Chinese wagons and loading wheat in bulk in the containers for export to China and Southeast Asian countries. Feasibility of the grain terminal construction shows preliminary estimates of the possibilities to reduce the overall cost of grain transportation in this direction, by combining its handling with packaging into bags directly at the grain terminal.

- Subsidies for packing equipment installation (bag or container) on elevators involved in the export of wheat to China.

Today, talks with China held at the government level to find out the possibility of solving the existing problems are as follows:

- Construction of broad line railway from the territory of the Republic of Kazakhstan to the territory of China to the construction site of Terminal in the bonded area;

- Possibility of unimpeded import of Kazakhstan grain to the Terminal with the implementation of phytosanitary control directly in the bonded zone;

- Possibility OfKazakhstan grain import to the Terminal without quotas to import to China, taking advantage of the quota regime only if the export of grain from the terminal or bonded zone.

Domestic exporters of grain arranged the meetings between representatives of the national carrier JSC “NC “Kazakhstan Temir Zholy” to the PRC, where several options for delivery of goods to China were considered:

- Delivery of packaged bags of wheat from the loading elevator in covered wagons to the Alashankou station where bags with goods are transhipped to Chinese covered wagons for further transit through the territory of China.

- Grain from Kazakhstan’s grain loading elevator packed in bags is loaded into the equipped container, which is rearranged to Alashankou on the Chinese platform and sent to the destination station in the PRC.

- Bulk grain from Kazakhstan’s loading elevator is loaded into a container equipped with, which is rearranged to Alashankou on the Chinese platform and sent to the destination station in the PRC.

- Bulk grain from Kazakhstan’s loading elevator is loaded into the wagon-grain carrier, wheel sets of such a wagon are rearranged at the Alashankou station and wagon is sent to the destination station in the PRC.

- Bulk grain from Kazakhstan’s loading elevator is loaded into the wagon-grain carrier, and then the grain is transhipped to the grain terminal at the border of Kazakhstan-China, packaged in bags and sent to the destination station in the PRC.

To date, the Chinese side does not see the economic efficiency in the construction of a grain terminal, as export of wheat from Kazakhstan is unstable. However, COFCO Company is ready to begin discussion of the issue when the export OfKazakhstan wheat will reach about 500 thousand tons a year.

Based on the foregoing, it should be noted that the grain export infrastructure is built in accordance with the situation on the world market, and further study of its improvement requires a detailed and comprehensive study. Thus, to reduce transportation costs, we consider it appropriate to construct the grain terminal on the border of Kazakhstan - China, which will enable the effective loading of grain into the Chinese cars for further export to the PRC and Southeast Asian countries. Taking into consideration China’s growing population and changing the consumption patterns toward increased consumption of wheat products, the Chinese market is very promising for Kazakhstan.

REFERENCE LIST

- Strategy iiKazaklistan - 2050” - a new policy of established state the Address of the President of the Republic of Kazakhstan - Leader of the Nation Nursultan Nazarbayev to the people OfKazakhstan // Kazaklistanskaya Pravda. -14.12.2012

- The Development programme for agro-industrial complex OfKazaklistan //Agribusiness 2020 - Astana. 2012.

- Reference letter on the outcome of the Ministry of Agriculture of the Republic of Kazakhstan for the year 2013 and tasks for the year 2014. URL: http:// agrotnk.kz/press-tsentr/ekspertnoe-mnenie/484/index.php (Application date: 10.04.2013)