Abstract. The article is devoted to the study of trade and economic development of Uzbekistan and Kazakhstan in the framework of expanding mutual cooperation. The mutual cooperation of the Republic of Kazakhstan with the Republic of Uzbekistan in the Central Asian region is strategically important. The article describes the role of Uzbekistan in the region, its integration priorities and joint projects with Kazakhstan. It has been substantiated that the expansion of close cooperation in trade and economic activities contributes to the development of healthy competition and strengthening the position of member countries in entering foreign markets.

Introduction

The relevance of studying the issue of trade and economic development of Central Asian countries is predetermined by the need to form a new vector for the development of foreign trade strategy and adaptation of the economy of Central Asian countries to the new realities. Therefore, within the framework of this study, it is not only legitimate, but also necessary to be considered in the context of the general development of investment, institutional and other policy directions that form the overall economic policy of Central Asian participants.

Today, the strategy of the foreign economic development of countries in the new conditions of globalization should be based on the task of developing a competitive and mutually beneficial policy.

Note that the countries of Central Asia with a combined population of 73.8 million people and a GDP of 255 billion US dollars in world GDP account for only 0.3%. The region accounts for 0.5% of the world trade turnover. In terms of GDP per capita within the region, the largest volume falls on Kazakhstan, which is more than 9 thousand US dollars. In second place is Turkmenistan with an indicator of 6.5-7.0 thousand US

dollars. In Uzbekistan and Kyrgyzstan, GDP per capita does not exceed 2 thousand US dollars. The lowest indicator is in Tajikistan - about 800-900 thousand US dollars. At the same time, Tajikistan has the highest GDP growth rate, which over the past three years did not fall below 7.0%. At the same time, Kazakhstan and Kyrgyzstan have the lowest GDP growth rate in the region - 4.5%.

Kazakhstan and Uzbekistan: international rankings

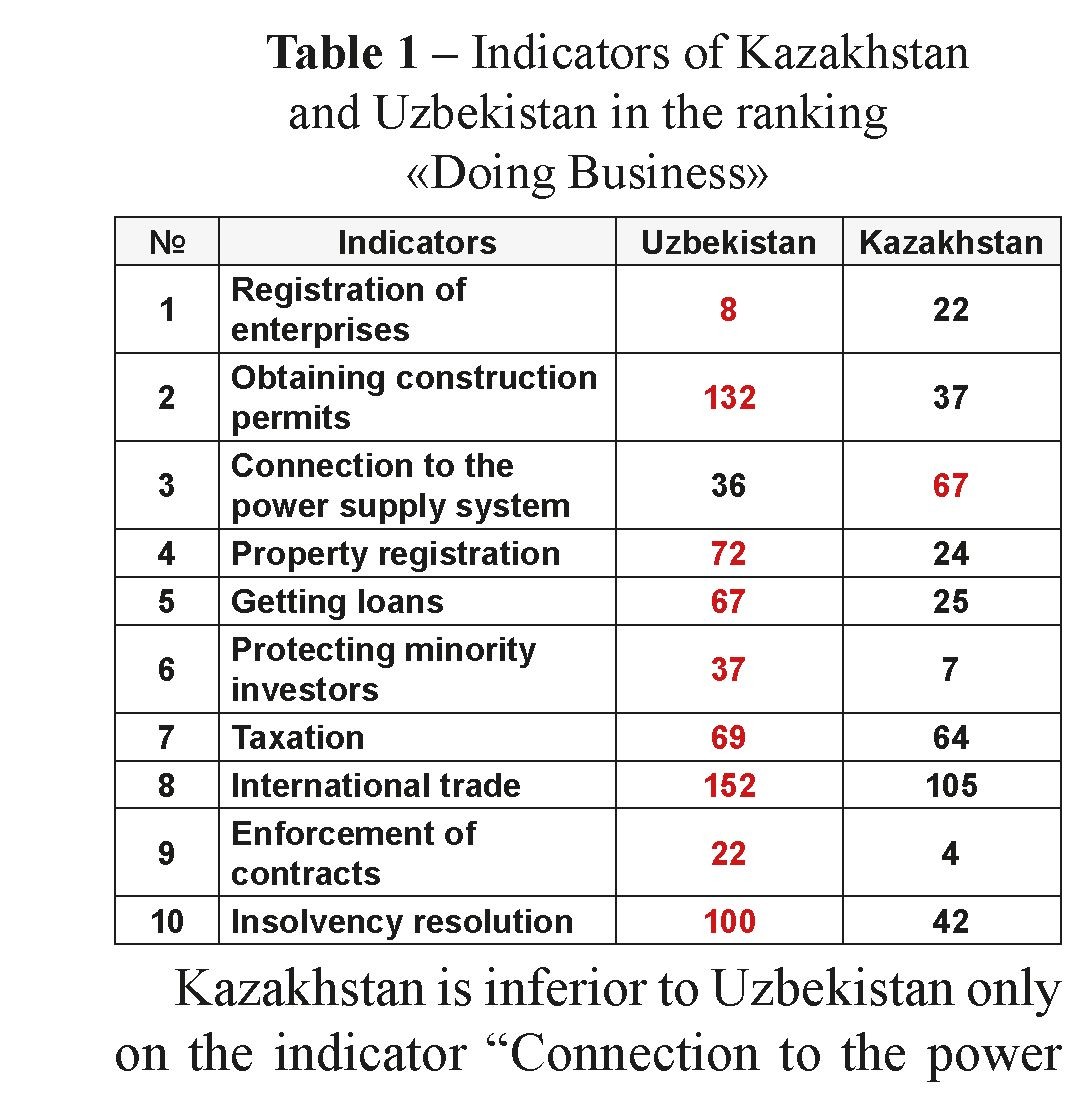

According to well-known global ratings, among the countries of Central Asia, Kazakhstan and Uzbekistan are considered the most competitive and investment- attractive countries.

This progress was noted in the World Bank’s Doing Business Index of Global Competitiveness for Doing Business, where the country improved its position by 3 points to 25th out of 190 countries, while Uzbekistan ranked 69th, Kyrgyzstan - 80, Tajikistan – 106 [1].

The ranking is assessed by 10 main indicators.

supply system”, according to all other indicators Kazakhstan has a competitive advantage.

According to in another authoritative international rating published by the World Economic Forum “Global Competitiveness Index” (GIC WEF), Kazakhstan took 55th place among 141 countries [2], having improved its position by 4 points in comparison with the previous rating. Kyrgyzstan in this rating took the 96th position and Tajikistan - 104. The key partner of Kazakhstan in Central Asia Uzbekistan did not participate in this rating.

In general, according to the results of the rating by the GIK WEF, the competitive advantages of Kazakhstan are such factors as the labor market - 25th place (improvement by 5 positions) and business dynamism - 37 (improvement by 2 positions).

Intra-regional trade of Central Asian countries

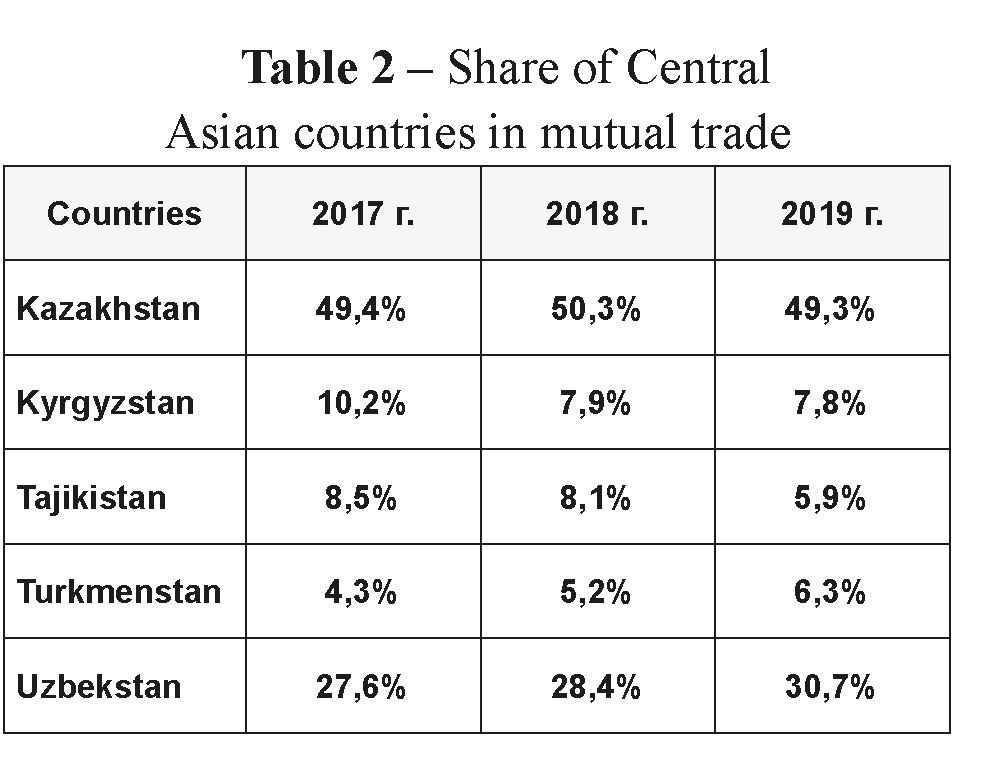

Intra-regional trade of the countries of Central Asia does not play a major role in the turnover of states, which is evidenced by its low share in the total foreign trade of the countries of Central Asia - 8.4%. At the same time, the volume of mutual trade in 2019 amounted to 6.9 billion US dollars, and almost half is accounted for by Kazakhstan, the share is 49.3% (Table 2).

Expansion of multilateral dialogue and cooperation in the Central Asian region, the importance of which in the Eurasian and global processes is steadily increasing, including in Uzbekistan, is a priority of regional and multilateral diplomacy.

From 2015 to 2019, Kazakhstan’s mutual trade with Central Asian countries has been continuously growing from $ 3.1 billion to $ 5.3 billion (Figure 1), that is, over a five- year period, the volume of trade increased by 71%. More than 60% of mutual trade falls on export deliveries from Kazakhstan, which increased by 70.0%. Imports for this period increased by 72.7%.

Among the countries of Central Asia, Kazakhstan trades the most with Uzbekistan. Thus, at the end of 2019, the share of Uzbekistan in Kazakhstan’s mutual trade with Central Asian countries amounted to 64.9%, while over 5 years it increased by 11.6 percentage points.

Kazakhstan and Uzbekistan are linked by close trade and economic relations. The countries can be attributed to the most important strategic partners in Central Asia, on whose territory large reserves of natural resources are concentrated, such as hydrocarbons, uranium, gold, gas, oil and non-ferrous metals.

Since the Independence Day gained, the states have signed more than a hundred joint

documents in various fields of activity [3]. The main of which is the Agreement on the CIS Free Trade Zone, which provides for duty-free trade between the participants, with the exception of exceptions. Also, in the future, it is planned to build the International Center for Trade and Economic Cooperation “Central Asia” on the border of the two states, which will give impetus to the growth of intensity at checkpoints, since, despite the increase in the volume of traffic flows in Central Asia, the main cargo flows are concentrated in places of concentration population.

In the period 2007-2015. in Central Asia, the volume of rail, road and water transport, expressed in ton-kilometers, increased by 49%, that is, an average annual increase of 5%. This is significantly higher than in many middle- and high-income countries. In Western Europe, the volume of cargo transportation has significantly decreased after the 2008 crisis and has not returned to the level of the pre-crisis period. Eastern European countries are experiencing growth in traffic, with a growth rate of 2.8%, almost half of Central Asia [4].

Foreign and mutual trade of Kazakhstan and Uzbekistan

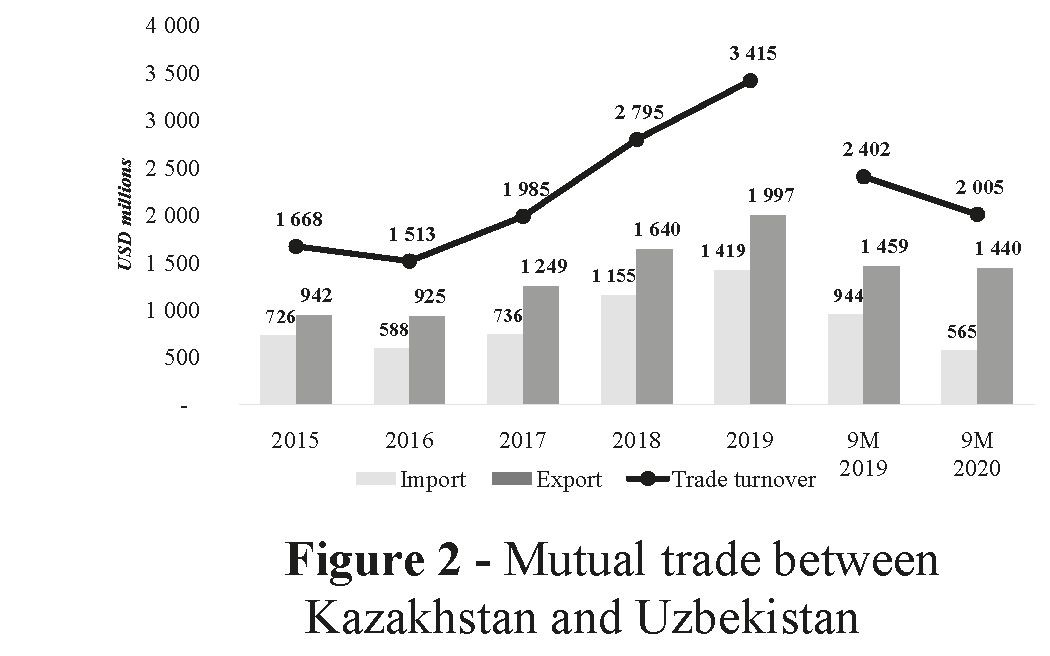

Trade turnover between Kazakhstan and Uzbekistan for 2015-2019 doubled, or from $1.7 billion to $3.4 billion (Figure 2). As well as in Central Asia there are more exports than imports in the structure of mutual trade with Uzbekistan. On average, over five years, the share of exports is 59.5%, imports - 40.5%.

Exports to Uzbekistan from 2015 to 2019 increased from US $ 942 million to US $ 2.0 billion, or 2.1 times.

Basically, Kazakhstan supplied wheat (18.6% of all exports to Uzbekistan), semifinished products from unalloyed steel

QUARTERLY ANALYTICAL REVIEW

4 (80)/2020

QUARTERLY ANALYTICAL REVIEW

4 (80)/2020

22

|

№ |

Country |

Trade turnover ($mln.) |

Export ($mln.) |

Import ($mln.) |

Share tin turneover |

|---|---|---|---|---|---|

|

TOTAL |

42 177,8 |

17 901,7 |

24 276,1 |

100% |

|

|

1 |

China |

7 620,9 |

2 519,0 |

5 101,9 |

18,1% |

|

2 |

Russia |

6 626,9 |

2 492,5 |

4 134,4 |

15,7% |

|

3 |

Kazakhstan |

3 367,8 |

1 429,7 |

1 938,0 |

8,0% |

|

4 |

The Republic of Korea |

2 755,4 |

93,5 |

2 661,8 |

6,5% |

|

5 |

Turkey |

2 525,2 |

1 203,6 |

1 321,6 |

6,0% |

|

6 |

Germany |

980,1 |

53,9 |

926,2 |

2,3% |

|

7 |

Kyrgyzstan |

829,1 |

679,0 |

150,0 |

2,0% |

|

8 |

Afghanistan |

618,0 |

615,1 |

2,9 |

1,5% |

|

9 |

USA |

596,2 |

29,1 |

567,1 |

1,4% |

|

10 |

Turkmenistan |

541,9 |

145,1 |

396,8 |

1,3% |

|

Others |

15 716,3 |

8 641,2 |

7 075,4 |

37,3% |

(7.9%), copper ores (4.3%), aluminum (4.3%), wheat flour (3, 8%), sunflower seeds (3.8%), cattle (3.5%), zinc ores (3.0%), oil products (3.0%), cement (2.7%).

Over the years, imports increased by 95.5% and amounted to USD 1.4 billion in 2019.

Most of all imported from Uzbekistan was natural gas (48.3% of all imports from Uzbekistan), fruits (12.5%), vegetables (6.2%), ethylene polymers (5.6%), cars (5.1 %), zinc (2.8%), unalloyed steel rods (2.5%), lead ores (1.6%).

In January-September of the current year the volume of mutual trade decreased by 16.5% compared to the same period of last year and amounted to USD 2.0 billion. The unfavorable dynamics is more connected with the consequences of the pandemic, when production stopped, consumer demand decreased and borders were closed.

Exports decreased by 1.3% from 1.46 to 1.44 billion US dollars. The decrease in imports was 40.1% or from 943.6 to 565.4 million US dollars.

The structure of both exports and imports remained unchanged. Uzbekistan mainly supplies natural gas, cars, vegetables and fruits. Kazakhstan exported the same wheat, semi-finished products from unalloyed steel, wheat flour, aluminum, etc. Also, thanks to joint meetings of working groups, Intergovernmental Commissions, the export of passenger cars to Uzbekistan has increased from 232 units of equipment to 2,988 units, or almost 13 times.

In general, the structure of Uzbek exports to the world, which amounted to US $ 17.9 billion, mainly consists of gold (27.5%), energy carriers and oil products (14.1%), textiles and textile products (9.1%), food products (8.5%).

The largest imports from the world are machinery and equipment (43.8%), chemical products (13.2%), metals and metal products (8.7%), food products (7.8%).

The main trade partners of Uzbekistan are China and Russia (Table 3), which account for 33.8% of the total foreign trade turnover of Uzbekistan [5]. This is followed by Kazakhstan with a specific weight of 8.0%, the Republic of Korea - 6.5% and Turkey - 6.0%.

Table 3 - Main trade partners of Uzbekistan

In the structure of Kazakhstan’s export to the world, there are most of all mineral products (72.0%), metals and products from

them (14.1%), products of animal and plant origin (5.7%), chemical products (4.6%).

Imports mainly consist of machinery and equipment (43.2%), chemical products (13.8%), metals and products made from them (11.7%), animal and vegetable products (10.0%), mineral products (7.8%).

The main trading partners of Kazakhstan are Russia, China and Italy (Table 4), which account for 45.8% of the total foreign trade turnover of Kazakhstan [6] They are followed by the Republic of Korea with a share of 6.7%, the Netherlands - 4.7% and France - 4.4%.

Considering that both Kazakhstan and Uzbekistan have the first two trading partners China and Russia, in the top ten includes the Republic of Korea, Turkey. It makes sense for close cooperation of the two states both in the markets of third countries and in their own markets, complementing each other.

Foreign trade and integration priorities of Uzbekistan

Up to this day, Uzbekistan has not participated in any trade and economic associations, integration unions or free trade agreements, with the exception of the CIS FTA and bilateral agreements between the CIS countries. But despite the existence of bilateral agreements on FTAs (Table 5) not all of them are practically implemented or applied. The table contains information about physically existing and operating RTAs, as well as notifications about existing RTAs [7].

However, since Sh. Mirziyoyev came to the post of president, he began to actively establish trade and economic relations with partners, resuming active negotiations on accession to the WTO, thereby making it clear that the country was moving towards trade liberalization. For the first time, an application for accession to the WTO was filed in 1994, the working group was created in 1998, but since the mid-2000s. its meetings with international experts were suspended. The process of the Republic’s accession to the WTO started again in July 2019, when the Uzbek side submitted to the WTO an updated memorandum on the foreign trade regime to consider an application for the country’s accession to the organization. In March 2020, Uzbekistan and the United States discussed the repeal of the 1974 Jackson-Vanik amendment to the US Trade Law, “which contradicts the fundamental WTO rules for ensuring” most favored nation in trade”, as well as interaction during the fourth meeting of the a group on Uzbekistan’s accession to the WTO and giving the country the status of a developing economy to obtain preferences in negotiations with the member countries of the organization [8].

Table 5 - Participation of Kazakhstan and Uzbekistan in regional trade agreements

|

Country |

Uzbekistan |

Kazakhstan |

|

Kyrgyzstan |

+ |

+ |

|

Tajikistan |

Х |

Х |

|

Turkmenistan |

Х |

Х |

|

Azerbaijan |

Х |

Х |

|

Armenia |

Х |

+ |

|

Belarus |

Х |

+ |

|

Georgia |

Х |

+ |

|

Moldova |

Х |

Х |

|

Russia |

+ |

+ |

|

Ukraine |

+ |

+ |

|

Vietnam |

- |

+ |

|

Iran |

- |

+ |

|

Serbia |

- |

+ |

|

Singapore |

- |

+ |

|

CIS |

+ |

+ |

|

EAEU |

- |

+ |

Note: "+" - physically existing and operating RTAs; "X" - notification of valid RTS; "-" - no RTS

At present, Uzbekistan’s intention to join the EAEU is being widely discussed. President Sh. Mirziyoyev addressed the chairman of the SEEC with a request to consider and grant Uzbekistan the status of an observer at the EAEU. This is another indicator that Uzbekistan is opening the boundaries of trade and economic cooperation.

Undoubtedly, accession to the EAEU will give Uzbekistan certain benefits, including widen opportunities to increase foreign trade volumes due to the signed and existing free trade agreements with Vietnam, Iran, Serbia, Singapore. Nest, access to a single market of goods, services, capital and labor. The last is of great importance for Uzbekistan. On accession to the EAEU, customs posts at the borders will be removed, which will simplify procedures in mutual trade. There will be an opportunity to expand cooperation with the EAEU member states in different sectors of the economy, implement large investment projects, industrial cooperatives, and territorial clusters. Cooperation in the field of education will provide an opportunity for the training of highly qualified specialists.

For Kazakhstan, Uzbekistan’s accession to the EAEU will give approximately the same positive effects as for Uzbekistan itself, such as simplification of border procedures, increase in mutual trade, simplification of transit traffic, free movement of labor.

Nevertheless, Uzbekistan will compete with Kazakhstan in the EAEU markets, in particular, market of agricultural products. There is a risk of ousting from the Russian market such Kazakhstani goods as tomatoes, onions and garlic, sulfates, ethylene polymers, paper pulp, cotton fiber, bed linen, zinc, wires and cables, freight railroad cars for a total amount of about USD 105 million.

Table 6 – main competitors from Uzbekistan for Kazakhstani goods on the Russian market

|

№ |

Code |

Title |

Import of RF from RU ($ mln.) |

Total export of RU ($ mln.) |

Import of RF from RK ($ mln.) |

Total export of RK ($ mln.) |

Total import of RF ($ mln.) |

|

1 |

6302 |

Bed linen, table linen, toilet linen and kitchen linen |

21,5 |

28,4 |

14,7 |

14,9 |

190,8 |

|

2 |

7901 |

Unwrought zinc |

20,1 |

163,3 |

16,4 |

279,3 |

41,5 |

|

3 |

0702 |

Tomatoes, fresh or chilled |

19,3 |

46,6 |

15,1 |

15,7 |

629,8 |

|

4 |

3902 |

Polymers of propylene |

19,2 |

32,3 |

27,7 |

30,3 |

397,8 |

|

5 |

8606 |

Railway or tramway freight cars, not selfpropelled |

8,5 |

9,1 |

13,7 |

20,5 |

66,2 |

|

6 |

5201 |

Cotton, not carded or combed |

3,4 |

161,6 |

6,4 |

78,0 |

54,2 |

|

7 |

8544 |

Insulated (including enameled or anodized) wire, cable |

9,2 |

17,0 |

2,2 |

11,7 |

1 060,5 |

|

8 |

4706 |

Pulps of fibers derived from recovered (waste and scrap) paper or paperboard or of other fibrous cellulosic material |

3,7 |

23,6 |

2,1 |

3,0 |

11,9 |

|

9 |

2833 |

Sulfates; alums; peroxosulfates |

2,3 |

15,1 |

1,9 |

11,3 |

42,6 |

|

10 |

0703 |

Onions, shallots, garlic |

3,8 |

18,0 |

4,4 |

7,8 |

127,0 |

|

итого |

110,8 |

514,9 |

104,7 |

472,5 |

2 622,3 |

Joint projects and initiatives

One of the positive facts of vertical intraindustry trade between countries is the presence of beneficial aspects of mutual cooperation and acceleration of industrial cooperation. Particular attention should be paid to the possibility of using of the mechanism of joint entrepreneurship, deepening industrial cooperation and trade and economic cooperation. Interstate cooperation is especially important in the production of light industry products, mechanical engineering, and the food industry.

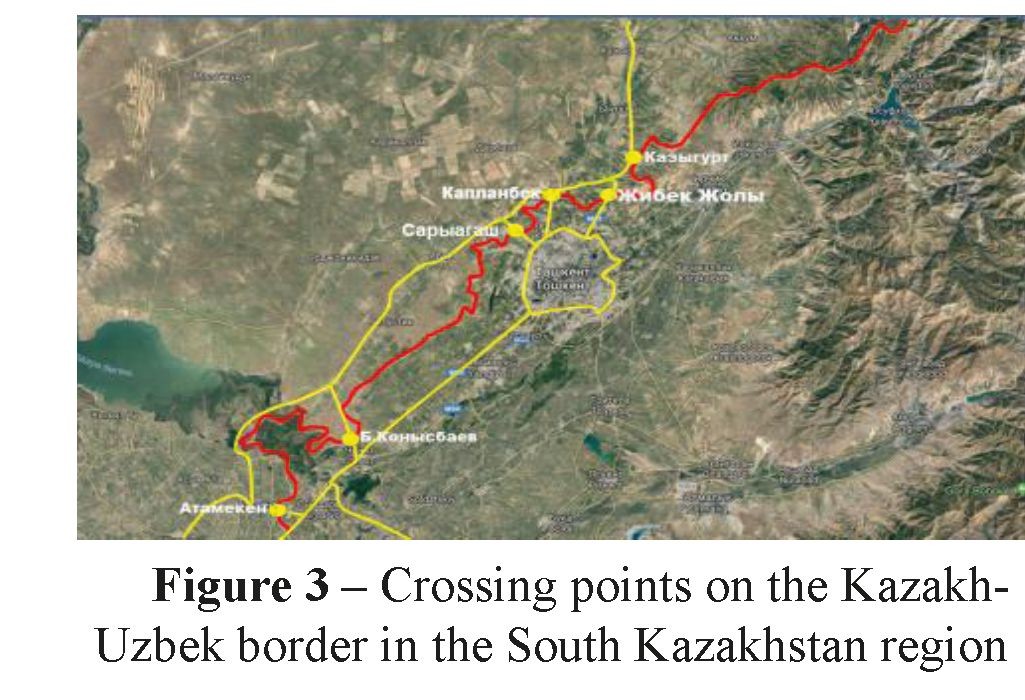

An example - is the joint Kazakh-Uzbek project - the construction of the International Center for Trade and Economic Cooperation “Central Asia” [9].

The international center will be located on the border territories of the Republic of Kazakhstan and the Republic of Uzbekistan in the area of the crossing points “Zhibek Zholy” and “Gisht Kuprik”. The total area of ICTEC will be 400 hectares.

The creation of ICTEC is aimed at the development of international and regional small-scale wholesale and retail trade in the border areas of Kazakhstan and Uzbekistan. To complete the task, services are provided for storage, packaging and packaging, assembly, pre-export processing

of products. In the future, the products will enter the markets of third countries.

In parallel with the development of mutual trade, there is the task of developing international tourism in the cities of Central Asia along the Silk Road.

The development of the infrastructure of modern international trade in the border areas will ensure the creation of new growth points [10].

Moreover, joint initiatives are a consequence of the development of priority goals, where Kazakhstan has launched a new for Central Asia four-year project Ready4Trade Central Asia (2020-2024) [11]]. The project is being implemented by the International Trade Center (ITC) in partnership with the MTI of RK and the Joint Stock Company “QazTrade” Center for Trade Policy Development”, funded by the EU and aimed at the development of intraregional and international trade between the Central Asian countries, including between Kazakhstan and Uzbekistan.

The goals will be achieved by simplifying trade procedures between countries, strengthening the entrepreneurial potential of businesses, as well as improving crossborder e-commerce.

In order to reduce the time and cost of business in trade, certain procedural and regulatory barriers will be removed and/ or simplified; increased transparency and improved predictability of crossborder procedures; accelerated procedural coordination in the region. To increase the competitiveness of business in terms of quality standards, technical regulations, Kazakhstani enterprises will be provided with the necessary knowledge and tools to comply with the requirements of crossborder procedures (a comprehensive export curriculum and an institute of mentors, a national portal on trade facilitation). Also, the

work is underway to strengthen the capacity of SMEs in the basics of e-commerce.

To date, priority export-import goods in trade between the two countries have been selected, teams of national experts have been formed, consultations and negotiations are being held with concerned participants.

As a result, a significant expected result of joint projects of Kazakhstan and Uzbekistan may become:

- Removing major regulatory and procedural barriers to international trade by increasing transparency and predictability of cross-border formalities, eliminating individual regulatory and procedural requirements, and promoting convergence of procedural and regulatory process across the region.

- Improving the capacity of small and medium-sized enterprises to comply with cross-border requirements, especially quality standards, technical regulations, and relevant preferential trade schemes. This, in turn, will provide individual enterprises with the necessary tools and knowledge to comply with cross-border procedural and regulatory requirements, and expand business support opportunities to assist the private sector in implementing project internationalization initiatives.

- Increasing opportunities for women- led enterprises to participate in international trade by encouraging women to participate in trade.

The creation of a new economic corridor «Shymkent-Tashkent-Khujand», which will connect Shymkent, Tashkent, Khujand, as well as Turkestan, Tashkent, and Sogd regions, is planned within the framework of the Central Asia Regional Economic Cooperation Program. It is home to 15% of the population of Central Asia [12].

There is easy cross-border labor mobility along this corridor, fueled by close historical, cultural, ethnic and linguistic ties between three countries. These three cities and regions complement each other economically, especially in the areas of agriculture and food.

CAREC economic corridor: «Shymkent- Tashkent-Khujand» will significantly increase the competitiveness of the region, improve the logistics infrastructure, and reduce the cost of production of goods and services.

The catalysts for the creation of an economic corridor were the change in the status of Shymkent, which is now a city of republican significance, and the improvement of the business climate between Uzbekistan and Tajikistan.

ADB has begun the assessment of the economic potential of the corridor at the request of the member countries of the Central Asia Regional Economic Cooperation.

The review of the economic analysis made it possible to conclude that the ongoing integration processes in Central Asia, including Uzbekistan’s accession to the WTO and potential accession to the EAEU, shows an inevitable trend of globalization and transformation of the trade regime in the future. The result will be trade liberalization, simplified market access and reduced barriers in the Central Asian region, which in turn will open up opportunities for expanding mutually beneficial cooperation for the countries of the region.

At the same time, there are concerns of high competition in certain sectors of the economy. Nevertheless, the countries of Central Asia should be considered from the point of view of partnership and cooperation, mutual investments, the possibility of creating joint projects to further deepen the division of labor and joint access to foreign markets.

When considering the beneficial aspects of integration processes and intensifying production cooperation, vertical intraindustry trade takes the main position. The implementation of joint projects such as the creation of ICTEC, Ready4Trade Central Asia contribute to the formation of modern formats of international and regional trade.

Finally, the deepening of trade and economic cooperation will lead to increased transparency and predictability in Central Asia, simplification of trade requirements, and facilitation of regulatory convergence in the region.

REFERENCES:

- World Bank report «Doing Business 2020». URL: https://www. doingbusiness.org/en/reports/global-reports/doing-business-2020 (access date: 23.11.2020).

- Report of the World Economic Forum “Global Competitiveness Index 4.0». URL: https://www.weforum.org/reports/how-to-end-a-decade-of- lost-productivity-growth (access date: 23.11.2020).

- Khanova I.E. Kazakhstan - Uzbekistan: history of cooperation and prospects for interaction //RGGU Bulletin. Series “Political Science. History. International relationships.». 2017; Vol. 4. № 1. P. 79-89 URL: https://politicalscience.rsuh.ru/jour/article/view/154/153.

- ITF, «Enhancing Connectivity and Freight in Central Asia», International Transport Forum Policy Papers, No. 71, OECD Publishing, Paris. 2019. URL: https://doi.org/10.1787/0492621a-en

- Report of the State Committee of the Republic of Uzbekistan on Statistics. Foreign economic activity, 2019. URL: https://www.stat. uz/ru/default/ezhekvartal-nye-doklady/5861-2019#tab-4 (access date: 23.11.2020).

- The main indicators of foreign trade of the Republic of Kazakhstan by country. Express information. Official website of the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic of Kazakhstan, 2019. URL: https://stat.gov.kz/official/ industry/31/statistic/6 (access date: 23.11.2020).

- N. Kurbanbaeva. The Factor of Regional Agreements //Economic Review, Vol. 10. № 238. P. 30-35. 2019 URL: https://review.uz/ journals/10-238-2019

- U.S. Ziyadullaev, N.S. Ziyadullaev. Foreign trade and integration priorities of the Republic of Uzbekistan, Russian Foreign Economic Bulletin, № 6. 2020. P. 63-82 URL: http://www.rfej.ru/rvv/id/3002FF572

- The Concept of the Foreign Policy of the Republic of Kazakhstan for 2020-2030 as of March 6, 2020. //Akorda, official site of the President of the Republic of Kazakhstan (access date: 23.11.2020).

- The Concept of the state program of the Republic of Kazakhstan on the trade development for 2021-2025 (access date: 23.11.2020).

- International Trade Center. ITC. Projects. Large projects and programmes. Ready4Trade - Central Asia URL: https://www.intracen. org/ready4trade/ (access date: 23.11.2020).

- Technical Assistance Report ADB. Assessing Economic Corridor Development Potential Among Kazakhstan, Uzbekistan, and Tajikistan. 2018. URL: https://www.adb.org/sites/default/files/project- documents/52188/52188-001-tar-en.pdf (access date: 23.11.2020).