The purpose of insurers’ rating creation is to provide ensuring transparency of the results of insurance companies’ activities and determination of level of their financial reliability. General approaches in methodology of compiling of insurance companies rating by various foreign agencies are determined. The indicators characterizing fields of insurance companies’ activity are analyzed: insurance, investment and financial. The indicators of an insurance activity regarding the insurance payments collection, the insurance indemnity payments and securing formation of insurance reserves are considered. The indicators of investing activities of an insurance company regarding placement of insurance reserves are characterized. The indicators characterizing financial activities of an insurance company regarding maintenance of liquidity, solvency and profitability are highlighted. The authors in article determined the problems of creation of a rating assessment technique of insurance companies’ activities. The complex analysis of indicators of insurance companies’ activities is performed, the stages of its carrying out are allocated. Based on the indicators usage which characterizes the fields of insurance companies’ activity the rating assessment technique of insurance companies is developed. The rating assessment technique of insurance companies is presented in the form of the system consisting of consecutive stages, each of which represents the logical sequence of the actions providing creation of insurers’ rating. Implementation of this technique in insurance practice would provide transparency of insurance companies’ activities, increase the trust of insurers to them and to promote development of insurance system.

The rating as a complex assessment of a condition of an insurance company by independent experts became one of basic elements of «non-price competition». Availability of rating and its level is profitable to distinguish the insurer, being the proof of transparency of its activities, gives the chance to see how this insurance company is competitive.

The purpose of insurers rating consists in ensuring transparency of insurance companies’ activities results and determination of their financial reliability level. The insurance market of Kazakhstan is characterized by functioning of various insurance companies offering identical insurance services and practically lack of any objective information about a financial position of this or that insurer. In this respect there is a need of creation of domestic insurance companies rating. It is especially important in the conditions of integration of the Kazakhstan insurance market with infrastructures of the regional and world market.

In the work of the Kazakhstan scientists-economists the determining factors influencing development of insurance business in Kazakhstan and the features of development of the Kazakhstan insurance market are noted [1; 117].

The Kazakhstan researchers proposed measures for increase in competitiveness of Kazakhstan insurance system, including increase in capitalization and compliance to requirements of calculations of the standard rate of the Kazakhstan insurers’ solvency [2; 195].

As of today, in Kazakhstan the competitiveness of insurance companies’ rating is practically not made, there is no rating agency which would be recognized by domestic insurers. It should be noted that services of foreign rating agencies for domestic insurance companies are too expensive. Besides, despite advantages of foreign techniques, the existing distinctions in a regulatory framework, and also the developed business practice require forming of a technique in relation to conditions of Kazakhstan.

In the light of the foregoing, there is a need of development of a technique of competitiveness rating of domestic insurance companies which would get support from the Kazakhstan insurers, state bodies and, the main thing, that it would reflect the degree of the insurer’s reliability. At the same time the technique shall be based on the commonly accepted scheme of rating process in the international practice.

All known foreign techniques of ratings creation rather in detail paint groups of both quantitative, and qualitative indexes which are used for calculation of rating, and also the procedure of rating assignment [3].

Though abroad there is no single system of insurers rankings, in approaches and methodology of creation of rating of various agencies there are general approaches. First, the rating purpose is to estimate financial opportunities of the insurer and to express the opinion on its competitiveness. Secondly, in the course of ratings creation the reports of the insurer over the last 5 years, plans of profit earning, and also information obtained during the poll of a clientele, management, conversations with staff of the analyzed companies are subject to the analysis. Thirdly, practically all ratings are under construction on the basis of both the highquality, and quantitative analysis of information though the criterion and quantity of the indicators used in the course of rating creation vary depending on the technique accepted in this or that agency.

To make the insurers’ rating by techniques of the foreign agencies of creation and its use in pure form for assessment of competitiveness of domestic insurance companies is impossible for the following reasons:

- Distinctions of financial accounting of insurance transactions of the Kazakhstan companies from world practice. Ensuring comparability of data and a possibility of application of foreign techniques of a financial condition assessment requires acceptance of the following measures:

- transition to world system of accounting, to enter into practice the international standards of the chart of accounts of the insurer’s financial accounting;

- to unify system of the accounting and statistical recording of insurance transactions according to requirements of the international insurance

- Lack of complete transparency in reporting and activities of insurance companies. Currently, all Kazakhstan insurers aren't ready to show the work to the foreign observer though the financial reporting of insurance companies is periodically published in mass

- It is difficult to make the analysis of some aspects of insurance companies’ activities because of backwardness of corporate securities market in the republic, the reinsurance

In compiling the domestic ratings technique of reliability it is necessary to use the conventional scheme of rating process in foreign countries, considering at the same time specifics of the Kazakhstan legislation and national peculiarities [4]. For compiling ratings technique of domestic insurers it is necessary to consider various groups of indicators which found reflection in modern economic literature. One of approaches allowing to carry out the financial analysis characterizing the level of insurer’s competitiveness there is the following classification of indicators:

- group – absolute figures;

- group – relative indicators; 3 group – average values [5].

The other approach can be the classification allowing to consider insurance specifics of the insurer in activities indicators:

- the volume (absolute) indicators characterizing scales of activities of insurance companies;

- indicators of assessment of insurance companies solvency;

- the indicators characterizing the level of assets liquidity;

- the indicators estimating the level of liabilities on one risk;

- the indicators characterizing extent of reinsurer’s participation in insurance transactions;

- the indicators characterizing investing activities of insurance companies;

- indicators of assessment of financial results sufficiency for the accounting period [6].

In our opinion, for creation of rating technique of insurance companies’ competitiveness the given indicators should be grouped for the purpose of the analysis of separate fields of activity of the company:

- group of the indicators characterizing the sphere of an insurance activity;

- group of the indicators characterizing the sphere of investing activities;

- group of the indicators characterizing financial activities of insurance

It is necessary to include the financial performance used in practical activities of insurance companies in this system of indicators.

Thus, the creation of ratings technique is under construction based on use of the indicators characterizing fields of activity and includes the following stages:

- The indicators analysis characterizing an insurance activity regarding collection of insurance payments, payment of an insurance indemnity and ensuring forming of insurance reserves;

- The analysis of the indicators characterizing investing activities in terms of insurance reserves placement;

- The analysis of the indicators characterizing results of financial activities regarding maintenance of liquidity, solvency, profitability;

- On each of the specified activities the intermediate value of rating is removed;

- After adjustment of intermediate values, additional poll of experts taking into account their opinion final value of the rating, constituted based on quantitative indices, is

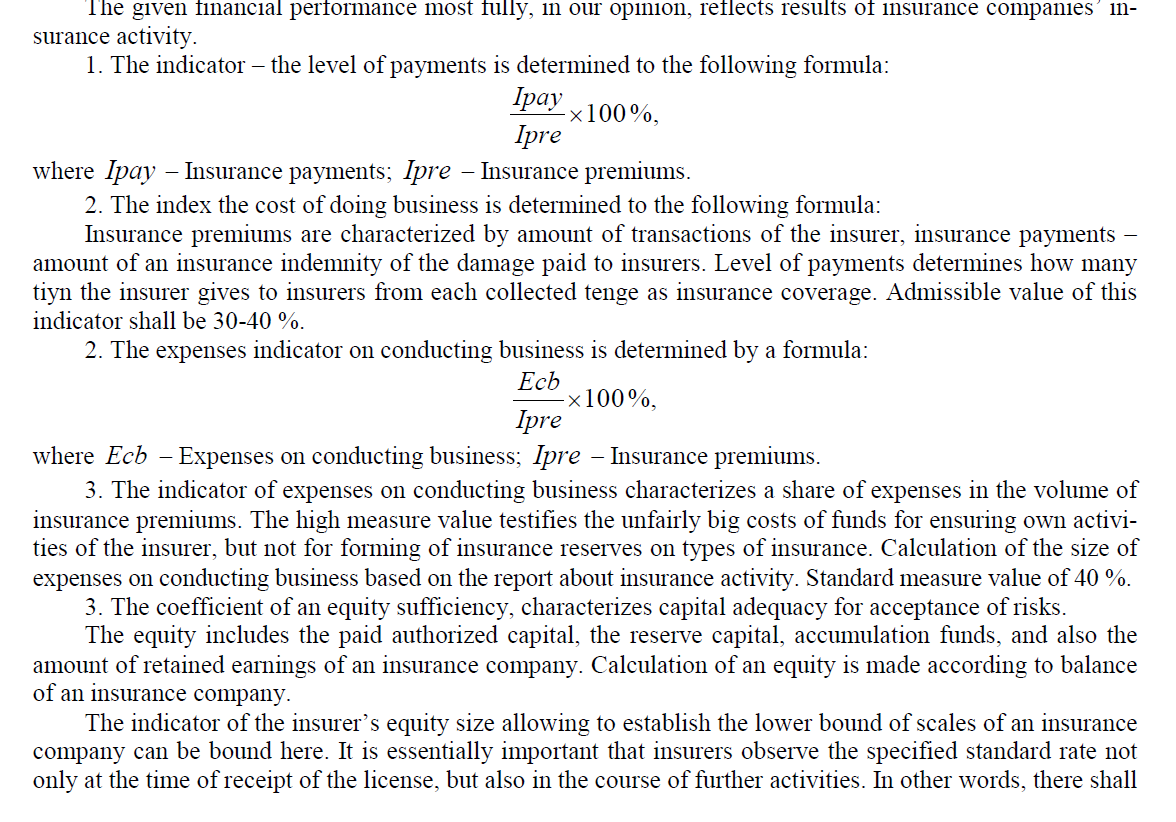

Indicators which are included in system of indicators of rating assessment, their admissible values on all indicators are constituted on the basis of the research of economic literature and experience which developed in domestic insurance practice. For assessment of an insurance activity of the company it is reasonable to analyse the following indicators:

- Level of payments;

- Indicator of expenses on conducting business;

- Coefficient of an equity sufficiency;

- Relation of insurance reserves to liabilities;

- Dynamics of scope change of insurance

The measure value shall not be less than refunding rate, but no more 1,5 of its value.

Admissible values of each recommended indicator are given in the offered technique proceeding from requirements of the current legislation and depending on the practice which developed in the insurance market. For the purpose of simplification of calculations it is reasonable to lead all received measure values to a five-point type according to Table 1.

T a b l e 1

Indicators ranking of insurance company activities

|

Point |

Reasons |

|

5 |

Optimum indicator value |

|

4 |

Normal indicator value |

|

3 |

Average (minimum or maximum) indicator value |

|

2 |

Too low or too high indicator value |

|

1 |

Violation of the requirements of an insurance supervision body, or inadmissible indicator value |

|

0 |

Lack of data, or it is impossible to calculate this indicator according to the provided reporting |

Depending on calculation result each coefficient will get point from 1 to 5. Points on all indicators are summed up and the category of reliability of the insurer, at the same time is determined by a total sum, the higher the amount of final value, the higher reliability of the insurer. Final value of rating consists of the amount of the intermediate values calculated on each activity of an insurance company, i.e. by the following formula:

FR = IR (ia) + IR (inva) + IR (fa), where FR – final value of rating;

IR (ia) – intermediate value of rating of an insurance activity; IR (inva) – intermediate value of rating of investing activities; IR (fa) – intermediate value of rating of financial activities.

Intermediate value of rating of an insurance activity is found by summing of five-point assessment by all indicators of this group. The maximum value which can be received in an analysis result of an insurance activity makes 25 points.

Intermediate value of rating of investing activities is determined by summing of five-point assessment by all indicators of this group. The maximum value which can be received according to the analysis of investing activities makes 10 points.

Intermediate value of rating of financial activities is determined by summing of five-point assessment by all indicators of this group. The maximum value which can be received on this group makes 25 points.

The maximum value of final rating shall make 60 points.

Intermediate values can be adjusted taking into account the opinion of the experts performing assignment of rating, at the same time:

- the received value of intermediate rating can't exceed its maximum value established on each group of indicators;

- value of intermediate rating shan't be increased more than (is reduced) for five

Based on the received value of final rating taking into account the opinions of experts, the reference of an insurance company to the corresponding group of reliability is made. For determination of category of financial accountability of an insurance company it is necessary to use the facts of Table 2. 10 categories of insurance companies are given in the table depending on the maximum and minimum values of rating.

T a b l e 2

Determination of financial accountability category of an insurance company

|

Category of the company reliability |

Maximum value of rating |

Minimum value of rating |

|

1 |

2 |

3 |

|

ААА |

60 |

55 |

|

АА |

54 |

49 |

|

А |

49 |

44 |

|

1 |

2 |

3 |

|

ВВВ |

43 |

38 |

|

ВВ |

37 |

32 |

|

В |

31 |

26 |

|

ССС |

25 |

20 |

|

СС |

19 |

14 |

|

С |

13 |

8 |

|

D |

7 |

2 |

The characteristic of financial accountability category of insurance companies is reflected in Table 3.

T a b l e 3

The financial accountability category of an insurance company

|

Rating value |

Characteristic |

|

AAA |

The highest level of financial accountability |

|

AA |

The highest level of financial accountability |

|

A |

Good level of financial accountability |

|

BBB |

Average level of financial accountability |

|

BB |

Less average level of financial accountability |

|

B |

Unstable financial position. At the moment the company is capable to fulfill liabilities to owners of policies, however in case of adverse economic conditions accomplishment of liabilities of the company to holders of policies is under the threat |

|

CCC, CC |

Problem level of financial stability |

|

C |

The company is on the verge of bankruptcy |

|

D |

Bankruptcy of the company |

Categories of insurance companies which can be grouped as follows are shown in the table:

- the groups of safe ratings (“the highest level” – AAA, “highest level” AA, “good” – A);

- the groups of vulnerable ratings (“average level” – ВВВ, “less average level” –BB, “an unstable financial position” B, “the problem level” – CCC, CC).

If the insurer didn't present all data, necessary for creation of rating, that rating agency has the right to assign the rating “O / ISB” (it is impossible to estimate) with indication of the reason. If the license for carrying out an insurance activity was limited, suspended or revoked from the insurer, then regardless of the gained points number the rating of “O / ISB” is assigned to such insurer (under observation of an insurance supervision body). In case of the publication of rating the rating agency without fail shall specify date of the last assessment, an interpretation of a rating scale, and also has the right to specify additional data which will allow to gain deeper impression about activities of the insurer.

The implementation of rating assessment of insurance companies will allow to obtain information on activities of insurance companies of the republic, to increase the trust of insurers to them and to promote development of the sphere of insurance.