The article analyzes the current state of the credit relationship of banking and real sectors of the economics of the Karaganda region. There were considered the basic indicators of economic entities by sectors of the economics of the region, identifying opportunities and prospects for expansion in bank lending. Designed matrix of efficiency of development of individual sectors of the economy of the Karaganda region, the degree of participation of the banking system in the financing of industrial production, output / services, investments in fixed assets. Analyzed the share of overdue debt on loans to banks branches. There were considered the ways of interaction intensification of the credit banking and real sectors of the economy.

Currently, one of the most advanced and important segments of the financial market of the Republic of Kazakhstan on the volume, range and quality of services, still remains the banking sector. His leading role in the financial support and economic development of Kazakhstan is due, primarily, by the existence of the resource potential. So, as to the 10.01.2015, total assets of second-tier banks (STB) of Kazakhstan amounted to 75.7% of GDP, and the loan portfolio of STB 51.6% of GDP [1].

At the regional level in the banking sector also occurs post-crisis dynamics of the gradual recovery of active operations, which determined the increase of its presence in the regional economy, including in the Karaganda region.

In the period 2012–2015 development of the banking activity in the Karaganda region was mixed. Against the backdrop of lower production parameters compared to the previous period, there were observed inhibition rates of lending to the real sector. Issues of bank loans and the solvency analysis of borrowers were aggravated, that objectively restricted the participation of credit institutions in the promotion of economic processes. Lending to the real sector of the economy, namely the financing of capital investments of industrial and agricultural enterprises, banks regarded as a high-risk operation with low attractiveness in terms of return on invested capital. Commercial banks are increasingly using alternative means of accommodation with less risk and higher returns, such as a short-term loan products or investments in securities, the purchase of foreign currency, gold and others.

In this connection it is necessary to analyze the possibilities of interaction between the banking and real sectors of the regional economy.

При исследовании развития реального сектора экономики Карагандинской области был проведен анализ основных показателей развития в разрезе отраслей экономики.

In the study of the development of the real sector of Karaganda region was analyzed main indicators of development in the sectors of economy.

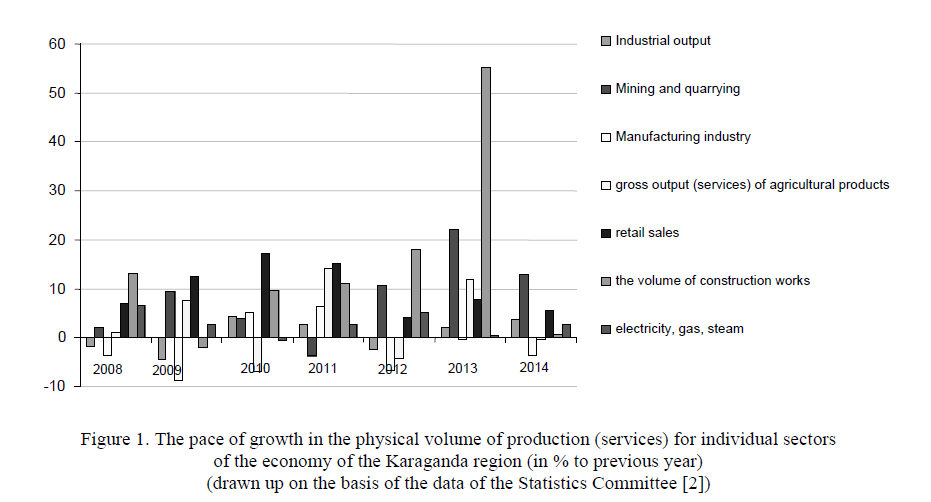

Dynamics of indices by selected branches of economy of the region in % to the previous period is presented in Figure 1.

Changing of production indices (in comparison with the previous annual period) allows to draw conclusions about the presence / absence of economic growth.

Production index of basic industries for the area (agriculture, mining, manufacturing, production and distribution of electricity, gas and water, construction, transport, retail) in 2008–2014. showed mixed trends. Positive growth rates were maintained in the period 2012–2013 in extractive economic activities (at the maximum fall in production in 2011), the highest growth rate recorded in 2013 (the index of physical volume of production — 122.2%) and construction sector (with a maximum fall in output in 2009) highest growth rate recorded in 2013 (the index of physical volume of production — 155.2%).

Figure 1. The pace of growth in the physical volume of production (services) for individual sectors of the economy of the Karaganda region (in % to previous year) (drawn up on the basis of the data of the Statistics Committee [2])

The index of manufacturing industries in 2008–2009 was negative, in 2010–2011 — positive and then in 2012–1014 it has decreased significantly relative to its value prior period and was at a level lower than 100%. As part of the energy complex enterprises, after a significant decline in 2010, in 2011–2012 it was marked index increase, then a decrease in 2013 to the level equal to 100.3%, and in 2014 the index of physical volume of production industry only has tended to increase. Retail trade, after rising to an index in 2000– 2010, later began to show a slowdown. Agricultural production had different variation of the index, so, it had positive value in 2008, 2009, 2011, 2013 and a negative value in 2010, 2012, 2014.

Thus, the most successful post-crisis developed mining industry, construction and retail trade. In general, the positive trend observed in the power sector of Karaganda region.

Considering the volume of investment in fixed assets of the regional economy, it should be noted that the proportion of such investments for 2009–2014 does not exceed 7% of the total investment in fixed assets in the Republic, and declined to 6.2% in 2014 (Table 1).

T a b l e 1

Investment in fixed assets in Kazakhstan and Karaganda region, billion tenge at the end of the period

|

Indicator |

2008 у. |

2009 у. |

2010 у. |

2011 у. |

2012 у. |

2013 у. |

2014 у. |

|

Investment in fixed assets in Kazakhstan |

4210,9 |

4585,3 |

4653,5 |

5010,2 |

5473,2 |

6072,7 |

6591,5 |

|

Investment in fixed assets in Karaganda region |

210,2 |

214,1 |

211,1 |

253,0 |

323,8 |

405,0 |

411,8 |

|

Share (%) |

4,9 |

4,7 |

4,5 |

5,0 |

5,9 |

6,7 |

6,2 |

|

Note. Calculated based on the [2, 3]. |

|||||||

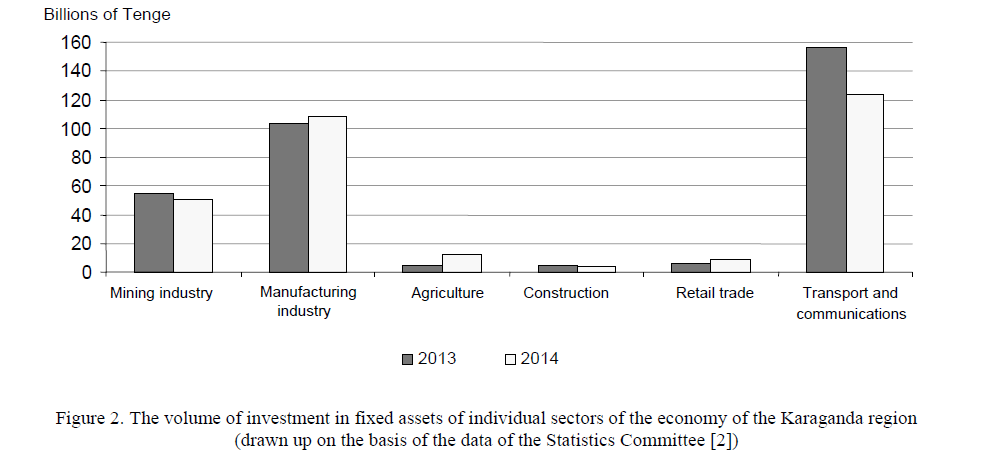

Investment activity of the real sector of the Karaganda region in 2013–2014 remained insufficient (Figure 2).

Figure 2. The volume of investment in fixed assets of individual sectors of the economy of the Karaganda region (drawn up on the basis of the data of the Statistics Committee [2])

In 2014 there was a decrease of the index of physical volume of investments less than 100% in the extractive economic activities. Continued decline in investments in the construction industry and transport and communication enterprises. The growth of the physical volume of investment observed in 2014 in the manufacturing industry, trade and agriculture.

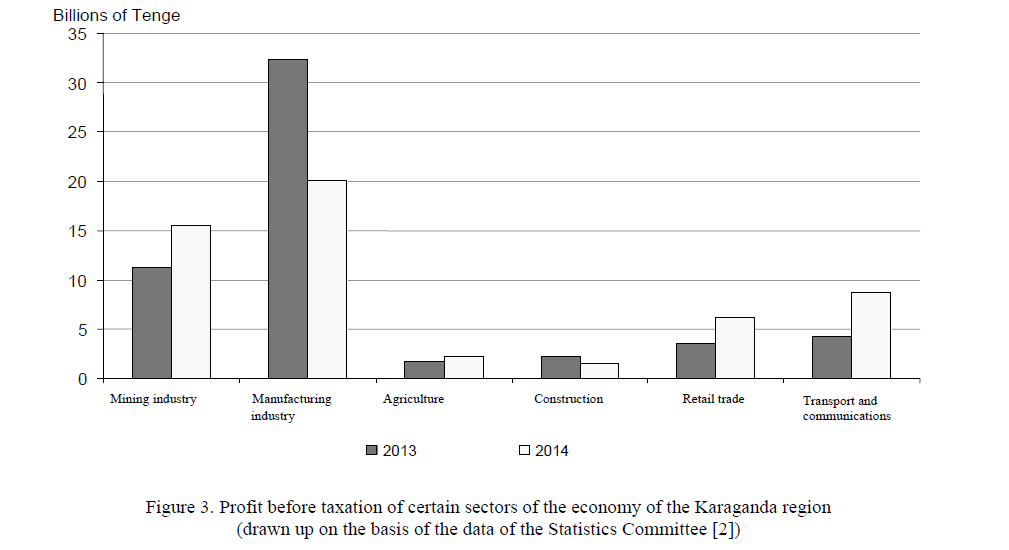

According to statistics, in all types of economic activity in 2013–2014 there was obtained a positive financial result, although in some sectors in 2014 its growth has slowed (mining, agriculture) or it was lower than in 2013 (manufacturing, construction) (Figure 3).

Figure 3. Profit before taxation of certain sectors of the economy of the Karaganda region (drawn up on the basis of the data of the Statistics Committee [2])

One of the main economic indicators, reflecting the commercial activity of economic entities in the non-financial sector, is the volume of production and release of products (services). «The growth of this indicator is the increase in gross output in value terms, which allows us to estimate the dynamics of the development of individual branches of the regional economy. Distribution of the volume of loans granted of economic activities makes it possible to determine the bank lending priorities» [3].

In 2014, the most successfully developed mining and manufacturing industries, as well as the organization of transport, communication and trade, the growth rate of which exceeded 110%. In addition, the transport companies, communications and trade in 2014 increased their share in the economic circulation in the whole region (Table 2).

T a b l e 2

The volume of gross regional product, industrial production, output (services) and bank loans in Karaganda region at the end of the period

|

Indicator |

GRP production volumes of output (services), bln. tenge |

The volume of bank loans, bln. tenge |

||

|

2013 |

2014 |

2013 |

2014 |

|

|

GRP |

2634,3 |

2908,7 |

357,8 |

396,7 |

|

Industry |

1324,7 |

1443,9 |

51,7 |

56,6 |

|

Share (%) |

50,3 |

49,6 |

14,4 |

14,3 |

|

Agriculture |

142,9 |

143,8 |

4,9 |

2,4 |

|

Share (%) |

5,4 |

4,9 |

1,4 |

0,6 |

|

Construction |

214,3 |

224,6 |

10,6 |

14,0 |

|

Share (%) |

8,1 |

7,7 |

3,0 |

3,5 |

|

Transport and communications |

368,4 |

424,9 |

8,8 |

7,5 |

|

Share (%) |

13,9 |

14,6 |

2,5 |

1,9 |

|

Trade |

497,6 |

561,5 |

54,0 |

39,2 |

|

Share (%) |

18,9 |

19,3 |

15,1 |

10,0 |

Note. Calculated based on the data [4, 5].

Decreased share of industry (while remaining the most significant), agriculture and construction.

In general, for the year to increase production of all types of economic activity.

In the structure of loans to non-financial sector in 2013, and in 2014 dominated the industry and trade; at the same time the share of industry decreased from 14.4 to 14.3%, trade — from 15.1 to 10%. In general, the share of bank loans investigated sectors of the regional economy in 2013–2014 does not exceed 40%. The bulk of the Karaganda region in bank loans provided to the field of self-employment.

By comparing the data shown in Table 2, we get the participation rates of bank lending in the economic activities of organizations serving the real economy (Table 3).

T a b l e 3

The share of loans in the volume of industrial production, output (services) in the Karaganda region

|

Indicator |

2013 |

2014 |

|

Industry |

3,9 |

3,9 |

|

Agriculture |

3,4 |

1,7 |

|

Construction |

4,9 |

6,2 |

|

Trade |

10,8 |

6,9 |

|

Transport and communications |

2,4 |

1,7 |

Note. Authors' calculations.

After analyzing the parameters (volume indices of goods (services), business turnover and other organizations) we obtain the matrix of efficiency of the economic sectors in the period 2013–2014. Indicators evaluated as follows: «+» — the presence of the positive difference between the indices of 2013 and 2014; «-» — Negative difference between the indices of 2013 and 2014 (Table 4).

T a b l e 4

Matrix efficiency of development of individual sectors of the economy of the Karaganda area for 2014

|

Economic sector |

The pace of growth in the physical volume of production (services) |

Profit (loss) before tax |

The growth rate of investment volumes |

Change in industry in GRP |

|

Mining industry |

– |

+ |

– |

– |

|

Manufacturing industry |

– |

– |

+ |

– |

|

Agriculture |

– |

+ |

+ |

– |

|

Construction |

– |

– |

– |

– |

|

Retail trade |

– |

+ |

+ |

+ |

|

Transport and communication |

– |

+ |

– |

+ |

Note. Calculated by authors.

Based on the analysis of the data in Table 4, it can be concluded that 2014 was quite difficult for all sectors of the economy of the region. In terms of the economic viability, mostly promising lending trade and transport institutions (positive growth, good financial performance, satisfactory investment activity). At the same time, bank loans are mostly interested in the industries which are experiencing financial difficulties.

The data in Table 5 indicate that in 2014 for increased security for bank loans of industry enterprises and agriculture. A significant proportion of short-term loans is in industry and construction.

T a b l e 5

Loans to subsidiaries of banks by sectors of the economy of the Karaganda region (excluding arrears)

|

Indicator |

On 01.01.14 |

On 01.01.15 |

On 01.01.16 |

|||

|

Bln. tenge |

including short term (in%) |

Bln. tenge |

including short term (in%) |

Bln. tenge |

including short term (in%) |

|

|

Total |

357,8 |

13,6 |

396,7 |

13,4 |

394,8 |

10,5 |

|

Industry |

51,7 |

31,0 |

56,6 |

26,8 |

67,0 |

20,0 |

|

Agriculture |

4,9 |

60,5 |

2,4 |

38,4 |

6,3 |

13,7 |

|

Transport |

8,2 |

6,9 |

6,3 |

8,8 |

7,3 |

1,8 |

|

Communication |

0,6 |

0,2 |

1,2 |

1,2 |

0,8 |

0,8 |

|

Construction |

10,6 |

37,2 |

14,0 |

33,2 |

9,1 |

40,8 |

|

Trade |

54,0 |

37,2 |

57,4 |

47,9 |

46,1 |

43,5 |

|

Individual labor activity |

195,1 |

1,3 |

221,1 |

1,2 |

215,4 |

1,2 |

|

Other |

32,5 |

6,6 |

37,6 |

4,8 |

42,7 |

1,7 |

Note. Calculated based on the data [6].

It should be noted that against the background of reduction of arrears on loans to commercial banks in Kazakhstan in recent years of the analyzed period in the Karaganda region was an increase in the proportion of non-performing loans from 1.7 to 3.6% of the total arrears in the Republic (Table 6).

T a b l e 6

Arrears on loans to commercial banks in Kazakhstan and Karaganda region, billion tenge at the end of the period

|

Indicator |

2011 |

2012 |

2013 |

2014 |

2015 |

|

Arrears in Kazakhstan |

1663,1 |

1903,1 |

2265,1 |

1492,3 |

920,1 |

|

Arrears in Karaganda region |

28,9 |

32,8 |

40,9 |

36,3 |

32,9 |

|

Share (%) |

1,7 |

1,7 |

1,8 |

2,4 |

3,6 |

Note. Calculated based on the [5].

Thus, for the region's banking sector retained a significant level of risk of non-repayment of loans, which directly affects the ability of banks to expand lending to the economy and the difficult search for the ideal borrower. The process of attracting customers is limited as the credit policy of the bank and its potential. In order to achieve sustainable economic growth it is required a strategy development of the region, which also includes issues on credit of promising innovative projects.

Certainly, also in the Karaganda region there are support programs and the financing of various projects in the key sectors of the economy under the State Program of Forced Industrial-Innovative Development of Kazakhstan.

The region has developed a strategy of territorial development of the Karaganda region up to 2015, which sets out priorities for the development of the industry. Describing the Karaganda region, it should be noted that it is «the largest in territory and industrial potential». In the region there have been developed such industries as ferrous and non-ferrous metallurgy, coal industry, energy, chemical industry, food industry, construction industry. The region has sufficient potential for development of the enterprises of machinebuilding and metal-working industries. In addition, the region has a raw base and production facilities for the processing of agricultural products [7].

At the same time as one of the main development risks are defined a lack of attractive targets for investment and limited access to credit resources of the financial sector.

To solve the problem of reducing the lending business is necessary either to increase the resource base of credit institutions, or to increase the investment attractiveness of lending is mainly due to reduction of risks through various mechanisms. One of the ways could be the differentiation of interest rates on deposits with an increase in interest rates on long-term deposits in an amount greater than the rate of inflation. This measure will allow banks to raise funds for the long term. In addition, for the expansion of the real sector banks lending business economics need to address the significant banking risks.

References

- The official website of the National Bank of the Republic of Kazakhstan. — [ER]. Access mode: http://www.afn.kz/attachments/105/0/publish0-1083592.pdf. Date of the application 03.2016 г.

- Social and economic development of the Republic of — [ER]. Access mode: http://www.stat.gov.kz/

- Gustap Y.V., Gustap N.N. Actual questions of development of bank lending in the Tomsk region // The Tomsk Polytechnic University. — 2013. — № 6. — Т. 323. — P. 12–17.

- The main socio-economic indicators of the Karaganda — [ER]. Access mode: http://www.karaganda.stat.gov.kz/

- Statistical Bulletin of the National Bank of the Republic of — [ER]. Access mode: http://www.nationalbank.kz/cont/

- Official site of the Karaganda branch of the National Bank of the Republic of Kazakhstan. — [ER]. Access mode: http://nationalbank.kz/mailto:kar_80@nationalbank.kz

- Territorial Development Strategy of Karaganda region up to 2015, approved by decision II session of the regional maslikhat № 29 dd. October, 16, 2007.