The article discusses general tendencies in the development of pharmaceutical industry in the Republic of Kazakhstan in the conditions of modern socialization of economy. The prospects of the development of pharmaceutical production market, conditions of realization developed by the state programs for the further growth of this sector of economy in the Republic of Kazakhstan are analyzed as well.

The modern model of a market economy is characterized by active state intervention in economy the purpose of which is social and economic modernization. Socially oriented economy forms a new model of a person as a worker, consumer, individuality and socializedindividuality. The economy has reached such level of development when it is required to refuse understanding of a person only as a production factor. Almost in all economic systems the sphere of personal consumption and growth of its volume was consid- ered as a necessary condition of the development of a worker [1].

One of the directions of national economy modernization is to ensure the growth of its need, develop- ment of branches and markets providing its social orientation. A special place in the system of these branch- es and markets is given to pharmaceutical sector and pharmaceutical market.

The pharmaceutical market of Kazakhstan is estimated at the level of 1, 2 billion US dollars. The main share of the market is import production.

The total market consists of more than 6000 items. Pharmaceutical industry provides requirements of domestic healthcare by 30%, thus the main part of products is produced by low-profitable generic drugs (85%) and the market of original drugs amounts to 15%. Similar structure of pharmaceutical sector doesn't promote the investment of scientific research and development of new original preparations. According to Forbes, expenses of large well-known pharmaceutical forms for scientific researches and development per one medicine amounts from 4 to 11 billion US dollars. Kazakhstan pharmaceutical industry can't objectively invest such financial means. In Kazakhstan 79 enterprises of large and medium business are engaged in manufacture of pharmaceutical production. Six largest enterprises produce 90% of all pharmaceutical pro- duction: «Chempharm» JSC, «Global Farm» SP, «Nobel AFF» JSC, «Romat» pharmaceutical companies, «NurMai-Pharm» LLP, «Karaganda pharmaceutical complex» which are the enterprises of a full cycle and «Aktyubrentgen» that produces medical equipment.

According to the Ministry of Health of the Republic of Kazakhstan, pharmaceutical industry provides domestic needs in real terms by 30%. All consumption is estimated at 73 US dollars and is the second in the CIS but is lower than all countries of Europe. For comparison, in France this indicator is $800, Switzerland is $700, in the Czech Republic, Slovenia, Great Britain is $400. For the last decade the market of pharmaceuti- cal production has increased on average by 10% due to the growth of the national economy and welfare of the population. The pharmaceutical market of Kazakhstan includes more than 6000 items of medicines and is the third in the CIS [2].

The state regulation of regional economy has to be aimed at a more complete disclosure of internal sources and resources, more efficient use of its potential. The development of regions in modern conditions demands, first of all, strengthening of regional intellectual property, a full use of informative, analytical and human resources. Transformation of regions into active subjects of economic relations shouldn't lead to dis- integration of national economic space and to predominance of local interests. The activity of the state has to provide realization of the principle of joint and social liability of economic subjects of the region that is, the power, business, citizens for ensuring full social partnership [3]. State function has to be the locomotive for investments to stimulate scientific and technical process and innovative activity for ensuring competi- tiveness of industry. Business function has to be a deliberate waste of money for innovative projects with the loss of its current profits but making favorable conditions for steady profits in the future at the same time.

Social responsibility allows business to improve company’s image, to attract new customers, to increase pro- duction sales and cost of its shares. The interaction between business and state is caused as an impossibility to carry out its social and economic functions of the state without business and impossibility of effective de- velopment of business without state support.

The pharmaceutical industry in its economic nature is also innovative, i.e. it needs the world support of scientific researches. The state support of innovative industries is necessary to carry out in the following directions: direct financing; granting means; target grants; the establishment of funds for innovation; gratui- tous loans.

The strategy of industrial and innovative development of Kazakhstan defined cluster method as the most important and effective direction. The pharmaceutical cluster is the group of interconnected innovative enterprises and firms within the certain region that includes the following [4]: developers of medicines; sup- pliers; production companies; objects of infrastructure; research and educational institutions.

In general, the organizations and enterprises are organized and technically supplement each other, pro- vide the output of constantly innovative production and strengthen competitive advantages that increase the stability of production. The state support is a necessary condition for the functioning of the pharmaceuti- cal sector of economy.

The state support of pharmaceutical industry is carried out on a competitive basis as this industry refers to the market oriented economy sector. The pilot pharmaceutical cluster is formed at the initiative of the state in Karaganda. Pilot cluster formation and foreign experience testify the need of providing an accurate system of interaction and partnership based on the interest of all members of cluster formation. Cluster formation in Kazakhstan has regional character due to the following factors: historical and geographical aspect (a huge area, climatic, historical and political factors, etc.); availability and prospects of formation of qualified per- sonnel; volumes and activity of local business; scientific and production potential; level of development of industrial infrastructure; location of the market of potential consumers, materials and equipment.

The current situation in pharmaceutical branch and market of the Republic of Kazakhstan is character- ized by stable growth. According to the program on the development of the pharmaceutical industry in 2010– 2014 it was supposed to achieve 50% of meeting country’s needs in pharmaceuticals in natural means due to responsible production, the introduction of international quality standards until the end of 2014 at pharma- ceutical plants, providing the industry with qualified personnel and modernization of existing and construc- tion of enterprises that meet the requirements of good manufacturing practice. The formation of capacities of pharmaceutical companies is focused on the development of a full production cycle [2].

The program defined 5 main directions of the development of pharmaceutical industry and the market.

The first direction is the ensuring stable market of pharmaceutical production’s object. This direction includes: transition to long-term contracts (up to 7 years) with domestic manufacturers of medicines and medical devices with the help of the uniform distributor having an indispensable condition, that is, to invest in the modernization of production and to ensure technology transfer from their foreign partners; increase of export’s share by compensating company’s expenses by the state connected with their foreign trade activi- ty.

The second direction is providing the industry with qualified personnel with the help of training pro- grams involving the assistance of foreign experts and training on-site courses.

The third direction is the improvement of standard legal base in the mode of removing administrative barriers.

The fourth direction is the optimization of trade policy for harmonization of legislative base on the movement of medicines, products of licensed application and component parts, ensuring mutual recognition of registration documents on medicines.

The fifth direction is the development of innovative projects to specify and to detail the program of forced innovative development.

While developing this program the modern situation in the world pharmaceutical market, globalization parameters, political aspect of a problem were obviously considered. Corporations, firms from EU countries, India, Turkey dominate in the market of pharmaceutical production in Kazakhstan.

Pharmaceutical industry of Kazakhstan in many respects depends on import of medical equipment, raw and packing materials and is under pressure from high-growing in this economic sector of China, India and the countries entering Eurasian Economic Union.

This situation is supplemented with problems of internal contents: the first is an access to credit means, the second is an absence of modern technologies; the third is an emphasis of state procurements on acquisition of expensive original drugs; the fourth is a long-standing practice of the registration procedure (8 months and more); the fifth is an interest of the most doctors in prescribing of import medicines; and at last are constant offers from workers of drugstores with expensive import preparations.

Nowadays, the dynamics of the development and implementation process is as follows:

In January-September, 2014 the output of pharmaceutical production amounted to 21.402 billion tenge and SFS amounted to 102.1%.In terms of regions at the end of 2013 the basic output of pharmaceutical industry of total production in Almaty amounted to 48.5% and South region of Kazakhstan amounted to 34.3%.This is due to the fact that leading manufacturers of pharmaceutical products as: «Chempharm» JSC, «Nobel AFF» JSC, «Abdi Ibrahim Global Farm» LLP and others are located in these regions. In Janu- ary-August, 2014 the leader in the manufacture of pharmaceutical products among the regions is the South Kazakhstan region with a share of total production of Republic of Kazakhstan — 53.2% (Table).

T a b l e

Manufacture of pharmaceutical products by regions of Kazakhstan, thousand tenge

|

|

2008 y. |

2009 y. |

2010 y. |

2011 y. |

2012 y. |

2013 y. |

January– August, 2014 y. |

|

Republic of Kazakhstan |

11286467 |

14903715 |

19979439 |

27063854 |

33884837 |

33533324 |

18645766 |

|

Almaty city |

2961381 |

4687636 |

5256738 |

12139850 |

12794219 |

16283123 |

5305256 |

|

South Kazakhstan region |

5433696 |

7576304 |

11171829 |

10325277 |

14802362 |

12499359 |

9915137 |

|

East Kazakhstan region |

512909 |

575057 |

464738 |

944191 |

1377956 |

1514606 |

842296 |

|

Pavlodar region |

188776 |

281981 |

357315 |

429980 |

711436 |

1066935 |

605938 |

|

Almaty region |

626211 |

832649 |

612998 |

931641 |

118490 |

592576 |

737112 |

|

Karaganda region |

221975 |

242146 |

474447 |

548632 |

585250 |

535622 |

418795 |

|

Zhambyl region |

357418 |

406918 |

434125 |

327910 |

397097 |

434988 |

521576 |

|

Akmola region |

946952 |

264333 |

1125865 |

1245850 |

1924542 |

270379 |

168521 |

|

Mangystau region |

8527 |

6167 |

50568 |

84733 |

161920 |

142050 |

35429 |

|

Aktobe region |

- |

- |

- |

44583 |

118594 |

102717 |

31174 |

|

North Kazakhstan region |

25839 |

27729 |

28013 |

38461 |

54516 |

53256 |

36553 |

|

Kostanay region |

2762 |

2795 |

2803 |

2746 |

38455 |

37713 |

27979 |

|

Astana city |

21 |

- |

- |

- |

- |

- |

- |

Note. CS of RK.

The growth in production of antibiotics for certain types of products is observed by 4 times from 2008 till 2013 (from 3,3 to 13,6 tons).In January-July, 2014 compared with the same period of 2013, there has been outputs decline from 6.7 tons to 4 tons or 39.9%. Production of syringes grew in 2013 in comparison with 2008 by 19 times — from 13,1 to 251,5 million pieces. In January-July, 2014 in comparison with the similar period of 2013 the decrease in outputs amounted to 56,5% — from 158 to 68,7 million pieces.

The volume of investments into fixed assets of pharmaceutical industry of Kazakhstan in 2013 amount- ed to 8262,4 million tenge, the growth rate in nominal terms in comparison with 2012 grew 4 times (2095 million tenge) and 3.6 times in comparison with 2009.

Total investments are own funds. In 2013 its share in total investment amounted to 69%, in 2012 — 95%. The rest of the investments are made due to borrowed funds.

The volume of investments into fixed assets of pharmaceutical industry in January-September, 2014 amounted to 11592 million tenge. There is the growth of 2.6 times in comparison with the similar period of 2013 (4506 million tenge).

Total investments are own funds and in January-September, 2014 its share in total investment amounted to 69%.

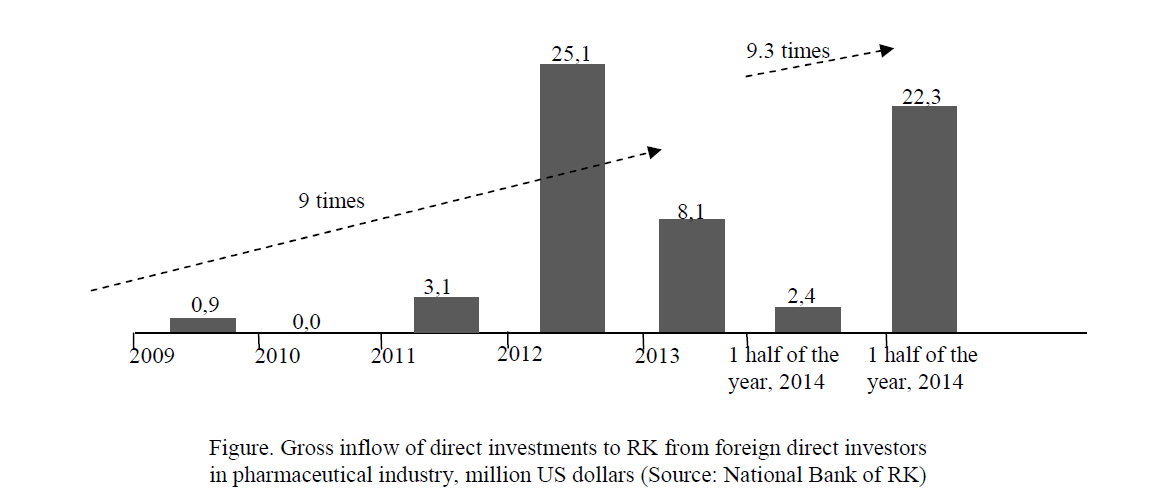

Gross inflow of direct foreign investments on enterprises of pharmaceutical industry amounted to 8,1 million US dollars in 2013 that is 9 times more than it was in 2009 (Figure).

Figure. Gross inflow of direct investments to RK from foreign direct investors in pharmaceutical industry, million US dollars (Source: National Bank of RK)

During the first half of 2014 gross inflow of direct foreign investments amounted to 22,3 million US dollars that is 9,3 times more than an indicator of the same period of previous year (2,4 million USA).

According to AC of the RK in 2013 the price index of company-producers of the pharmaceutical indus- try over the previous year amounted to 108.7%.

During the period from 2008 to the current period of 2014, a decrease of the price index was noted in 2009 (9.4%) and in 2010 (1.2%) compared with the previous period.

The price index of company-producers of the pharmaceutical industry in September, 2014 amounted to 122.5% compared to the same month of the previous year and in January-September, 2014 it amounted to 116.3% to the corresponding period of the previous year.

The growth of price index is caused by the increase in prices of the accompanying goods (raw materi- als) in the manufacture of pharmaceutical products which are generally imported from other countries as well as the growth of transport component.

Export of pharmaceutical products in 2013 amounted to 23.5 million US dollars that is 17% more than an index of 2008 (20,1 million US dollars). During January-August, 2014 exports amounted to 13.8 million US dollars. The decrease amounted to 13% (15.9 million US dollars) to the corresponding period of the pre- vious year. The major sales markets in 2013 were: Kyrgyzstan (8,8 million US dollars or 37,4%), Russia (3,7 million US dollars or 15,7%), Mongolia (2,2 million US dollars or 9,4%), Netherlands (1,9 million US dollars or 8%), Turkmenistan (1,8 million US dollars or 7,7%).

During January–August, 2014 Kazakhstan exported pharmaceutical production to Kyrgyzstan to the amount of 4,6 million US dollars (33,3%), Russia to the amount of 2,9 million US dollars (21%), Mongolia to the amount of 1,8 million US dollars (13%), Switzerland to the amount of 1,6 million US dollars (11,6%).

Import of pharmaceutical products in 2013 amounted to 1,603,300,000 US dollars which is 2.2 times more than in 2008 (726.3 million US dollars). During January-August, 2014 imports amounted to 900,3 mil- lion US dollars. The decrease amounted to 9% (989,5 million US dollars) to the corresponding period of the previous year.

The major sales markets in 2013 were: Germany (254,8 million US dollars or 15,9%), France (144,5 million US dollars or 9%), Russia (136,5 million US dollars or 8,5%), India (101,2 million US dollars or 6,3%).

During January-August, 2014 Kazakhstan imported pharmaceutical production from Germany to the amount of 143,4 million US dollars (15,9%), France to the amount of 91,1 million US dollars (10,1 %), Rus- sia to the amount of 75,1 million US dollars (8,3%), Belgium to the amount of 59,4 million US dollars (6,6%), India to the amount of 51,4 million US dollars (5,7%).

The share of domestic production of pharmaceutical products in domestic market during the period from 2008 to 2013 increased:

- pharmaceuticals — from 8.3% to 6%;

- antibiotics — from 7.6% to 16%;

- syringes — from 4.8% to 1%.

The share of domestic pharmaceutical production in January-July, 2014 compared to the same period of the previous year changed:

- pharmaceuticals — an increase from 15.7% to 1%

- antibiotics — a decrease from 13% to 6%;

- syringes — a decrease from 52.3% to 7%.

Comparative analysis of indicators and its dynamics raises certain doubts in achieving the planned indi- cators in 2014:

- on providing 50% of domestic market with domestic drugs in physical terms at the end of 2013 in comparison with 2012 a share of domestic drugs in domestic market decreased from 15,4% to 12,6% (minus 2,8%) in relation to the plan — minus 33,3% (45.9% is plan).

- on the growth of gross value added (minus 1.9%) in 2013 but it should be noted that Kazakhstan has growth on cost indexes over the last 5 years from 4.1 to 90.3 billion tenge — (22 times) and in 2014 GVA index according to the forecast will be minus of 61%.

- on labor productivity, real growth over 5 years is lower than planned by 103.7% (316,6 is plan, 212,9% is fact). Dynamics in 2014 is also negative — minus 111,5% according to the forecast (318,4 is plan–206,9% is fact).

Thus, within the framework of the state support at present, the following investment projects are implemented in Kazakhstan:

- expansion and modernization of existing production through the establishment of additional produc- tion facilities and modernization of existing production of solid and liquid medicines;

- construction of pharmaceutical full-cycle plant in Almaty cost of $ 25 million of direct investment;

- Polish company «Polpharma» has acquired from «Chemfarm» JSC 51% of the shares and will pro- vide access to capital and «know-how», the transition to GMP standards for 4 years, 100 million. dol- lars for investments, modernization of the plant, new facilities, innovative technologies and modern environmental

The strengths of the pharmaceutical industry of Kazakhstan are the willingness of the industry to mod- ernize and support from the state, providing demand within the guaranteed volume of free medical care through the public procurement of medicines and medical devices, potential of export to the CIS markets, political stability of Kazakhstan and favorable geographical location.

Thus, the main tendencies in the pharmaceutical industry of economy of Kazakhstan include production of new generic products upon the expiration of patents on original medicines, sales warranty up to 7 years by entering into long-term contracts, purchase (transfer) technology allowing to adjust production of modern medicines, contract manufacturing organization with foreign companies, transition to a sustainable medicinal maintenance — increase in consumption of domestic generic medicines.

References

- Budantseva S.V. Ways to achieve a socially oriented market economy: Methods and Techniques, Social economic phenome- na and processes, 1 (017), 2010, p. 30–34.

- The program of the development of the pharmaceutical industry of the Republic of Kazakhstan for 2010–2014 from August 4, 2010 #791, [ER]. Access mode: group-global.org

- Otarbayeva Z. The government and business as subjects of social partnership, Al-Farabi, 2 (30), 2010, p. 87–93.

- Enright M.J. Regional clusters: What we know and what should know. Innovation Clusters and Interregional Competition, Berlin, Heidelberg, New York; Springer, 2002, p. 99–129.