Initial public offering (IPO) is one of the most interesting scientific problems that can arise in an equity market research. From one hand it has relevance to the study of investment in terms of a financial category. From the other hand IPO has become a key issue in attracting of money inflows from the capital market. IPO as a type of access to capital has become a central topic of search for purposes of this article. IPO’s structure and forms of performance are analyzed here as well.

What is IPO?

According to London Stock Exchange (LSE) it is the company’s first offer of shares in the stock market. NASDAQ determines IPO as the company’s first sale of stock to the public.

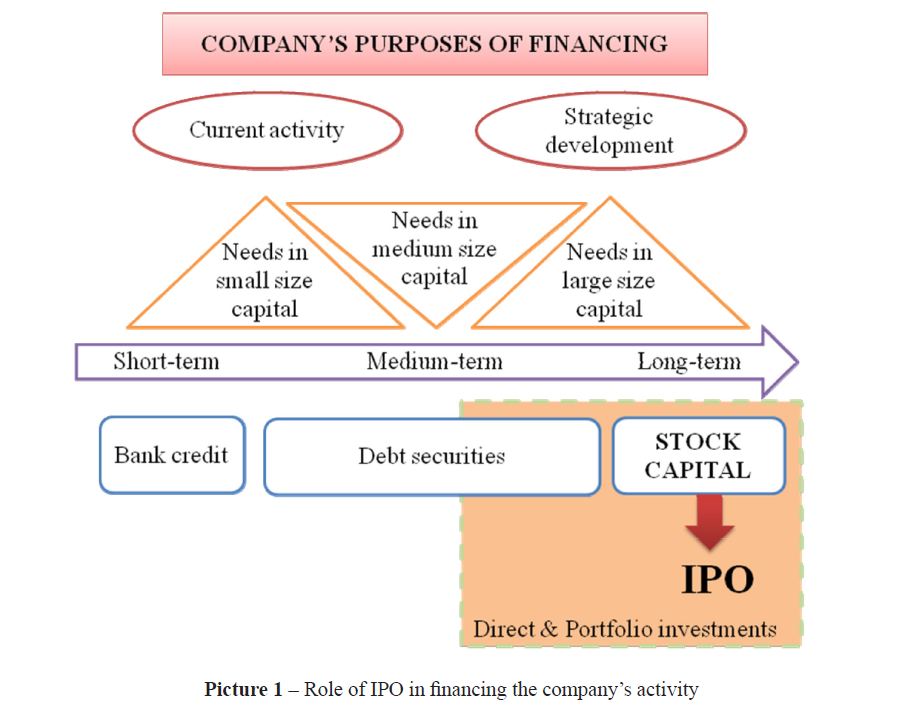

The sense of IPO relates to the principles of financing. The amount of internal savings or reserves commonly is not enough for a business’s growth. As a result many companies have intends to attract investment for their current activity and/or for their further development. The picture 1 can help to understand role of IPO in financing the company’s activity.

The chart was composed by author using common information

Financial markets can offer several instruments to help commercial organizations in achievement of their main goals in financing of current spendings or projects for future development. The first goal can be solved by issue of short-term securities or receiving a bank credit. It may seem obvious if a creditor is a reliable partner there are practically no problems with its shortand medium-term financing. Banks are seeking for the borrower that can return given money on time with needed profit yield. On the contrary, the second goal has a strategic meaning and leads to a general choice that usually made between direct or portfolio investments – mediumor long-term.

Both types of investments have specific advantages and disadvantages. For example, direct investments can attract outstanding experience or strategic partnership as well as outside operational or total control over recipient. Not all of the owners want to lose an influence on their company or share this influence with someone else. In turn, portfolio investments traditionally made by institutional or individual investors through securities market can offer large volumes of capital without involvement into the operational activity of the issuer. Overall control and analysis are expected measures of surveillance. Securities such as bonds or shares are used for these reasons. However, it is not simple to issue securities, especially on a stock exchange. Firstly, special listing procedures should be implemented. Secondly, nobody will invest into an unpredictable and non-profitable business. As a result portfolio investments can be available mostly for stable medium or large enterprises. Although there are many international markets that are opened for venture capital; some categories of the investors accept high risks relatively to potential profits.

Picture 1 – Role of IPO in financing the company’s activity

Comparing two types of securities the following features can be noted. Bonds are debt that should be returned on time with certain level of profit yield. Of course this type of debt has substantial preferences over banking credit because there is no need to provide some pledge; besides, core debt is paid to investors at the end of the bonds’ period of circulation. Shares represent stock capital. Investor’s ownership of shares carries rights to receive a proportion of the issuer’s profits in the form of dividends, or to vote at all meetings of shareholders, and other rights according to law. Optionally investors also can make arbitrage operations. Shares aren’t debt obligation, so the issuing company doesn’t return money to investors in certain period of time. Hence, shares’ “life-cycle” continues while the company exists. That’s the reason why shares’ issue is so popular all over the world when enterprises or ventures seek for investments. The company can also arrange depositary receipts’ issue that related to its shares. The structure specifies that shares are deposited by custodian/investment bank that repackages them and issues depositary receipts.

Thus, the companies go “public” by making IPO, and attracting unlimited quantity of investors or groups of investors. These issuers provide a deal between them and investors. “Public” means to obtain an official quotation for a security on the stock exchange. IPO can start on OTC market and results by admission onto official list of the stock exchange.

How is to be the public company?

It’s much more than just to attract money. There are many precedents when enterprises go “public” not aiming to receive investments. It is a status of transparent and reliable counterparty proving that the company follows its obligations; and, therefore, the company is ready for the open dialog with its shareholders, investors, partners and consumers. Such issuer receives the opportunity to present itself widely increasing media and analyst coverage, investor interest. In some cases the issuers should care about social responsibilities especially if they attract people’s monies or pension funds’ assets.

Foreign experience also shows that IPO can be used in different deals to change equity’s structure. For example, debt capital can be replaced by stock one; or structure of shareholders by type can be improved. From other side, in some countries there are strict requirements used for specific occasions to provide listing of the local companies’ securities on the stock exchange. This trend helps to develop narrow local securities market, and solve the problem of a lack of financial instruments as well as improve portfolio of institutional investors.

There are two typical types of IPO defined by the deal’s structure: primary public offering, or classical one; and secondary public offering. The first category specifies additional or new shares’ issue; the second category represents a part of early issued shares that belong to the existing shareholder/shareholders and can be sold to public. Another difference between these categories refers to investment inflows. In the first case the company itself takes capital; in the second case shareholders who sold their stocks receive financing. A mixed form is also applied in practice.

According to NYSE companies go public in order to accumulate capital to expand. Prior to going public, the company contacts an investment bank (or brokerage company / financial consultant) to advise them about how many shares to offer and the price of the shares. The investment bank plays the role of underwriter. The underwriter is responsible for the legalities of the deal as well as selling shares to public investors.

There are three basic methods of IPO: a fix price offering, bookbuilding, and an auction. The first type assumes supply of shares at a certain (fixed) price that was determined beforehand. The second one formed by underwriter represents total demand, and helps to define price of shares using gathered investors orders. The third one provides shares sale until the appropriate (high) price of securities is reached; however this method is used rarely. Mixed methods are also widely experienced. Decision about the method of IPO is taken by the issuer basing on views of its advisors and purposes of IPO.

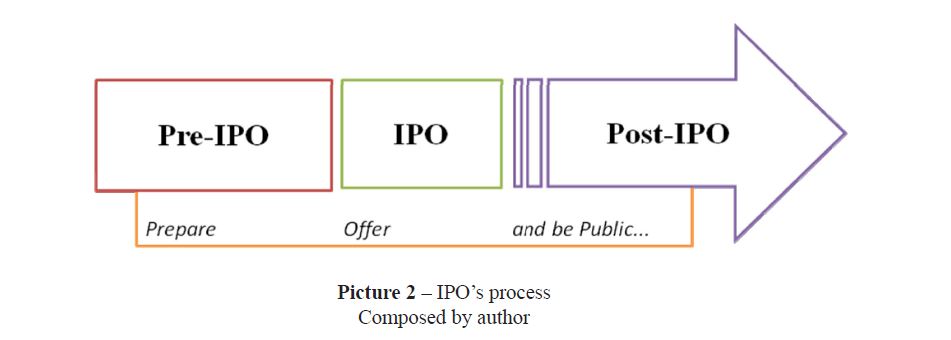

General procedure of IPO consists from three stages pre-IPO, IPO itself and post-IPO as it illustrated in the picture 2.

Picture 2 – IPO’s process Composed by author

One of the most important project’s components is pre-IPO preparation phase; this phase is time-consuming. Many participants are involved into the PreIPO’s procedures; they are: auditors, lawyers, consultants, estimators, registrar and others. Share capital can be sold in whole or in part. Main decisions of this concern are made by the existing shareholders or by the responsible bodies of the issuer.

The key areas to focus on follows:

- defining key objectives, estimation and evaluation of future IPO needs and results, financial analysis, risks minimisation

- Taking a decision to issue and/or sell shares basing on deal’s estimation

- Making changes or additions to prospectus if any arises (valid for the primary public offering). Prospectus should be registered at the responsible state body

- Realization of the existing shareholders’ primary rights. Primary right occur on shares purchase due to shareholders’ fraction if any demand arises from them

- Determination of pricing and IPO’s method

- Documentation process

- Listing on the stock exchange

- PR, communications, marketing and roadshows for investors

- Shares’ offering or underwriting

- Preparation of an IPO results’ report and its registration

- Tradings on secondary market

- Investor relations process

Successful IPO means that the company or shareholders reach all goals of IPO, have a high demand on their shares and raise expectable volume of investments. Post-IPO stage has particular meaning: a stable grow of market-value, high liquidity and strong demand are evidence of good beliefs relying to the company. It’s very important to provide secondary market for issued securities supporting demand and supply among investors with the help of different market measures.

All schemes mentioned above are true for the Kazakhstani market. Our companies have been experienced IPOs for more than ten years in Kazakhstan and abroad. Although scale of the most of these IPOs differ from the global IPO examples basing on estimation of investors’ number and/or volume of raised capital.

Local financial market including securities market offers full range of services for the issuer to run IPO; among them are: financial estimation, underwriting, issue registration, listing and etc.

Kazakhstani companies follow admission procedure to list on the Kazakhstan Stock Exchange (KASE). According to legislation there are some requirements when an issuer can receive a status of a public company. One of the most noticeable items is that the 30% shares fraction should belong to the investors who own not more than 5% from the total amount of companies’ shares per one investor. Not many companies satisfy these requirements evidencing of narrowness of the local market.

How to choose listing category?

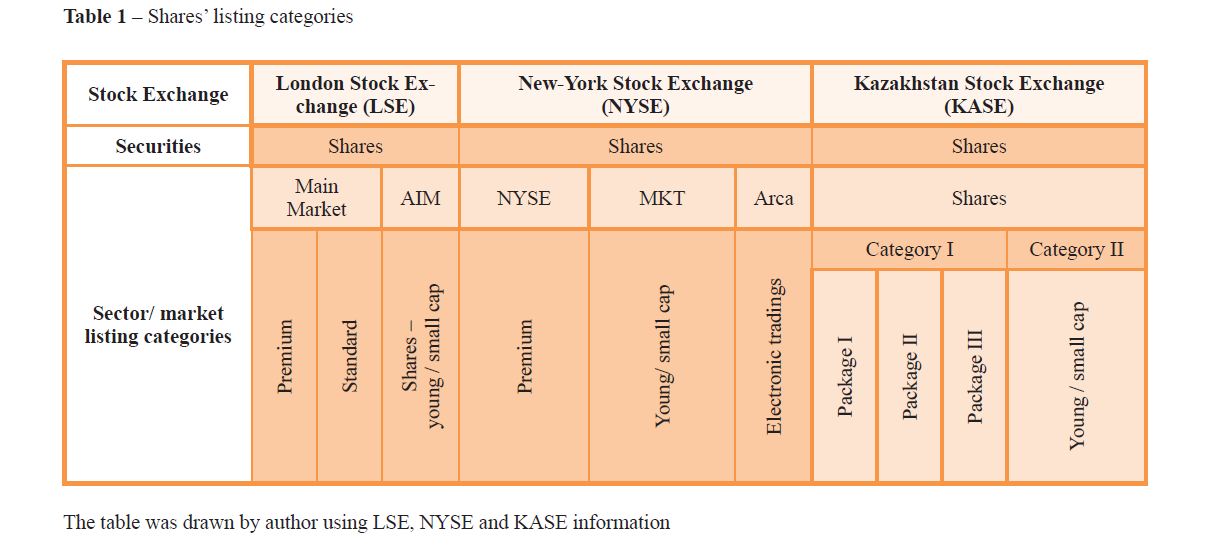

As it’s mentioned above IPO experiences close connections with organized market. The company faces with listing rules and listing requirements of the stock exchange that should be implemented. In fact the company meets the quantitative listing standards. Every stock exchange can offer a number of different listing categories. Developed securities markets show the highest standards of listings presenting the best international experience in exchange activity. KASE intends to follow best practice of exchange trading; and it is considered as an emerging securities market. Comparing of shares’ listing categories of the London Stock Exchange, the New-York Stock Exchange and KASE can help to understand weaknesses and strengths of the local market.

A table showing examples of shares’ listing categories for commercial companies presented bellow.

Table 1 – Shares’ listing categories

The table was drawn by author using LSE, NYSE and KASE information

All three exchanges offer opportunity for the different commercial companies to apply for listing or IPO. Every category designed to support the issuing companies according to their size, time of existing, financial results and other indicators:

- large enterprises – premium category on LSE’s Main Market, NYSE (premium) or Acra of NYSE, packages I-II of category I on KASE

- medium companies – standard category on LSE’s Main Market, NYSE or Acra of NYSE, packages II-III of category I on KASE

- start-ups or small companies – AIM of LSE, MKT of NYSE, category II on

From one hand similar features of listing requirements can be noted when comparing three equity markets; among them are free float, financial reports, auditing reports, corporate governance, equity capital, income and etc. The companies follow almost the same stages to go public on any market. From the other hand, there are a lot of differences in quantitative indicators and their sizes. Unfortunately Kazakhstani equity market is tenfold smaller; operational activity standards of local companies stay far from basic international standards. There is a lack of interest from the companies to run IPO as well as apply for listing. Hence, local investors are not active, demanding narrow interest for domestic securities. For individuals the most appropriate financial instrument is bank deposit, because it is guaranteed and not risky.

Instead of summary and conclusion: How to increase demand for IPO?

Two main counterparties of IPO are the Issuer and the Investor.

So being public is a significant decision that the issuer will ever take. IPO gives access to capital. It is an ambitious project to ensure next stage of development and growth. However, there are a lot of difficulties which can course misunderstanding of IPO process and lead to its failure. For the stable issuer the main reasons to refuse IPO following:

- It is too complicate to go public

- The company should follow high corporate standards

- IPO is time-consuming

- IPO can be resulted by M&A

- IPO procedure carries high cost

- IPO can be unsuccessful

- Post-IPO period is timeless

- Market condition should be convenient for IPO and etc

Therefore, the responsible bodies or organizations should provide appropriate support and conditions for the issuing companies for example, special consultant services, taxation preferences, transparency, simplification of procedures and others. Without these measures local securities market and investment distribution mechanism will suffer leading to their imbalance or even fail.

As for the investor especially the local one the main problem continuous to be a lack of practice and experience how to invest effectively in shares as well as how to manage market risks.

Financial illiteracy in the sphere of securities market should be improved in our country. From this point of view one of the most important tasks for the financial educational system is to provide preparation of highly qualified specialists for the Kazakhstani market that can offer good services for our people.

IPO is a very important element of the investment gear. In order to provide the effective development of the securities market IPO’s intends should be supported by a complex of measurements related to the market infrastructure. Modern strategies of public offerings should be one of the top priorities in research of the stock market. Studying of principles of IPO improves common understanding of the equity capital and the companies’ financing.

References

- Law of the Republic of Kazakhstan «On the securities market» from the 2nd of July 2003 № 461-II.

- Law of the Republic of Kazakhstan «On joint stock companies» from the 13th of May 2003 № 415-P.

- London Stock Exchange. A guide to – Boston, 2015. – 75 p.

- London Stock Exchange. A guide to listing on the London Stock Exchange. – 2010. – 113

- New-York Stock Exchange. Overview of NYSE Quantitative Initial Listing Standards. – 2015. – 3 p.

- Kazakhstan Stock Exchange. Category “Shares” of the KASE Official list. – 2015. – 4 p.