During the bank’s realization of a loan policy about loan repayment provision there is very important work with problem loans. Problem loans are those loans whose borrower doesn’t discharge a liabilities after receiving a loan on time and in full or those loans which security price has dramatically decreased.

A problem loan is a loan that has a delay of discharge a liabilities according to a bank loan agreement.

The observed increase of population crediting, including blank and express loans, leads to the growth of problem loans part in bank assets. Problem loans can be displayed in many different ways.

More often problem loans are resulted by a money crisis of a client. In this connection after loaning bank should implement measures for preventing bank losses. For this purpose banks conduct periodical independent and objective clients surveys, executed by audit department for their indication the problem loan’s signs.

For more detailed assessment of a loan market statement it os necessary to thorougly consider the changes in the structure of a loan portfolio.

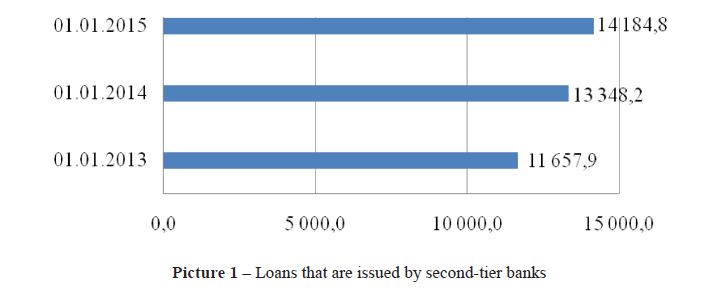

The credit investment volume which is presented by a banking sector during the last 3 years has increased on 21,7% from 11 657 billion tenge to 14 184 billions tenge. This growth shows a positive trend for the future growth. However, there are possible deteriorations of the quality of a loan portfolio.

The quality of a loan portfolio is one of the most important indicators of banking sector activity, which directly affects on financial sustainability and bank stability.

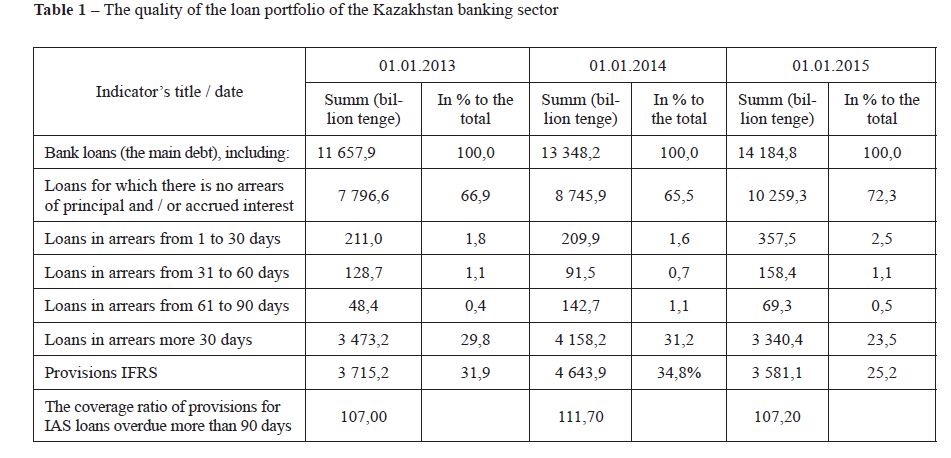

Changes in the structure of a loan portfolio looks this way (Table 1):

The table show that:

Loans in arrears from 1 to 30 days in the period of 2012-2014 increased on 69,4% in the total loan portfolio;

Loans in arrears from 31 to 60 days in the period of 2012-2014 increased on 23,1% in the total loan portfolio;

Loans in arrears from 61 to 90 days in the period of 2012-2014 increased on 41,2% in the total loan portfolio;

Loans in arrears more than 90 days in the period of 2012-2014 decreased on 3,8% in the total loan portfolio.

Picture 1 ‒ Loans that are issued by second-tier banks

Table 1 ‒ The quality of the loan portfolio of the Kazakhstan banking sector

Consequently, the volumes of bad loans in total for the Kazakhstan commercial banks have increased in every category, except loans in arrears more than 90 days, which have decreased on 3,8%. It all was preceded by the work of the banks itself and of the National Bank of the country.

It’s common knowledge that the communication with the borrowers of this category is very long, and it’s set reforms, a partnership with collector companies and creating the Problem loans Fund promotes the fulfillment of the requirements of the National Bank.

One of the actual problems in providing the stable functioning of a banking sector and a financial system is production and using efficient measures for clearing bank balances from loans in arrears more than 90 days.

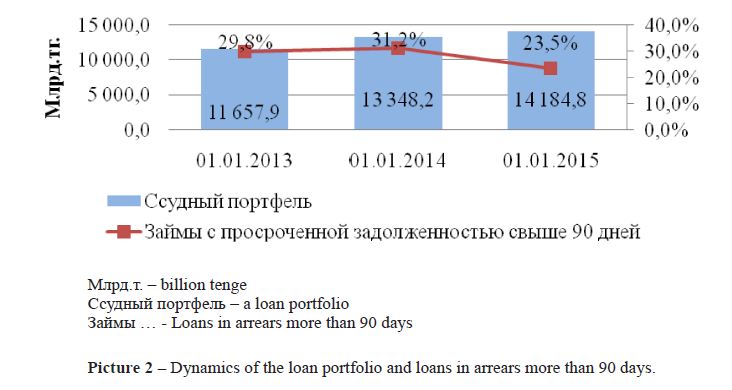

For the best understanding the problems of «non-working» loans of STB (second-tier banks) of The Republic of Kazakhstan let’s research the data on the Picture 2:

Beginning of the second half-year 2014 there was conducted an active work for decreasing the level of «non-working» loans, however, despite this decreasing, the quality of a loan portfolio is still being unsatisfactory.

Changes of NPL for more than 90 days in 2014 compared with 2012 decreased on 6,3%, notwithstanding that a situation with providing the quality and optimal structure of loan portfolios of Kazakhstan banks hasn’t changed during last several years. It is a progress in the work with loans in arrears more than 90 days.

Provisions are the amounts of funds which is necessary for covering the losses of failures to return assets of their price reduction.

Picture 2 ‒ Dynamics of the loan portfolio and loans in arrears more than 90 days.

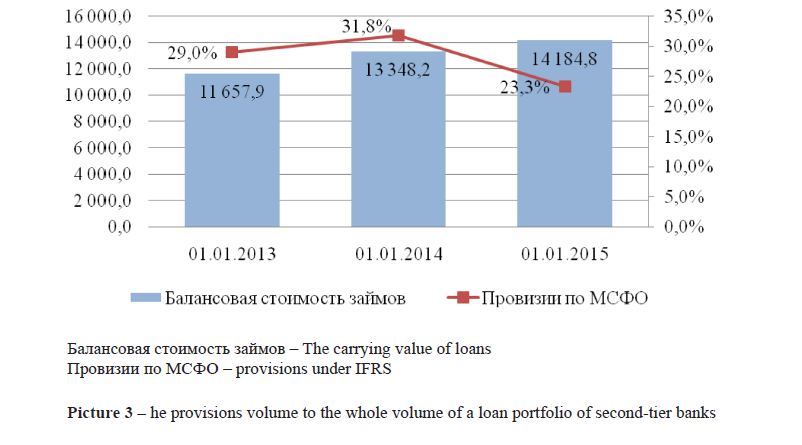

Provisions are divided into general and special ones. Special provisions are the provisions that are formed for covering losses of the concrete classifies assets, for which the possibility of failure to return prevails or which current price at least two times less than the buying price. General provisions are the provisions for the possible losses in the whole totality of bank assets, except those for which it is necessary to create special provisions. Let’s observe the picture for researching the ratio of the provisions volume to the whole volume of a loan portfolio of banking sector.

It is shown in the picture the reduction of the provision volume in 2014 compared with 2013 and 2012. In total there is decreasing of provisions on 5,7% for the reporting period. It proves the effectiveness of using the tools by The National Bank for improving the quality of a loan portfolio.

As it shows the practice of the developed countries in the solving problems of bad loans that finding of such a solution can last for long years if there is no active policy and support from government. It also can cause the decrease of the competitiveness of the Kazakhstan banking sector, including the integration process within Eurasion Economil Space, and the stability in front of the possible future deterioration in world markets.

Picture 3 ‒ he provisions volume to the whole volume of a loan portfolio of second-tier banks

In order to realization of the measures, provided by The Plan ot realization of The Road Map 2020 of The Republic of Kazakhstan, there was developed the conception of the shareholding «Problem Loans Fund». The purpose of the conception is the increase of the effectiveness of the Fund functioning and of its methods of partnership with banks.

In its turn, the goal of the Fund is assistance to banks in the process of «clearing» a balance from «non-working» loans in order to implementation the strategic objective for improving the quality of a loan portfolio in a bank system, reaching the tafget level of «non-working» loans (no more than 10% by 2016), including through long-term financing in the national currency. Wherein the ability of partnership with the Fund must be considered by banks along with another available tools for work with «non-working» loans (remission, write-off, sale and transfer to a bank’s daughter organization, acquiring doubful and helpless assets of a parental bank, collector companies, etc.)

Generalizing abovementioned information, we can conclude the seriousness of the problem with risk management in bank activity. It should be noted that the necessary conditions in risk management is a right system of full powers distribution, concrete official instructions and perfect information transfer channels. Generally, the risk management system is realized through precise events, implemented on the level of strategic management and within the cooperation of the sctructural departments of a bank.

The analysis above has shown that the volume of given loans rises from year to year, which is caused by financial needs of borrowers. For satisfaction such needs the second-tier banks use different innovations, including inventing new products, creating advantageous conditions, running marketing manipulations.

The quality statement, the portfolio bottom have showed good changes. As it was stated before, it was affected by the reforms and the reasonably strict policy of The National Bank. As we see in the struggle with loans in arrears more than 90 days there used the tools of a default and a loan policies. As the most priority measures in the work with problem loans there are sale to collector companies, write-off the hopeless loans, prolongation the total term of a loan, changing a payment schedule, refinancing of a debt.

References

- The Law of The Republic of Kazakhstan from 31st of August 1995 № 2444 «About banks and a bank activity in the Republic of Kazakhstan» (with changes and additions to 15.07.2015)

- Classification of bank loans. Approved at the session of the Committee of Financial Supervision from 31.01.2011. №8

- The rules of formation of the system of risk management and internal control systems for the second-tier banks: approved by The Decree of the Government of The National Bank of The Republic of Kazakhstan from 26.02.2014 № 29

- The banking sector’s current statement on 01.01.2015 // The official website of The National Bank of The Republic of Kazakhstan // http//www/nationalbank.kz

- The banking sector’s current statement on 01.01.2014 // The official website of The National Bank of The Republic of Kazakhstan // http//www/nationalbank.kz

- The banking sector’s current statement on 01.01.2013 // The official website of The National Bank of The Republic of Kazakhstan // http//www/nationalbank.kz

- The Decree of the Government of The National Bank of The Republic of Kazakhstan from 05.2015 №96 About Approving the Conception of the functioning og the Shareholding «The problem loans Fund»

- Zholamanova T. Money. Loan. Banks: Tutorial. M.T. Zholamanova – Almaty: 2011. – 384 p.