The article addresses a significant threat to global economic and legal order as the growth of the shadow economy, the existence of which leads to the growth of the laundering of proceeds of crime and financing of such dangerous socio-political phenomenon such as terrorism. Offered financial and legal controller of combating legalization of illegal incomes and terrorism financing’s national security: economic and legal aspects.

The collapse of the Soviet Union radically changed the geopolitical situation on the Eurasian continent. The states formed the post-Soviet space, with varying degrees of success strengthen their sovereignty, form their own set of national interests in foreign policy. In addition, the crushing of Soviet space for fifteen sovereign states changed the geopolitical situation also for the neighboring countries, before they interact with single Soviet Union. It changed not only the local balance of power, but also increased the multi-variant political and economic relations. There was the collapse of bipolarity in international relations, which involves the formation of a multipolar world, the poles of which have become the most powerful countries [1].

But with the collapse of the Soviet Union the whole system of the socialist camp was collapsed, many post-Soviet countries faced the protracted crisis.

The disbandment of the Warsaw Treaty organization, The Council for Mutual Economic Assistance put the end of the Central and Eastern Europe dependence from Moscow and has turned each of them into an independent subject of international economic relations. In these countries there was a rejection of the oneparty political system of planned economy in favor of the transition to market economy and democratic control with multiparty system. There was the transition from an economic system with a bipolar confrontation between the two powers to the United States de facto monopoly in the global economy.

The basis of this kind of unipolarity is in strong US economy, the political power and the military superiority. All this allows US to successfully implement its foreign economic interests, without consulting with the world community. Since the late twentieth century, the United States directly or indirectly involved in the organization of military incursions in more than 30 countries. National currencyUS dollar is one of the major reserve currencies in the world.

Such unilateralism carries both political and socio-economic threat to the national interests of other countries. This is especially true for the economically weak post-Soviet states, with relatively little experience of sovereign existence in a global economic and political system.

Allocation of the United States as a major center of power, as well as the rapid pace of globalization and the dollarization of the economy contributed to increased dependence of the global economy from the US economy. Therefore erupted in 2007 the US mortgage crisis to further impact on many countries, gradually expanding from the second half of the year, invading the «border» (to the mortgage system) financial and banking relationships in Europe, Asia, Middle East.

Initially, the major European countries considered it possible to overcome the crisis independently, however, its powerful blows forced EU countries to move to bring together.

October 11–12, 2008 at the summit of finance ministers of G-7 in Washington plan was adopted, which included five points:

- must be used all available means to support systemically important financial institutions, preventing them from bankruptcy;

- еnsure all necessary steps to unlock credit and money markets and ensure free access of banks and other financial institutions to liquidity and funding;

- to ensure banks to raise capital from both private and public sources in sufficient amounts to restore confidence and the resumption of lending to businesses and individuals;

- To ensure the reliability of the national deposit insurance programs through government guarantees;

- to take additional measures for the resumption of secondary market of mortgage and other securities [2].

These general principles are far beyond the Bretton Woods agreements and indicate the transition of the financial system to a qualitatively different development vector.

The main tool for further regulating proclaims not the market, not its private agents, but the state and its financial authorities’ solutions.

Ineffective attempts of the central banks of the most developed countries of the world to unite their efforts to prevent a serious threat to the collapse of the global financial system show that there must be some other, more powerful forces, with qualitatively different properties — to create an international (supranational) regulation system of global financial and economic processes. The Bretton Wood institutions created for this purpose, are powerless in the present conditions; they demand the search for new international regulatory mechanisms with a distinct supranational element which specific to the laws of different countries. Otherwise, the global financial system will come to collapse exploding the world economy.

Another significant threat to the world economic and legal order is the proliferation of the shadow economy, the existence of which leads to an increase in the laundering of proceeds from crime, as well as funding such dangerous socio-political phenomenon as terrorism.

Today, the phenomenon of money laundering and terrorist financing is presented in the media as something that would seriously threaten the foundations of modern society, its economic fundamentals. Terrorism is no longer only the object of study criminology and political scientists, the most of the social sciences connected to its analysis. However, it is worth noting the following.

First, despite the huge amount of scientific research in this area, it has not yet determined the real criteria for the negative impact of legalized funds in the normal course of economic processes in any country, including developed countries.

Second, analysis of the efforts and measures intergovernmental and international organizations on combating the legalization of proceeds from crime and financing of terrorism shows how distorted the aims and objectives of these measures in the direction of dealing with the consequences of socially dangerous acts.

Third, the increasing capacity of countermeasures in various intergovernmental and other international organizations to combat money laundering leads, respectively, to the increase in cost to the states — participants of such events that flushes causing justified criticisms of taxpayers [3].

In short, we must recognize that today the process of counteraction to illegal circulation of capital, in spite of several measures taken, is ineffective and needs improvement.

Terrorism has a lot of varieties, but, in any form, it is the most dangerous problems of the XXI century by the scale, unpredictability and social and legal consequences. Not long ago, terrorism was a local phenomenon, but over the last 10–15 years has acquired a global character and increasingly threatens the security of many countries, has strong psychological and economic influence, takes more lives of innocent people. Terrorism is a crime against public safety, the subjects of which are the personality, society and state.Terrorism does not occur in a vacuum, there are certain reasons and social conditions conducive to it.Their detection and investigation reveals the nature of terrorism as a socio-legal phenomenon, explains its origin, shows that contributes to, and which counteracts of its growth. It is clear that this situation demands a large-scale state intervention. No person is able to ensure their individual security without functioning state security. Overcoming the economic crisis, elimination the threat of the safe development of the society are impossible without strict government regulation in all areas of life. Therefore, the state should have the priority in public security.

The problem of counteraction to legalization (laundering) of incomes and financing of terrorism has a special place not only in Kazakhstan but also in other countries of CIS. The fight against money laundering is an important means of control over organized crime, including its most dangerous forms, such as drug trafficking and terrorism. The implementation in Kazakhstan and Russia generally recognized principles and mechanism for combating money laundering and terrorist financing has not only legal, but also great socio — political importance.

Recent events in Chechnya, the taking of hostages in Moscow within «Nord-Ost», tragedy of September 11, 2001 in New York, the activity of the Basque separatist organization ETA in Spain, the undying conflict in the Middle East and the terrorist attacks in Kashmir and Indonesia — this is not a complete list of offenses paid by that money. In this aspect, the fight against money laundering takes on a global character.

Various techniques are known for financial allocation, which depending on the used financial institutions can be grouped into the following categories:

- placement in traditional financial institutions;

- placement in non-traditional financial institutions;

- placement through the establishment of the non-financial sector;

- g) placement

At the moment, the Russian Federation and Kazakhstan have no legal framework regulating issues of surveillance, control and legal regulation of this problem. The current legal practice does not reflect the level of economic relations of the state and new trends to change them.

Process of money legalization active goes on the financial market and banking services, which are now the most rapidly developing, which leads to the «transformation» of the economy in the direction of its further criminalization. It is obvious that the structure of the informal capital of the country, which is in financial turnover, consists of the criminal and illegal money the origin of which is unknown to the state.

Anti-money laundering (AML) is not only a financial and banking problems. It is fully legal, criminological, forensic one. Laundering of «dirty» money is always derivative, is a secondary offense. Starting is a process by which the money received.

Over the last 10 to 15 years the financial system has transformed under the influence of globalization. This, on the one hand, globalization promotes the establishment of a market economy, which leads to higher living standards, the development of the financial system, reducing unemployment, enhancing the exchange between two countries in goods and services. But, on the other hand, in the context of globalization it becomes easier for criminals to hide income derived from illegal activities, and to transfer those funds across borders for their legalization.

In July 1989 by the initiative of president of France during the Paris Summit under under the G7 (US, Japan, Germany, Britain, France, Italy, Canada) the Special Finance Committee for Combating Money Laundering (Financial Action Task Force on Money Laundering — FATF, FATF) with headquarters in Paris was organized. Today FATF includes 32 countries and two international organizations (the European Commission and the Gulf Cooperation Council) and covers the most important financial centers in Europe, Asia, North and South America.The purpose and objective of the organization is the development of certain standards to combat money-laundering at the international level.

Russia became a full member of FATF in June 2003 is largely due to the fact that it has adopted a similar to the US system of financial intelligence, which is focused primarily on information and coordination of law enforcement agencies and financial institutions.

The developers of the program proceeded from the fact that none of the countries could prevent the money laundering if law enforcement officials, banks and their governing bodies do not share information and work together. Moreover, the exchange should take place not only at the level of a single country, but also internationally. Such approach caused the creation of The Egmont Group of Financial Intelligence Units. By the number of participants is the second organization after the UN, uniting now 106 financial intelligence units, which also includes Russia and the authorized body — the Federal Service for Financial Monitoring of the Russian Federation. These bodies are responsible in their countries for the collection, processing and analysis of information received from financial intermediaries of suspicious transactions, as well as for the transmission of this information if there are sufficient grounds to law enforcement.

Thus, counteraction of money laundering should have complex character and consist of a system of necessary common rules and standards of activity, common goals and priorities, and the most importantly, the presence of interrelated aspects:

- the legislation, providing a clear indication framework, the division of powers of each level of the system;

- common economic policy in the field of law enforcement and integrated policy to ensure economic security.

Otherwise there are possible such phenomena as duplication of functions and waste of resources, and as a consequence — the lack of results.

The effectiveness of the state policy in any area depends on its level of public support.The status of non-governmental organizations do not represent the state or other authorities, essentially devoid of the element of compulsion in their work. Therefore, their capacity in many areas, especially in the field of combating money laundering, is severely limited. The main subjects of the anti-money laundering are Government and international organizations (see Figure 1).

Success in the fight against international terrorism can only be achieved in the implementation of an effective system of measures to destroy the financial basis of terrorist groups. Therefore hindering the penetration of «dirty» capital in the legal economic system is an important factor that promotes reduction in the activity of terrorist organizations.

![Organizational chart of combating money laundering and terrorist financing at the macro and micro level (composed by authors on the base of [4])](/uploads/data/files/pics8/1_246.jpg)

Figure 1. Organizational chart of combating money laundering and terrorist financing at the macro and micro level (composed by authors on the base of [4])

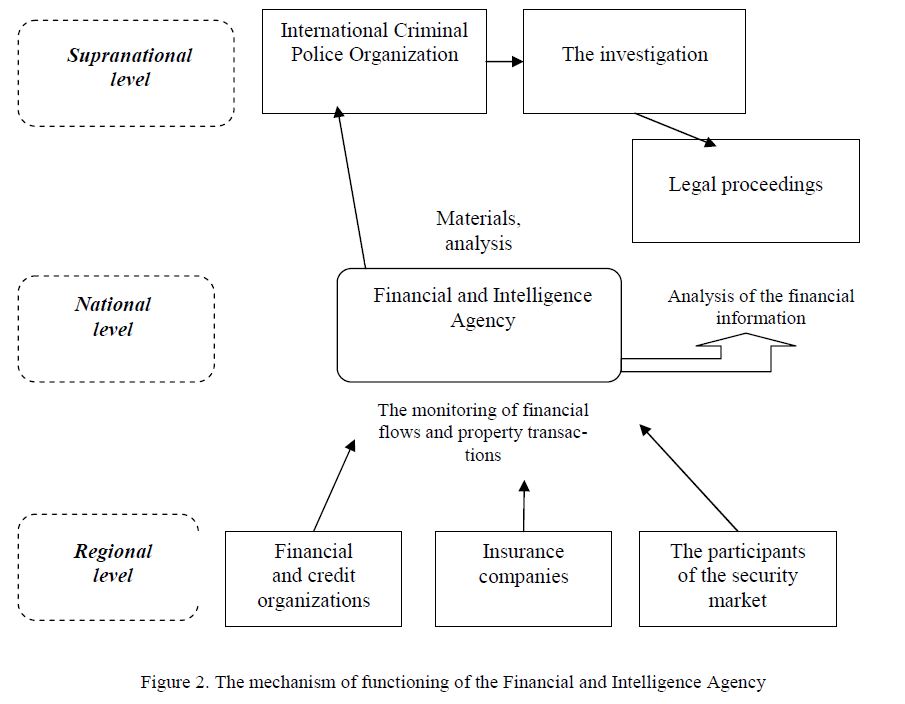

To prevent the penetration of illegal capital we offer the creation of the regulator — Financial and Intelligence Agency which branches may be placed in all countries.The mechanism of functioning of Financial and Intelligence Agency is shown on Figure 2.

Information about the cash flows on the basis of the agreements concluded in the framework of supranational legislation will beavailable to the management of banks and other financial institutions, insurance companies, securities market participants.

Agency analyzes the financial and economic information, investigating suspicious transactions. Further materials on suspicious transactions are sent to the International Criminal Police Organization to continue further investigation and legal proceedings.

Figure 2. The mechanism of functioning of the Financial and Intelligence Agency

The creation of such regulator requires changes in national legislation in part:

- strengthening the legal framework for combating the financing of terrorism within the SCO, BRICS;

- organizational aspects of the regulation of the relevant regulatory acts of collective security;

- Amendment of the relevant national legislation on banks and banking, insurance and

References

- Козлов А. Мир в 2030 году: однополярность или многополярность мира? // Бизнес. Общество. Власть. — № 2. — С. 47–65. // http://www.hse.ru/data/2011/04/23/1210740175/47_2008–2.pdf

- Бекетов Н.В. Мировой финансовый кризис и проблемы глобализации мировой экономики // Проблемы современной экономики. — 2009. — № 2 (30) // http://www.m-economy.ru/art.php? nArtId=2530

- Ниетуллаев Н.Н. Легализация незаконных доходов и «теневая» экономика Казахстана // Вестн. Караганд. ун-та. Сер. Право. — 2012. — № 3. — С. 50–57.

- Золотарев Е.В. Совершенствование системы противодействия легализации преступных доходов и механизмов контроля в кредитных организациях: дис. ... канд. экон. наук; спец. 00.10 / Финансовый ун-т. — М., 2014. — 193 с.