In this article we will observe some general provisions about taxes and consequences connected with it. The other point to be taken into account is the expansion of borders and the application of this type of tax. The main purposes of VAT in Kazakhstan and in Europe. Some description about VAT rates, membership and charging process. The analysis of different system of taxation.

Introduction

Kazakhstan and Europe are not so distant, at least in terms of tax.

Kazakhstan form, together with Russia, Belarus and Armenia*, the Eurasian Customs Union. From 2015 these four countries realized the Eurasian Common Economic Space, which guarantees the free movement of goods, services, capital and people. The Eurasian Customs Union, has already led to a partial economic integration between the three countries, and the Eurasian Union is considered the evolution of this customs union.

The idea, inspired by the integration between the countries of the European Union, was announced in October 2011 by the then Russian President Vladimir Putin, which resumed a proposal originally launched by Kazakh President Nursultan Nazarbaev in 1994 [1].

The particular definition of the Eurasian Economic Community means the opening of the Common Economic Space enlargement not only in all the countries of the Commonwealth of Independent States, but also in all European countries under the banner of a «harmonious community of economies from Lisbon to Vladivostok «as stated by Vladimir Putin. The birth of the Community should not be interpreted in opposition to the European Union, but as the formation of an economic pole complementary to it. The need to link the two markets arises from the intensity of trade between the two actors. Within these trade Italy stands as the third largest recipient of EU export products, with 12.012 million dollars, and the world's largest importer of commercial products from Kazakhstan.

1. The harmonized taxes

Within the European Community and the Eurasian Community harmonization is the procedure through which it’s possible to make the legal provisions related to certain taxes common to the Member States in order to eliminate tax distortions that hamper free competition in the single market and not to discriminate Armenia took part in the Eurasian Customs Union in October 2014 and will also be part of the Eurasian Economic Union from against goods, persons, services and capital on grounds of nationality. Harmonization does not mean unifying, but only adapt to a common type (prerequisite, tax base, tax rates) and eliminate the most significant divergences.

The harmonization of indirect taxes in Europe (Art. 93 EC Treaty) concerned essentially the VAT, excise duties and capital duty. On VAT were set the basic features of the tax (1967: first and second Directive) laid down uniform rules for determining the tax base (1977: Sixth Directive) and from 1 January 1993 (Directive 92/77) were harmonized rates (normally are not less than 15 % in specific cases have been brought to 5 %). For trade within the Community, also, it has been programmed the transition from the system of taxation in the country of destination to the source, even if the tax will ultimately be collected by the State where consumption takes place the well (the State of destination He will recover, against the State of origin, the tax deduction granted to the purchaser).

Excise taxes have been harmonized by a series of directives in 1992 (regime, possession, circulation, controls, structure and rates). It has been preserved the system of collection of income tax in the country of consumption of the product, providing the connection of the tax warehouses in the Member States.

The various forms of taxation of capital were harmonized by Directive 69/335 (the only capital duty, harmonized structure and rates to be applied in the state where there is the effective management of the company; abolition of stamp duty on securities and suppression of other similar taxes), which also referred to the requirements of the tax (company formation, transformation, increase in capital or assets, transfer to the third country to Member State and between Member States etc.) and forbidden 'application to corporations of other indirect taxes. These benefits were gradually expanded and in 1985 mergers (merger and, thanks to the Court of Justice Community) were exempted.

Equal attention to issues relating to direct taxes is not in the EC Treaty, which, moreover, do not require harmonization or coordination and, in accordance with the principle of subsidiary, are regulated independently by the Member States.

However, in consideration of the importance of direct taxation for the proper functioning of the single market, were approved: the Directive on cross-border corporate reorganizations (90/43, known as the 'Merger Directive'), which established the principle of fiscal neutrality (merger, divisions, transfers of assets and exchanges of shares does not involve taxation of capital gains resulting from the difference between actual values and tax values of assets involved in the transactions), and governs the transfer of a permanent organization; the Parent-Subsidiary Directive (90/435), which solves the problem at Community level of international double taxation of dividends within the Group; Directive 2003/48 on taxation of savings income in the form of interest, and Directive 2003/49, which governs the taxation of interest and royalties (royalties) paid by a company to other companies or permanent establishments of a the same group established in different Member States, abolishing the withholding tax and eliminating, in this way, the double taxation.

So I concentrate my work on the VAT.

2. VAT — The object

VAT applies to the following transactions:

- Supplies of goods, work and services in Kazakhstan;

- Imports of goods.

For VAT purposes, taxable turnover is the total of practically all types of supplies (for example, sales, exchanges or gifts) of goods, work and services and the total of its acquisitions of goods, work and services from non-registered nonresidents.

Goods include practically all forms of property or property rights. Taxable supplies of goods include: transfers of title to goods, including the sale, exchange and payment of salary (wage) in kind; free-of-charge transfers of goods; transfers of goods under a finance lease contract.

Taxable supplies of services are any supplies of work or services that are made for consideration or made free of charge or anything that is performed for consideration and is not a supply of goods. Taxable supplies of services are any supplies of services, both chargeable and non-chargeable, as well as the following: transfers of copyright or intellectual property; services performed by an employer for the benefit of an employee as a form of wages; and loan extension.

In Europe

For tax purposes, are considered supplies of goods the transfer for value of property or the creation or transfer of real rights of property (art 2 sixth Directive*) [2]; operations are also treated as supplies of goods contracts committee assignments of assets to shareholders, the destination of goods for use or consumption, or family entrepreneur or those who exercise an art or profession (so-called self-consumption) or purposes unrelated to the company or to the pursuit of art and profession.

It should be noted that they are excluded from VAT assignments to members concerning goods which are objectively excluded from VAT such as money, land not building etc.

Generally so that a transaction for the sale of goods are of importance as VAT is necessary, as mentioned, that the transfer of ownership or other real right of enjoyment on the same should be for consideration. Therefore, in general, they remain outside the scope of VAT transfers made free of charge.

However, an exception to this principle, the supply of goods that make up the business activity [3]; this is to prevent consumer goods alike are received with a different tax burden, is that it creates a serious deterioration in the toll system.

Conclusion

From a comparative point of view the Kazakh concept of good is wider than the European one.

3. Who is liable

Taxpayers are legal entities and nonresident legal entities that are registered for VAT purposes as well as importers of goods into Kazakhstan.

Tax registration. Legal entities must register for VAT on exceeding the VAT registration threshold or they can voluntarily register at their discretion. VAT registration is mandatory if turnover during the calendar year exceeds 30,000 MAI. The threshold is approximately 222,698 euro for 2014.

VAT registration is separate from tax registration. The deadline for VAT registration is within 10 business days after the end of the month in which the turnover threshold is exceeded.

In Europe

Taxable person is a person who, independently, carries out in any place any economic activity, whatever the purpose or results of that activity. Economic activity includes any activity of producers, traders or persons supplying services, including mining and agricultural activities and activities of the professions. To the extent that they are bound to their employer by a contract of employment or by any other legal ties creating the relationship of employer and employee, the activities of salaried and other persons are not regarded as being carried out independently.

Any person who, on an occasional basis, supplies a new means of transport transported to another EU country is also regarded as a taxable person.

An EU country may also regard as a taxable person anyone who carries out, on an occasional basis, an operation relating to an economic activity and, in particular, the supply, before first occupation, of a building or part of a building and of the land on which the building stands or the supply of building land.

States, regional and local government authorities and other bodies governed by public law are not regarded as taxable persons in respect of the activities or transactions in which they engage as public authorities, except where their treatment as non-taxable persons would lead to significant distortions of competition. When they carry out certain commercial operations, such bodies are nevertheless taxable persons.

Tax registration-The opening of the VAT number is required if the activity is carried out in the usual way, but not if it is carried out on an occasional basis.

In Italy to open the VAT taxable persons shall not exceed the sum of 5,000 euro for the total remuneration received by the year. If, therefore, this amount does not exceed the threshold, the employee will be exempt from the obligations occasional contributions and tax.

Conclusion

The concepts are almost the same also if the limit in Europe for the registration is really much lower than in Eurasian, in particularly this comparison is between Italy and Kazakhstan.

Sixth Council Directive 77/388/EEC of 17 May 1977 on the harmonization of the laws of the Member States relating to turnover

4. VAT Territorial application

Goods and services are subject to VAT if, under the place of supply rules, they are deemed to be supplied in Kazakhstan.

Under the tax law of Kazakhstan, the place of supply of goods is deemed to be the following:

- Goods sent by the supplier, the recipient or a third party: the place where the transportation of the goods begins;

- For all other cases: the place where the goods are handed over to the

The place of supply of work and services is determined based on the nature of the executed transactions. Work and services connected with immovable property (for example, buildings and installations) are deemed to be supplied in Kazakhstan if such property is located in Kazakhstan. The place of supply of certain services that are provided outside Kazakhstan is deemed to be Kazakhstan. Such services include, but are not limited to, the following:

- The transfer of rights to use items of intellectual property;

- Consulting;

- Audit;

- Advertising and marketing services;

- Staff provision;

- The leasing of movable property (other than means of transport);

- Agency services connected with the purchase of goods, work and services;

- Consent to limit or terminate entrepreneurial activities for consideration;

- Communication services;

- Radio and television services;

- Tourism organization services;

- Rent of freight wagons and

Europe

For the purposes of the Sixth Directive, the «territory of the country» shall be the area of application of the Treaty establishing the European Economic Community as stipulated in respect of each Member State in Article 227.

The supply of goods shall be regarded as the territory of the State, and therefore subject to VAT if the following some conditions occur.

The place of supply of goods is deemed to be:

- the place where the goods are at the time when dispatch or transport to the person to whom they are supplied begins (in the case of goods that are dispatched or transported);

- the place where the goods are when the supply takes place (in the case of goods not dispatched or transported).

The place where a service is supplied is deemed to be the place where the supplier has established his business or has a fixed establishment from which the service is supplied or, in the absence of such a place of business or fixed establishment, the place where he has his permanent address or usually resides.

Then there are the exceptions to the rule General said, providing different criteria to determine the relevance territorial of some types of services, also according to the nature of the buyer of the service:

- the place of the supply of services connected with immovable property, including the services of estate agents and experts such as architects, is the place where the property is situated;

- the place where transport services are supplied is the place where transport takes place, having regard to the distances covered;

- the place of supply of services relating to ancillary transport activities, cultural, sport, scientific or educational activities, as well as valuations of or work on movable tangible property, is the place where the services are physically carried out;

- the place of supply of services in the case of hiring out of movable tangible property, with the exception of all forms of transport, is the place of utilization;

- the place of supply of the following services is the place where the customer has established his business or has a fixed establishment or, in the absence of such a place, the place where he has his permanent address or usually resides: transfers and assignments of copyrights, advertising services, the services of consultants, engineers, lawyers or accountants; banking, financial and insurance

In order to avoid double taxation, non-taxation or the distortion of competition the Member States may consider:

- the place of supply of services situated within the territory of the country as being situated outside the Community in cases in which the effective use and enjoyment of the services take place outside the Community;

- the place of supply of services situated outside the Community as being within the territory of the country in cases in which the effective use and enjoyment of the services take place within the territory of the country.

Conclusion

The territorial rules are broadly similar to European Union rules, but the European rules seems to more complicated.

5. Rates of VAT

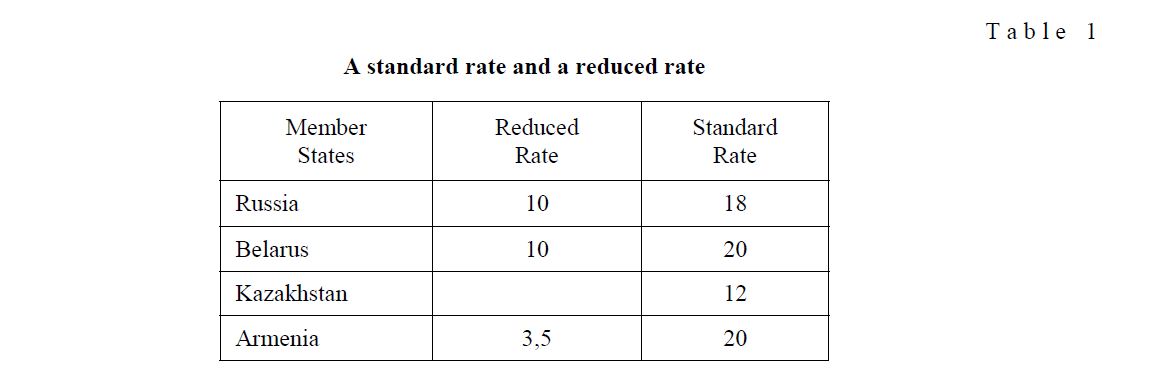

In the Eurasian Union there are a standard rate and a reduced rate.

A standard rate and a reduced rate

T a b l e 1

In Kazakhstan a small number of transactions are treated as non-taxable or have zero rating. Turnover taxable at a zero rate includes:

- Export sales of goods;

- International transportation

Turnover and imports exempt from VAT include:

- Turnover associated with residential buildings;

- Defined financial services;

- Transfers of assets under finance leases (interest part);

- Turnover from services rendered by noncommercial organizations;

- Turnover from services in the spheres of culture, science and education;

- Import of certain assets, the list of which is generally approved by the

From January 2015 import of the following medicines, medical goods and equipment are exempt from VAT:

- registered with the State Register of Medicines, Medical Goods and Equipment in Kazakhstan;

- not registered with the State Register of Medicines, Medical Goods and Equipment on the basis of the decision (an approval document) issued by the authorized public health service body [4].

Europe

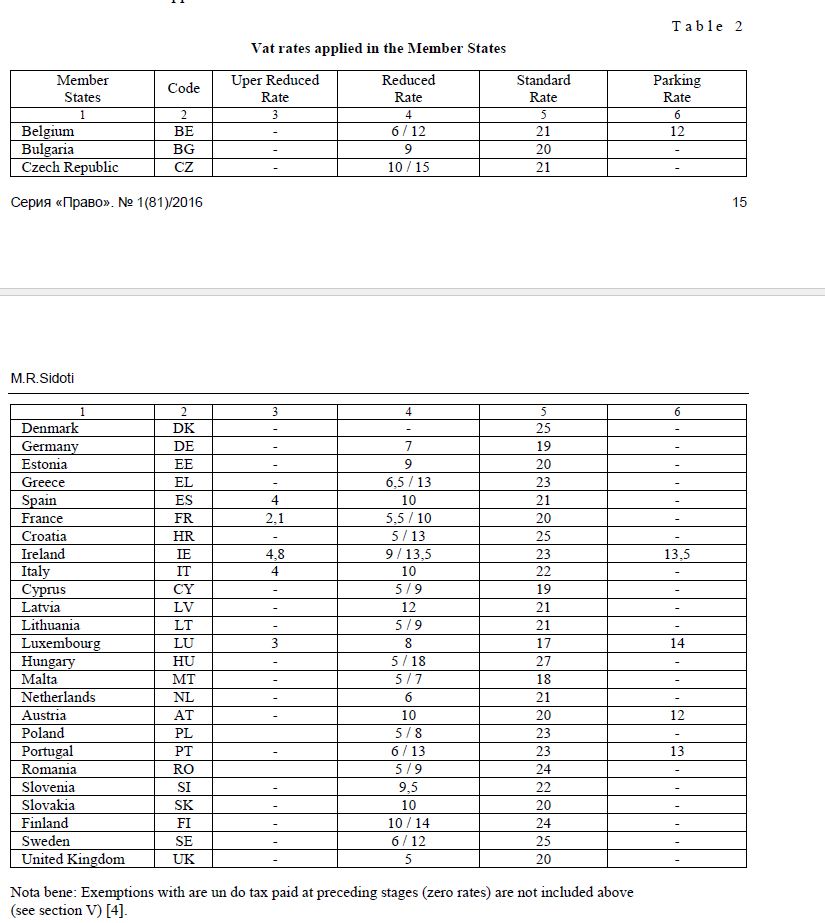

I.List of vat rates applied in the Member States

Vat rates applied in the Member States

T a b l e 2

Nota bene: Exemptions with are un do tax paid at preceding stages (zero rates) are not included above (see section V) [4].

As you can see some important categories of goods/services, e.g. educational, healthcare and financial services, are mostly exempt from VAT.

If you sell any exempt goods/services, you cannot claim back any VAT you pay when buying in goods/services directly related to such sales.

The list of VAT exempt goods and services is provided in the VAT Directive In Europe there are a standard rate a reduced rate and a super reduced rate

In Italy for example we have a Standard VAT rate: 22 % (1st Oct 2013, a Reduced VAT rates: 10 % for pharmaceuticals, passenger transport, admission to cultural and entertainment events, hotels, restaurants, and a Super Reduced VAT rates: 4 % foodstuffs, medical, books, e-books).

6. Procedures

VAT procedures in the Eurasian Union are in general similar to those in the European Union, however, there are important differences regarding cross-border deliveries.

VAT tax is charged on every step within the production system, with relief against taxpayers and final transfer of economic burden of the tax on the consumer. For internal transactions of the taxable base and the value of goods and services are sold in the base price of the transaction. The value for the imported goods is calculated according to their value increased by customs duty and applicable taxes (VAT exluded).

The excess of input VAT over output VAT may generally be carried forward against future VAT liabilities. In practice, obtaining refunds requires significant effort, although the rules do prescribe a procedure for refunds under certain conditions.

VAT paid on services and goods purchased by a VAT payer (i.e., input VAT), including reverse-charge VAT already paid and VAT paid at customs, should generally be available for offset (credit) when determining a taxpayer’s VAT liability to the budget.

However, offset is not available for VAT incurred for the purpose of making supplies that are either exempted or deemed to be supplied outside of Kazakhstan.

Reverse-charge VAT In Kazakhstan.

If a nonresident that is not registered for VAT purposes in Kazakhstan renders certain services for which the place of supply is Kazakhstan to a Kazakhstan purchaser and if the purchaser is a VAT payer, the purchaser must self-assess and pay VAT to the budget through a reverse-charge mechanism.

These services include: consulting, audit, engineering, design, marketing, legal, accounting, advocacy, advertising, information processing services, provision of personnel, lease of movable property, communication services.

The obligation to pay the reverse-charge VAT will be on the Kazakh purchaser of the services, which should be allowed to offset the amount of the reverse-charge VAT paid against output VAT, subject to the general offset procedure. The buyer of imported services should be VAT registered in order to –self-assess and pay VAT for non-resident.

Customs Union

The Tax Code contains certain procedures and monthly compliance requirements for import of goods to Kazakhstan from the Customs Union countries (Russia and Belarus).

In practice — VAT credit/reimbursement by national tax authorities subject to:

- Evidence on physical exportation (transit via third countries is possible), on import/export for barter/tolling operations

- Evidence of VAT payment in full by the reliable entity in the importing CU member (not only buy importer as such but also by the final buyer, i.e. for agents agreements).

Documentary and other evidence (max 180 days), including Contract (Agent contract), Invoice with 0 % VAT, Special forms from Tax authorities conforming importation and VAT payments, other transportation documents, Customs declaration (for tolling operations with third countries).

In Europe

The accounting mechanism through which there is a purchase invoice goods between EU countries is called «Reverse Charge».

The recording feature is the fact that the same operation must be recorded both on the VAT register purchases on the VAT register sales by the buyer, so that the same is not under any obligation to pay or any right to deduct VAT.

After quantifying VAT, calculated by multiplying the tax rate (which depends on the type of goods) for the amount of the invoice, and the buyer has noted on the bill this value, has to record the transaction as a normal purchase, inserting protocol. The bill, of course, should be retained. At the end of recording the result of VAT payable and receivable is zero.

In the procedures there are many differences in terms of the responsibility of the seller who is accountable for the payment of VAT if not made by the purchaser, from the point of view of the effectiveness of the payment, from the point of view of the concept of reverse charge, that is considered in a different manner in the two countries.

7. Conclusion

In the functioning of VAT there are no so many differences between European Union countries (Italy in particular) and Eurasian Economic Union countries (Kazakhstanin particular) and VAT is the most important form of taxation, really important for the economic integration of countries.

The matrix of the Eurasian VAT taxation model is clearly the European one but over time, these differences are meant to flattening, because the same fiscal model is an excellent starting point for integration.

The fundamental difference are in the model of integration: the Eurasian Economic Union is only an economic union. It does not provide for the creation of supranational political institutions, like the European Parliament, to which national governments should delegate some prerogatives constrain its sovereignty.

Moreover, despite the Eurasian Union will implement the measures to coordinate its monetary policy and its financial policy, as demonstrated by the desire to create a supranational financial regulator, the functioning of Economic at this stage does not provide for the creation of a single currency.

References

- Kazakhstan welcomes Putin's Eurasian Union concept // The Daily Telegraph. — 2011. — 6

- Sixth Council Directive 77/388/EEC of 17 May,

- Article 2, paragraph 2 n. 4 of Presidential Decree no. 633/1972.

- VAT Rates applied in the Member States of the European Union 2015; European Commission